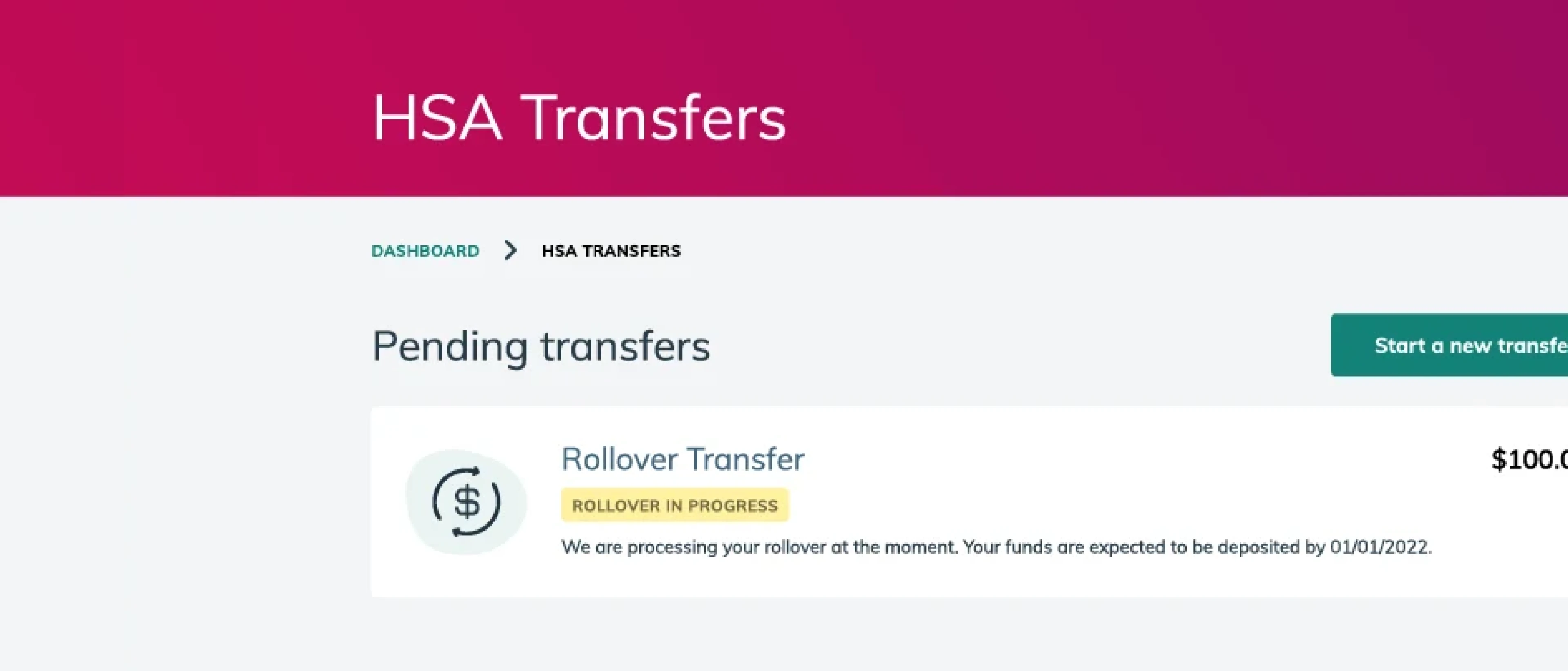

Fee-free rollovers & transfers

Lively won’t charge you any fees to roll over or transfer your HSA to us.

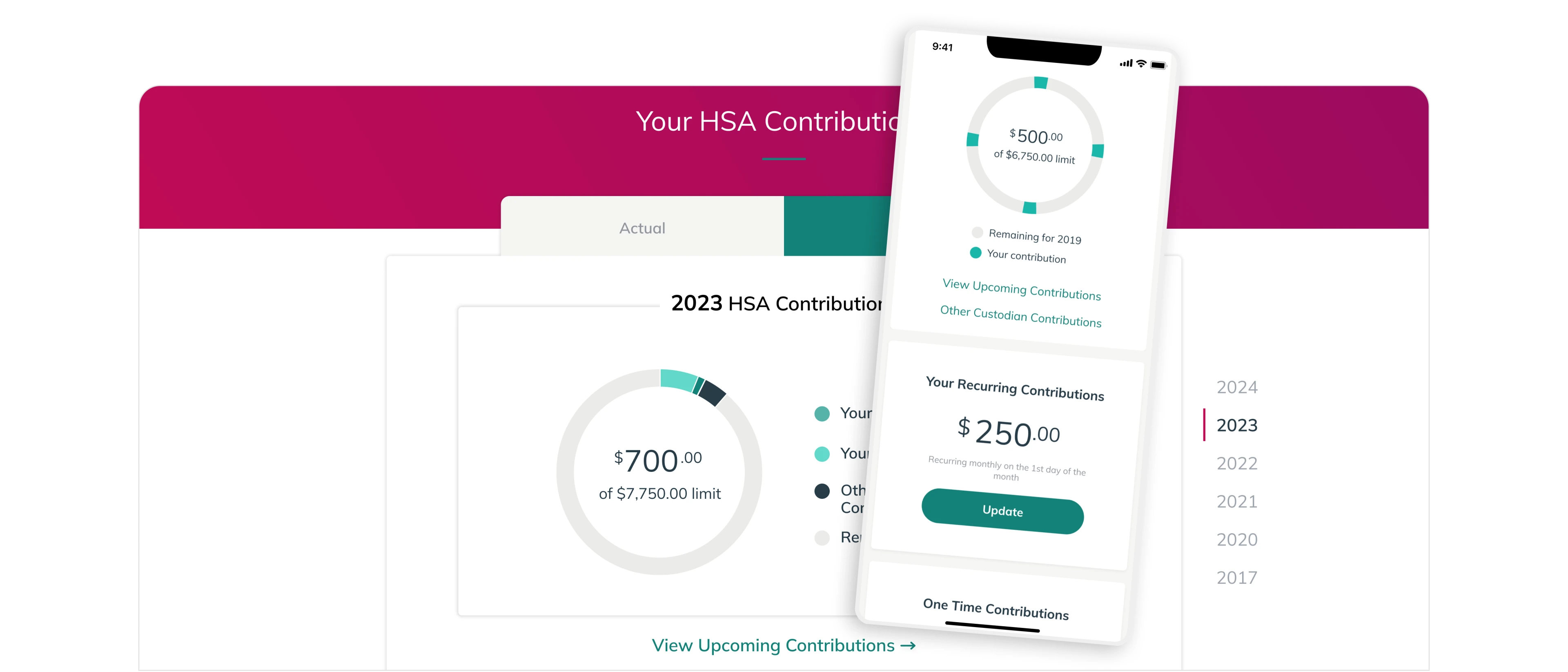

Fund your HSA your way

Link your preferred bank account in just a few steps and set up one-time or recurring contributions.

Paperless employer contributions

Your employer can make pre-tax contributions into your Lively account.

HOW IT WORKS

Funding your HSA is easy with Lively

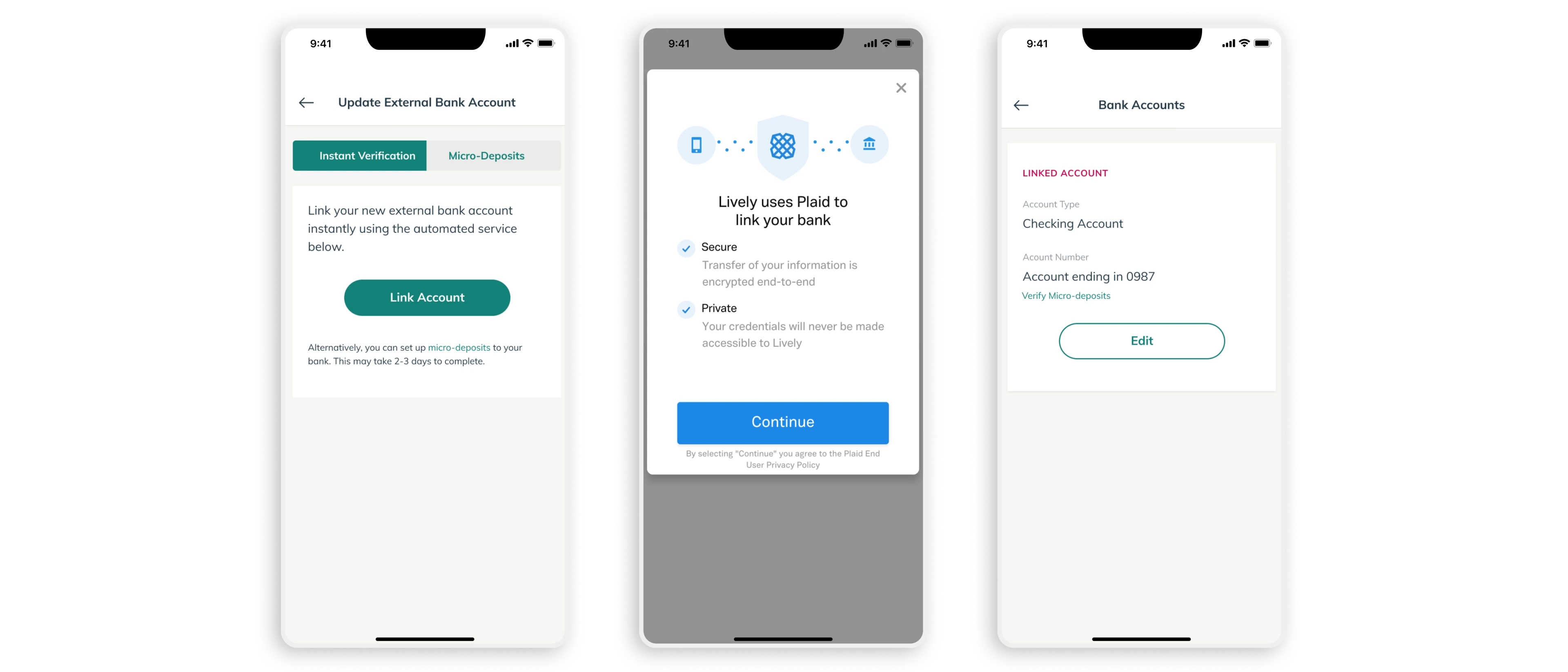

Trust a secure connection to your preferred bank

Step-by-step guidance helps you securely connect your preferred bank in a few steps. Selecting your bank from the list, or enter your account name and routing numbers.

Start contributing to build your healthcare dollars

Your contributions will be taken out post-tax, and we’ll send you formal notification of total contributions made into your account at the end of the year.

TRANSFERS

Seamless, fee-free transfers

We’ll never charge you a fee to transfer your account to Lively. Rollover or transfer your HSA during the enrollment process, or at any other time.

Trustee-to-trustee Transfers

You can transfer either your full or partial balance directly to Lively from your existing provider. We’ll contact your previous provider and handle the transfer on your behalf.

Easily pay for eligible expenses with your HSA debit card*

You'll receive a personalized Lively branded Visa card* for your qualified medical expenses. Use your debit card at your doctor's office, pharmacy, or any other qualified medical expense provider where Visa is accepted. Up to three debit cards are offered at no charge.

Ready to get started?

See why Lively is the top-rated HSA provider. Opening a Lively HSA is free and takes just a few minutes.