Why Lively

Scale your HSA program without the added complexity

Lively takes the costly, time-consuming operations of your HSA program off your shoulders, while you:

Tap into a sticky, low-cost core deposit source, and hold all HSA deposits from retail, small business and commercial banking customers.

Generate additional revenue from the day-to-day transactions and growth of your HSA program, such as interchange revenue, fee revenue, and net interest margin.

Maximize customer lifetime value with a two-pronged approach: Cross-sell HSAs to existing customers, and tap into market demand with a top-rated HSA solution for prospective clients.

Capture, grow, and retain HSA deposits with Lively

55.7% private sector workers enrolled in HDHPs

As the demand for High Deductible Health Plans and HSAs continues to grow, your financial institution has the opportunity to meet that market demand and gain new business from current and prospective clients actively looking for an HSA provider.

38% average account balance growth year-over-year

Compared to the industry average, Lively account holders are not only more likely to keep HSA funds in their account — as opposed to spending it — but their account balances are also higher.

98% average employer retention rate

Count on Lively to deliver industry-leading service that guarantees the satisfaction of your most valued clients, driving increased stability for your core deposit base.

Personalized to your financial institution

Cobranded solution

Gain immediate market differentiation, with your brand thoughtfully incorporated into each stage of the end-to-end cobranded HSA experience for account holders and employers.

Enablement, support and resources

Rest assured our team is here to support your financial institution at every step to ensure partnership success, from set-up, to education and onboarding, and deal support.

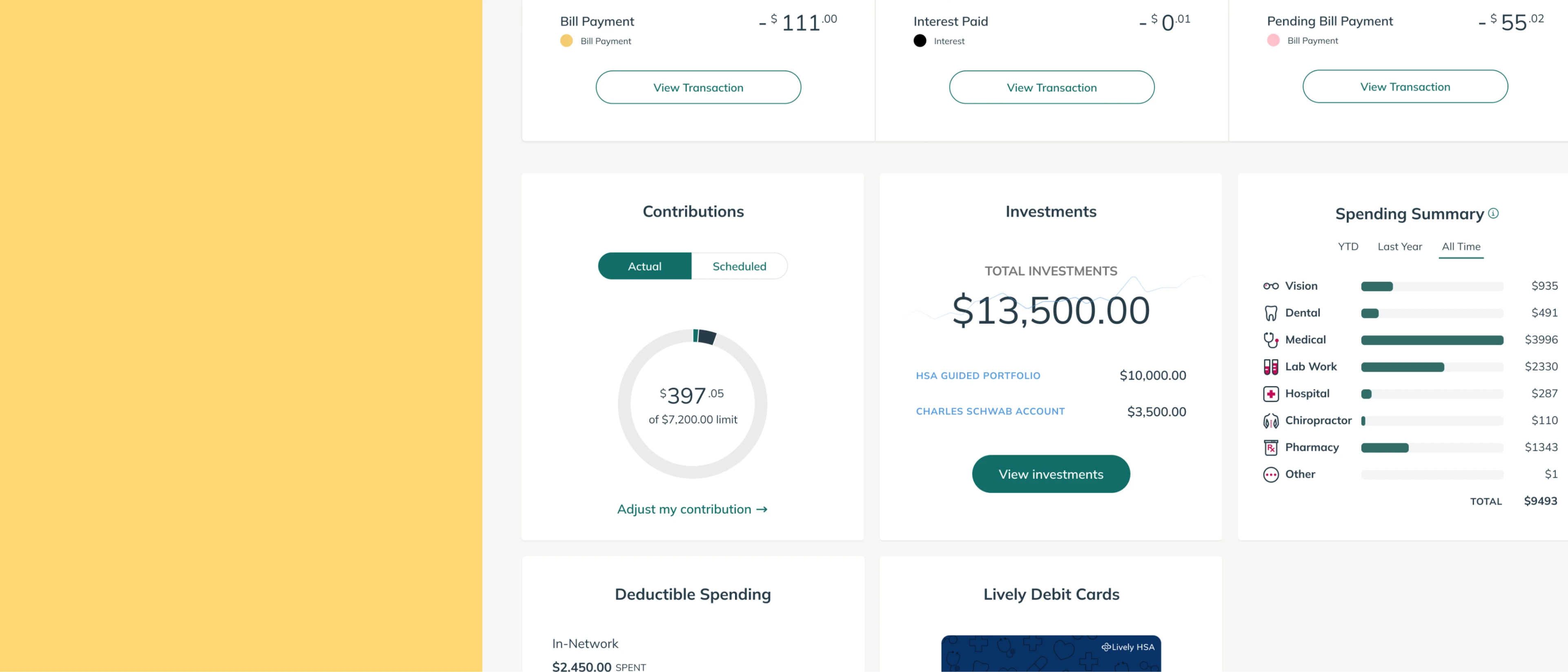

Robust reporting and dashboards

Stay on top of all the details of your HSA program with a tailored dashboard and up-to-date reporting, complete with key indicators and metrics to track and measure program success.

Customer stories

We like everything about working with Lively. Having different options for different clients depending on their needs is really nice.

Customer stories

User-friendly technology, backed by unparalleled service

360-degree service model

Exceptional support for employers and account holders, with customer satisfaction ratings that are more than 3 times higher than the industry average.

Innovative, simple-to-use platform

Our proprietary technology enables us to rapidly update our platforms, integrate with third-party providers, and onboard clients at a fraction of the time it takes competitors.

Ongoing education

Lively proactively provides ongoing education and engaging resources that drive benefits adoption for employees and maximize HSA usage.

Whitepaper

Drive revenue growth with an HSA

Learn how financial institutions can partner with the right HSA provider to boost revenue growth, generate new relationships, and advance innovation.

Lively for Financial Institutions

Get in touch

Simply fill out the form and our team will be in touch to discuss how we can support your organization.

Frequently Asked Questions (FAQ)

How do I choose the right HSA vendor for my financial institution’s needs?

To sustainably scale an existing HSA program, financial institutions should consider an HSA partnership solution. Look for a partner who:

Allows you to retain deposits, interchange, spread, and fee revenue.

Helps you develop a plan to achieve strategic goals and objectives for your HSA program, with actionable reporting and an easy-to-use dashboard for account management.

Provides high-quality service, onboarding, and resources for customers, including compliance help and communications when regulatory changes affect HSAs.

Trains your internal teams and provides enablement resources to sell your HSA product.

Offers transparent pricing and a straightforward fee schedule, so that you understand the true cost of offering an HSA product.

Is it a good decision to offer HSAs to my financial institution customers?

Achieving financial wellness requires a holistic approach that considers all income, assets, and expenses, and that includes the rising cost of healthcare. By offering an HSA product, you can help current and potential clients save for healthcare expenses today and close the retirement savings gap for the future. With the triple-tax advantages of an HSA, your clients can save up to 35% on eligible healthcare expenses. HSAs are the future of financial wellness, and now is the time to get on board.

How does the partnership with Lively work?

Lively offers financial institutions a top-rated health savings account solution, and the necessary resources and expertise to scale their existing HSA program. By going to market with an industry-leading HSA, financial institutions can attract new customers and gain a greater share of wallet with existing ones. With Lively’s partnership model, financial institutions are guaranteed to hold all core deposits, and keep interchange, fee revenue, and net interest margin from their HSA business segment, while Lively takes care of the operational complexities. From risk and compliance mitigation, all the way down to HSA account holder support — we take care of it for you.

How will partnering with Lively help set me apart from other financial institutions?

In the employee benefits space, an industry rife with clunky technology and subpar service, Lively helps you stand out with an innovative HSA product that’s easy-to-use, and 360-degree service readily available for your clients should they ever need it. Don’t just take our word for it: Lively has consistently been recognized as a top HSA provider by major industry publications, like Morningstar and Investors’ Business Daily, among others. Our customer satisfaction score is more than 3x the average of other HSA providers in the market.