TRUSTED BY

WHY LIVELY

Built differently on purpose

Health and money are complicated enough — your benefits shouldn’t be

Always-on support. Lively AI Chatbot understands context and provides answers 24/7. Our top-rated, U.S.-based experts are also available via phone, email, or chat.

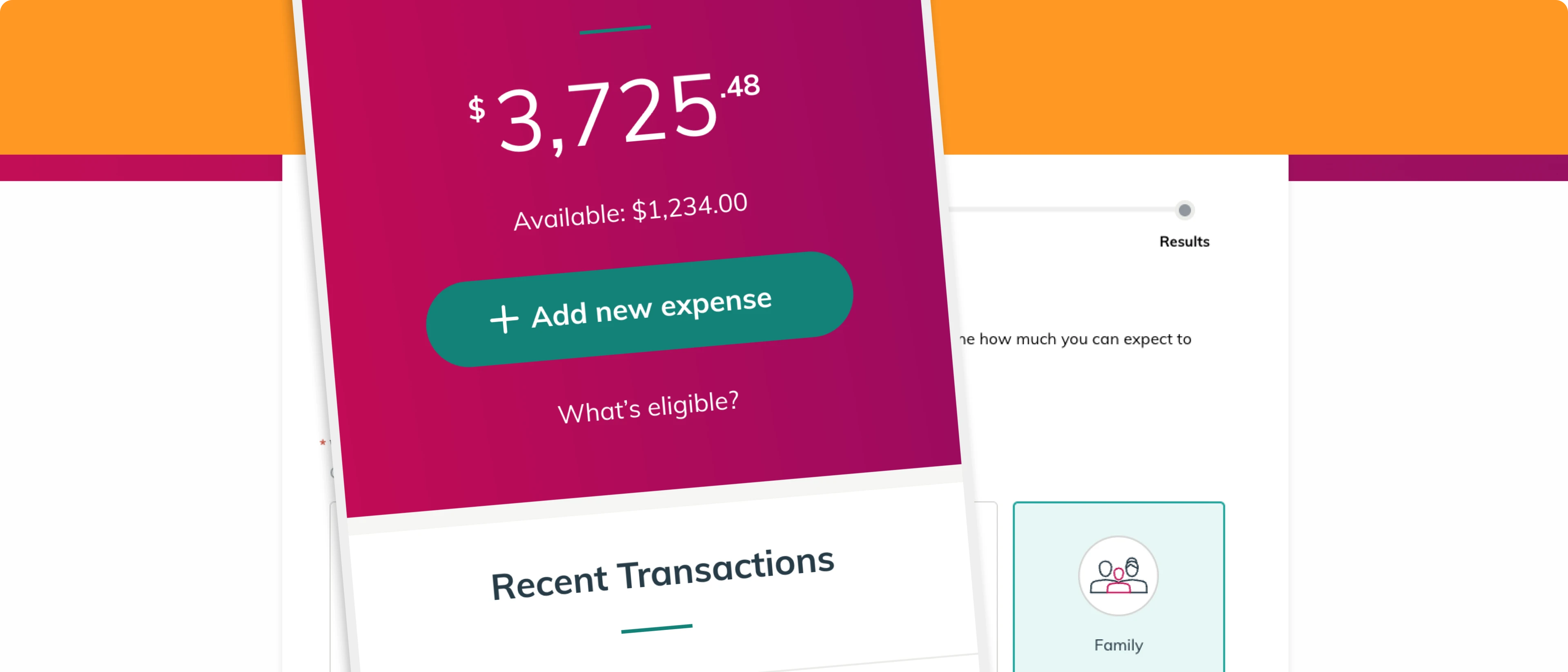

Technology as simple and modern as your favorite apps. Lively’s AI makes it easy to find information, automate and complete tasks, and submit claims in seconds – removing the mental load from benefits management.

Flexible configurations, tailored to you. From enrollment to contributions, setup is smooth and daily management stays easy.

Lively makes benefits human — helping people save for a healthier future and freeing HR to focus on what matters.

3 times better

Customer satisfaction is 3-4 times higher than the industry average.***

98% retention

You're in good hands. Lively retains over 98% of the employers that choose us.

$24 million saved

We're not here to nickel and dime you. Lively HSA account holders have saved over $24 million in fees, and counting.

***Based on Net Promoter Score (NPS). NPS is a widely used metric that measures customer satisfaction. Lively's NPS score is three times higher than the industry average of 16-34.

Maximize your healthcare savings and further your financial goals with a Lively HSA.

No hidden fees - ever

Lively HSAs are free for individuals and families, so you never have to worry about hidden costs.

Secure contributions and transfers

Put your money to work with peace of mind: Lively HSAs are FDIC-insured* and use bank-grade security.

Support — that’s here for you

Responsive, expert support whether you are saving, spending, or investing.

HR TEAMS LOVE LIVELY

Top rated on G2. Find out why.

Discover why employers give Lively five stars and read our reviews on G2.

HR TEAMS LOVE LIVELY

Top rated on G2. Find out why.

Discover why employers give Lively five stars and read our reviews on G2.

Transparent HSA pricing. Zero hidden fees.

INDIVIDUALS

$0.00

Simple, transparent HSA pricing at last.

Free for individuals & families

HSA cash balance is insured and interest bearing*

Choose when and how to invest (optional - additional fee may apply)

BUSINESSES

$0.00

Per Employee Per Month (PEPM)

(Subject to a $200 monthly minimum)

Streamline HSA administration for less.

Intuitive dashboard administration

Effortless contribution management

Personalized investment options

* Lively is not an FDIC or NCUA insured financial institution. Lively partners with financial institutions in order to provide its products. These financial institutions are FDIC or NCUA insured and your HSA account may be eligible for pass through insurance. Certain conditions must be satisfied for pass-through deposit insurance coverage to apply. Please contact Lively for more detailed information.

REPORT

How HR leaders are using AI

HR teams are using AI to simplify operations, reclaim time, and reduce complexity across benefits workflows.

Lively’s 2026 AI in HR Report reveals how enterprise leaders are applying AI to real tasks like reimbursements, claims processing, and data reconciliation. The report is based on a national survey of more than 250 HR leaders and reflects a practical, outcomes-first mindset.

Inside the report, you will learn:

Where HR time is being lost and how AI is helping

Why benefits workflows are the best place to start

What high-performing HR teams are prioritizing in 2026

Read the full report to see how AI is already making an impact.

FOR EMPLOYERS, BROKERS & HR TEAMS

Looking to offer Lively to your employees or clients?

Fill out this form, and we’ll be in touch within one business day.

Note: If you are an individual account holder or need personal support, please visit our Help Center.

Frequently Asked Questions (FAQ)

What is Lively?

Lively is the flexible benefits solutions provider that gets it right. We designed our solutions to take the guesswork out of managing benefits and our innovative features are built to simplify benefits administration and evolve with your business. By combining robust features with unparalleled service, we make benefits administration effortless, even when time and energy are limited. Experience benefits administration as it should be with Lively. Lively currently offers HSA, FSA, HRA, COBRA, Direct Bill, Lifestyle Spending Accounts, and Medical Travel Accounts.

What are flexible benefits?

Flexible benefits are saving and spending accounts, and other perks like paid time-off that are offered by employers and are optional for employees to participate in. These benefits can be pre- or post- tax contribution accounts and non-monetary benefits like professional development and wellness initiatives. By offering flexible benefits, employers empower employees to customize their benefits package in a way that best meets their unique needs and goals. Flexible benefits can also help improve employers' recruitment and retention efforts and improve employee engagement.

What flexible benefits does Lively offer?

Lively currently offers Health Savings Accounts (HSA) for individuals and employer groups and employer-sponsored savings and spending accounts, including Flexible Spending Accounts (FSA), Lifestyle Spending Accounts (LSA), Health Reimbursement Arrangements (HRA), Medical Travel Accounts (MTA), and COBRA and Direct Bill.

What makes Lively different from other providers?

Lively was built to create a better, easier-to-use benefits experience and save our account holders and administrators time and money. Our unparalleled, responsive, knowledgeable customer service and account holder education, innovative features, and technology built in-house enables easy set up and simple administration. Our customer satisfaction rating (NPS) is nearly triple the industry average and we’re the fastest growing HSA-provider in the market. Our solutions are simple, trusted, and reliable. In short, they just work.