Personalized investing made simple

Whether you are a novice or seasoned investor, Lively’s integrated investment solutions enable you to build and manage your portfolio with ease. So you can confidently maximize the benefits of your HSA.

You are in control

Choose when and how to invest with access options that align with your investment strategy

Automated transfers

Set up recurring or sweep transfers to shorten your to-do list and keep building toward your goals

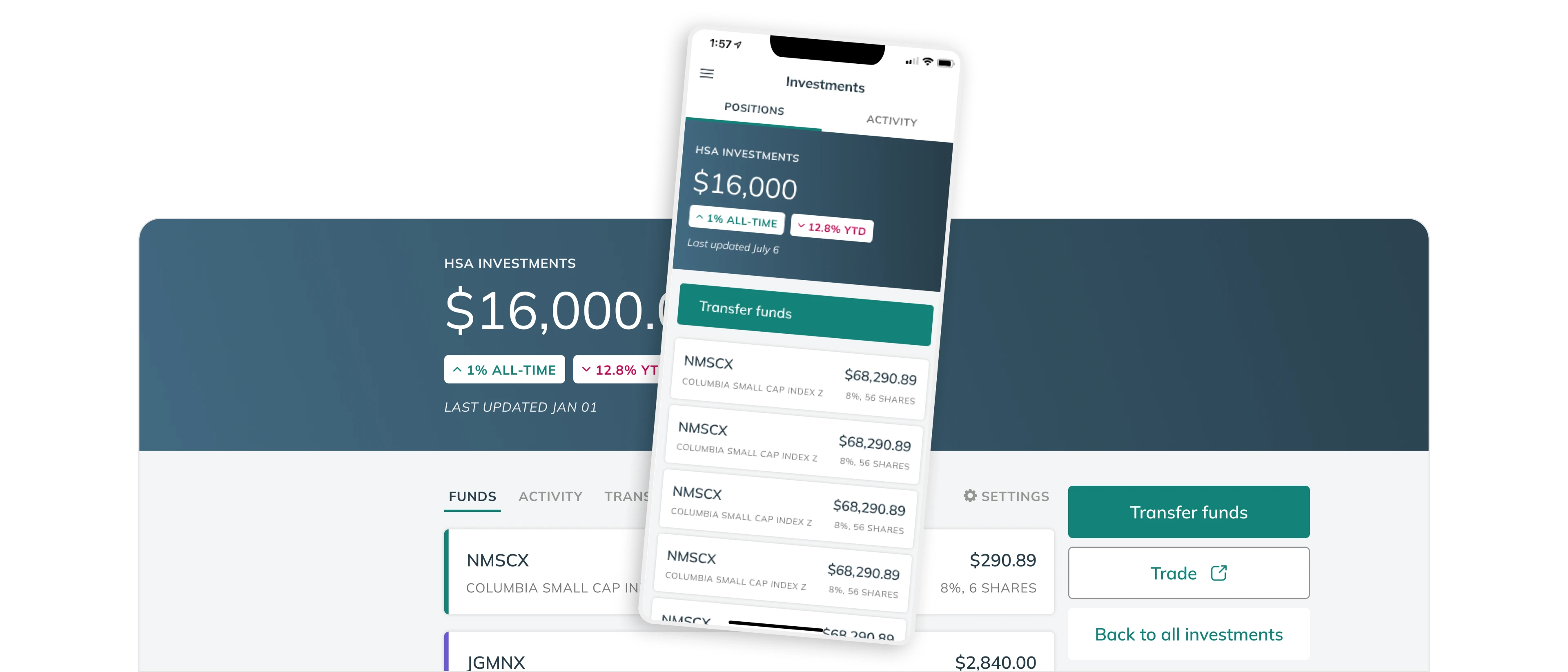

Online or on the go

Stay on top of investment activity no matter where you are, directly from your Lively account

Schwab Health Savings Brokerage Account

With this self-directed investment solution from Charles Schwab, you have the freedom to design and optimize your portfolio to align with your financial goals.

Access thousands of investment options, including stocks, bonds, mutual funds, and Exchange Traded Funds (ETFs)

Grant your financial advisor access to your portfolio by completing and submitting an “Advisor Authorization Form”

Choose from two ways to access the Schwab Health Savings Brokerage Account option: invest anything above $3,000 for no access fee or invest with no minimum requirements after a $24 annual access fee.(Additional fees from Charles Schwab may apply, see details here.)

HSA Guided Portfolio

HSA Guided Portfolio by Devenir, a national leader in investment solutions for health-based accounts, provides personalized portfolio mix suggestions based on your risk preferences and time horizon.

Choose from a curated menu of high-quality, low cost funds across asset classes

Enable automated rebalancing to keep your portfolio on track toward your goals

Maximize long-term returns through a low maintenance investing strategy.

There is no cash minimum required to invest with HSA Guided Portfolio. A 0.50% annual fee applies for invested assets. View the fund list here

Industry-leading solutions

Put your money to work and build toward your long-term financial goals with confidence.

Schwab Health Savings Brokerage Account

Starts at $0.00

Choose to invest with a $3,000 minimum and no access fee or invest with no restrictions after a $24 annual access fee. (Additional fees from Charles Schwab may apply)

View fee schedule

HSA Guided Portfolio

0.50%

Annual fee for invested assets with personalized guidance and automatic rebalancing.

View disclosures & fund list