Why Offer an FSA

Offer employees savings and flexibility

A Flexible Spending Account (FSA) is an employer-sponsored account offered to employees to help them pay for eligible healthcare and dependent expenses with pre-tax funds. FSAs offer:

Tax-deductible employer contributions

Employers can make contributions on top of employee contributions for additional tax savings.

Health plan flexibility

Unlike HSAs, which must be offered alongside an HDHP, an FSA can be offered alongside any medical or dental plan to offer employees additional flexibility, and accommodate a range of health plan needs.

Enhanced benefits package

According to BenefitsPro, FSAs are one of the top benefits employers should add to attract and retain talent, and can be used to round out your benefits package.

Why Lively

Elevate the traditional FSA experience

With Lively you can count on unparalleled customer service, proactive education, and intuitive technology that make managing FSAs simple and supports employee adoption and use.

Exceptional customer support

Every employer is assigned to a Customer Success team, while employees have access to a top-rated Member Support team.

Innovative and proprietary technology

Built in-house and thoughtfully designed to be easy-to-use, dependable, and to personalize employer experiences.

Taking the burden off employers

Robust education and resources, crafted to continuously drive usage for employees and take the burden off administrators.

Why Lively

Elevate the traditional FSA experience

With Lively you can count on unparalleled customer service, proactive education, and intuitive technology that make managing FSAs simple and supports employee adoption and use.

Get more out of your FSA

4 times better

Customer satisfaction is more than 3 times higher than the industry average.*

60 seconds or less

We don't keep you waiting. Over 95% of account holder calls are answered in less than 60 seconds.

90% first-touch approval

No back and forth. Over 90% of FSA claims are approved on the first review.

*Based on Net Promoter Score (NPS). NPS is a widely used metric that measures customer satisfaction. Lively's NPS score is three times higher than the industry average of 16-34.

Get more out of your FSA

*Based on Net Promoter Score (NPS). NPS is a widely used metric that measures customer satisfaction. Lively's NPS score is three times higher than the industry average of 16-34.

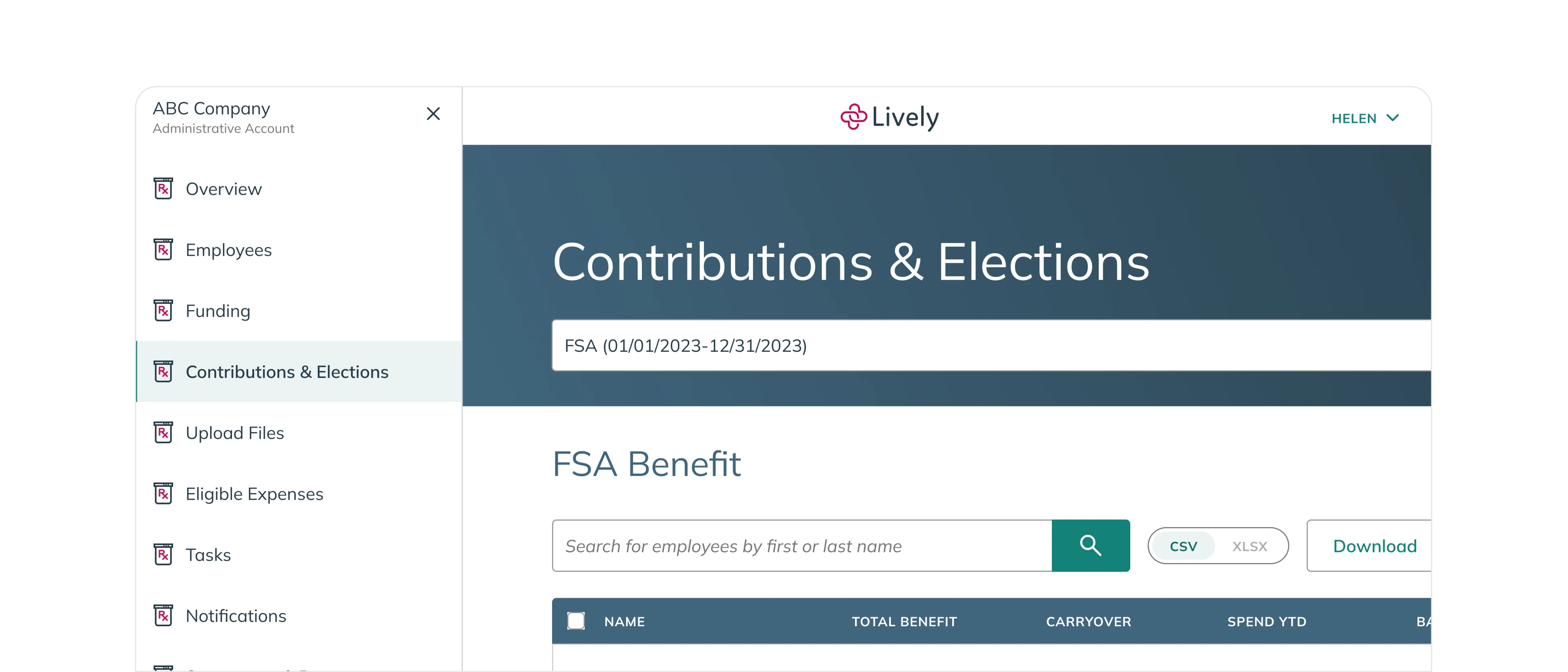

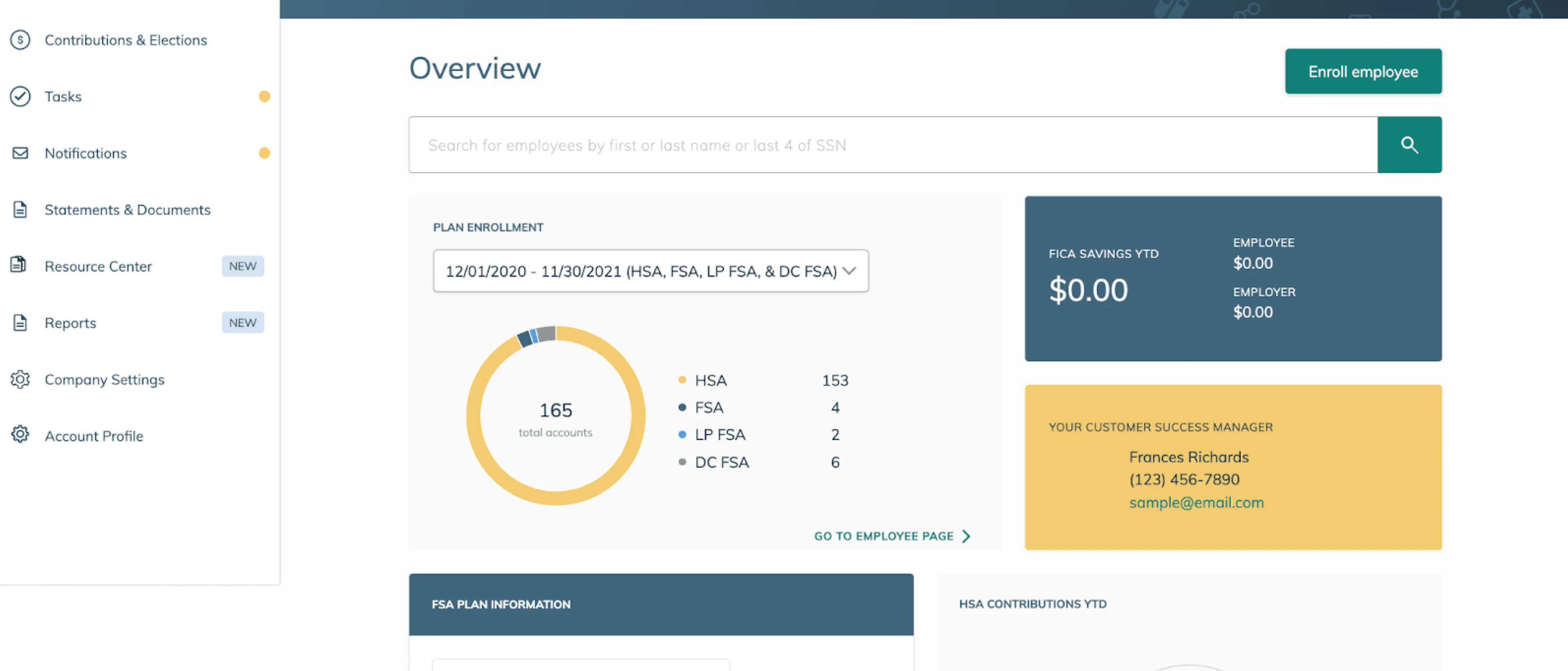

Benefits for employers

FSA administration simplified

The Lively FSA experience is designed to save employers time including a quick, efficient implementation process, and task automation that streamlines tedious day-to-day administration.

On-demand reporting

Make data-driven decisions to optimize your FSA program according to your goals. Effortlessly keep an eye on spending details, payroll tax savings, and more.

Smart payroll logic

Lively’s smart payroll deductions logic automatically calculates deductions, alleviating the burden of manual upkeep from the employer administrator.

Employee enrollment options

Whether you choose to enroll employees directly through the easy-to-use Lively dashboard, a secure file transfer, or a third-party integration, Lively has got you covered with a range of options.

Lively FSA suite

Offer a range of options with expert guidance

Give your team the flexibility to choose the best plan for their needs. Lean on Lively’s industry experts to guide you through the eligibility, coverage, and contribution guidelines of each plan.

General Purpose FSA

Commonly referred to as a healthcare FSA, a GPFSA covers eligible medical, vision, and dental expenses that not may not be covered by the employee’s health insurance. Unlike an LPFSA and DCFSA, this type of FSA is not HSA-compatible.

Some qualified medical expenses for General Purpose FSAs include:

Copays and deductibles

Prescriptions

Over-the-counter drugs

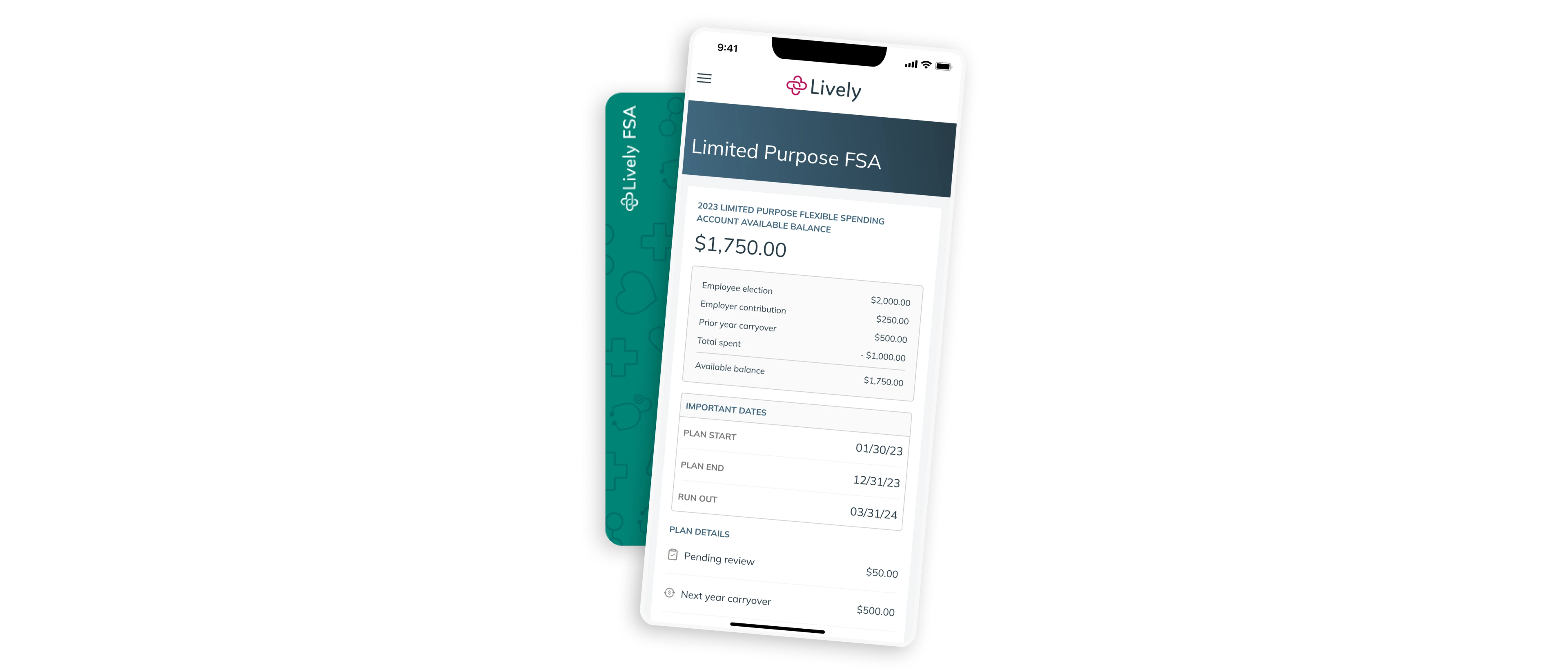

Limited Purpose Flexible Spending Account

LPFSAs cover eligible preventive, dental, and vision care expenses not covered by the employee’s health insurance.

Some qualified medical expenses for Limited Purpose FSAs include:

Eye glasses, contacts, and solution

Dentures and bridges

Orthodontia and guards for teeth grinding

Dependent Care FSA

Employees can save on care expenses for children up to age 13 and elderly or disabled adults claimed as federal tax dependents.

Some qualified expenses for Dependent Care FSAs include:

Physical care

In-home care

Child or adult day care given by qualified caregivers in an institutional setting

Customer testimonials

The Lively debit card and web page are very easy to use. We have had no problems using Lively for our medical expenses.

Customer testimonials

Guide

Master the FSA basics

Your comprehensive guide to Flexible Spending Accounts and answers to common questions for account holders, employers, and brokers.

FOR EMPLOYERS, BROKERS & HR TEAMS

Looking to offer Lively to your employees or clients?

Fill out this form, and we’ll be in touch within one business day.

Note: If you are an individual account holder or need personal support, please visit our Help Center.

Frequently Asked Questions (FAQs)

What is FSA-eligible?

Depending on what type of FSA is offered, employees may use their funds on a range of eligible healthcare and dependent expenses. Access the list of qualified expenses directly through Lively's What's Eligible tool. Our comprehensive lists are always up-to-date with information from the IRS.

To withdraw tax-free money from your flexible spending account, you need to spend it on eligible expenses. Eligible expenses include deductibles, copayments, coinsurance, and more. Your employer plan will likely outline what is eligible under your flexible spending account. Along with medical expenses, dental and vision expenses are typically eligible as well.

What is the difference between an HSA and FSA?

Health Savings Accounts and Flexible Spending Accounts have a lot in common, namely that they’re pre-tax savings accounts that can be used to pay for eligible medical expenses alongside certain health insurance plans. The biggest difference is HSAs are owned by individuals and funds never expire, and FSAs are set up through an employer and employees must use their funds within the year.

What happens to an employee’s FSA if they leave?

Unused money in a Flexible Spending Account will be forfeited back to an employer if an employee leaves their place of employment. Employees who are eligible for COBRA may be able to get their FSA funds until their COBRA insurance runs out. Employees will not be able to use FSA funds for health insurance plan premiums.

Can I offer both an HSA and an FSA?

In order to offer an HSA, an employer must also offer an HSA-qualifying HDHP, and in order for employees to participate in the HSA, they must be enrolled in an HDHP (but it doesn't have to be the employer's). An FSA can be paired with any type of health insurance plan. If you offer both an HSA and a Healthcare FSA, employees will need to choose between the two (they can't contribute to both at the same time). If you offer a Limited Purpose FSA and/or a Dependent Care FSA, employees can participate in both of these at the same time they are contributing to an HSA.