The value of an HRA

Offer your employees flexibility and savings

A Health Reimbursement Arrangement (HRA) is an employer-sponsored account that helps employees pay for qualified out-of-pocket medical costs. It helps employers offset high insurance costs while providing more for employees’ healthcare needs.

Offering HRAs has benefits for the employees that enroll and the businesses that offer them. HRAs offer employers:

Tax savings

Employee reimbursements are tax-deductible for your business.

Enhances benefits package

Helps to attract and retain talent with benefits for a variety of health plans and medical needs.

Highly customizable

Lively HRAs can be extensively configured to fit your organization’s needs. Customize your contributions schedule, extension options, plan duration, and more.

Why Lively

Loved by account holders, trusted by employers

The Lively customer experience raises the bar in the benefit solutions industry, with Lively leading the charge in:

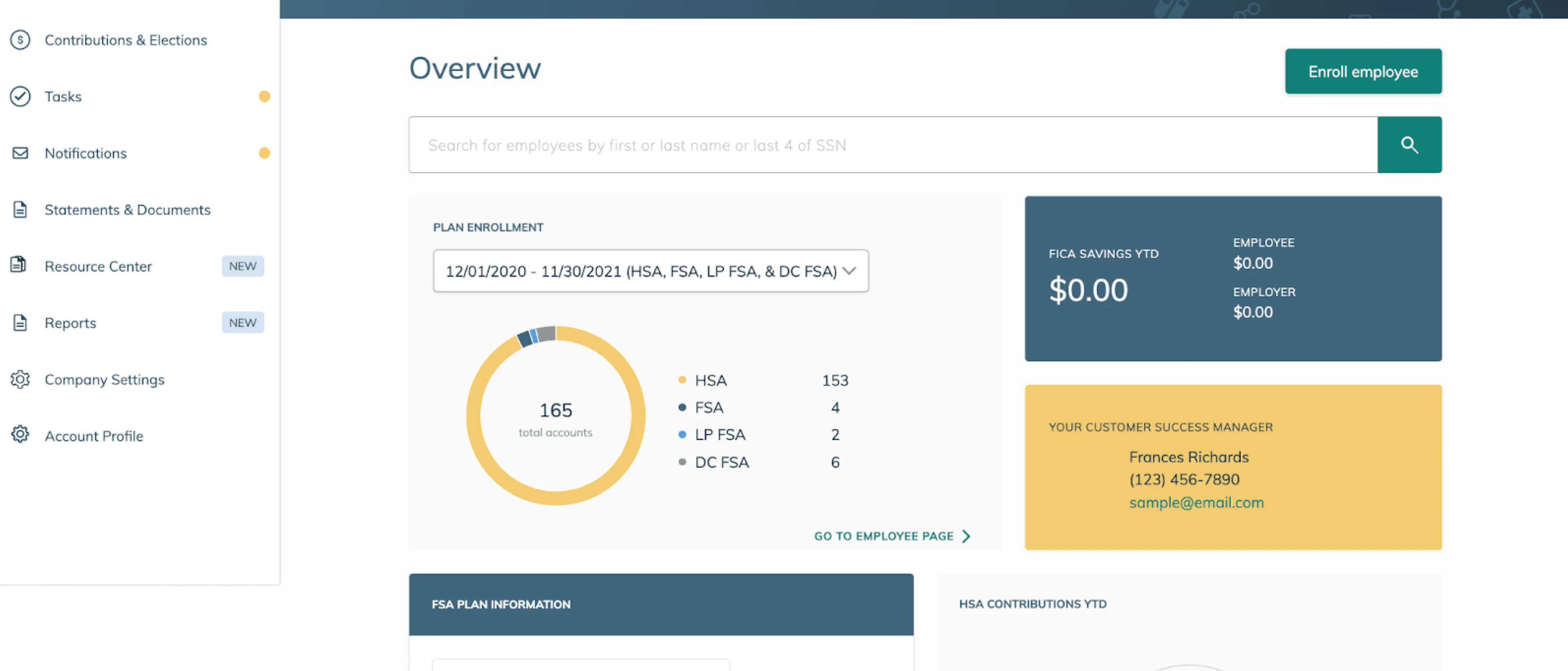

Exceptional customer support

Every employer is assigned to a Customer Success team, while employees have access to a top-rated Member Support team.

Innovative and proprietary technology

Built in-house and thoughtfully designed to be easy-to-use, dependable, and to personalize employer experiences.

Taking the burden off employers

Robust education and resources, crafted to continuously drive usage for employees and take the burden off administrators.

Why Lively

Loved by account holders, trusted by employers

The Lively customer experience raises the bar in the benefit solutions industry, with Lively leading the charge in:

HRA offerings

Choose from a range of options

Design the HRA plan that is the best fit for your business and your people.

Post-Deductible HRA

The employee must meet the HRA out-of-pocket requirement (set by the employer) to access funds.

Can be configured to cover copays, co-insurance, and expenses that count towards the medical insurance deductible; or, standard healthcare 213(d) expenses.

Dental and Vision HRA

This HRA design does not have an HRA out-of-pocket requirement in order to access funds.

Covers out-of-pocket vision and dental expenses such as vision exams, prescription glasses, routine dental cleanings, and more.

Features & benefits

The Lively HRA experience

Simplify administration and help each plan reach its maximum potential.

Custom plan designs with year-round administrator support

Choose from a wide range of plan configurations to design a just-right HRA program. Customize your plan name, eligible expenses, deductible, allocations schedule and more.

Lean on expert guidance from your assigned Customer Success Team, here for you year-round, starting with hands-on onboarding.

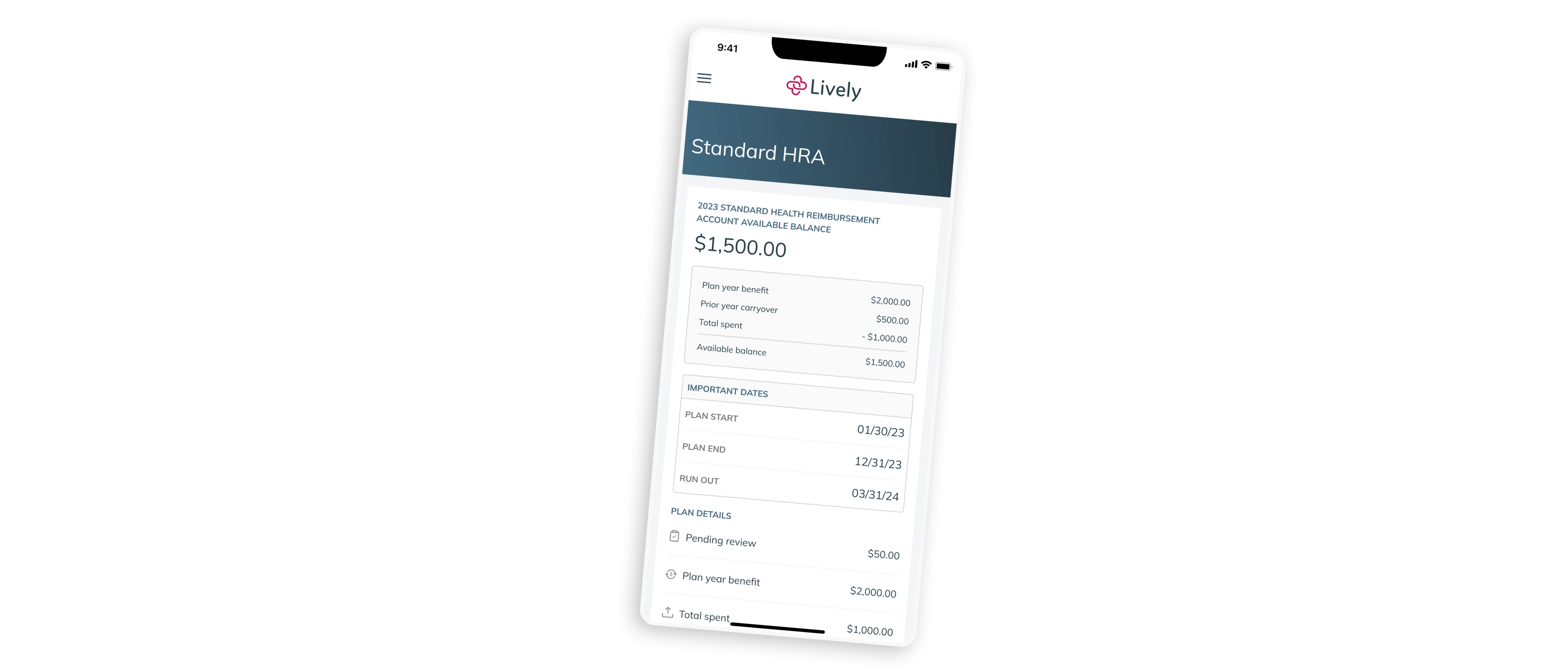

Convenient payments and reimbursements

Employees enjoy a paperless, simple claims verification process with fast reimbursements. Plus, they can easily access funds from their HRA and FSA with the Lively Visa® Benefit Access debit card.*

Smart features that automatically approve qualified recurring payments, purchases at select merchants, and co-payments.

*Available for Standard HRA plans with a non-customized list of eligible expenses.

FOR EMPLOYERS, BROKERS & HR TEAMS

Looking to offer Lively to your employees or clients?

Fill out this form, and we’ll be in touch within one business day.

Note: If you are an individual account holder or need personal support, please visit our Help Center.

Frequently Asked Questions (FAQs)

What is the difference between an HSA and an HRA?

While HSAs and HRAs are both used to cover out-of-pocket healthcare expenses, there are some key differences to note. Unlike an HRA, an HSA is owned by the individual, not the employer. This means HSAs can be funded by the employee as well as the employer, where HRAs only permit employer contributions to fund the account. Additionally, HSA funds never expire, so employees can take the funds with them even if they leave their employer or change medical insurance. HRA funds generally expire at the end of the plan year and are not portable. Another key difference is that HSA funds can be invested for growing potential and the funds in the account accrue interest. In contrast, HRA plans do not allow the same.

Do HRA funds rollover?

Yes, some HRAs can be designed to allow funds to rollover as well as a runout period. However, it is up to the employer sponsoring the HRA to decide what year-end extension options will be available for the type of HRA they offer.

What can an HRA be used for?

Eligible expenses for an HRA will vary on the type of HRA offered by your employer. For example, Standard HRAs cover out-of-pocket healthcare expenses that are not covered by your insurance, per the standard 213(d) IRS list. This includes coverage for medical, dental, and vision expenses; prescriptions, and select over-the-counter products. A Dental and Vision HRA will only cover vision and dental expenses such as dental exams, cleanings, eyeglasses, laser eye surgery, etc. Because HRAs can be customized by your employer, the list of eligible expenses will vary per employer.

How do you set up an HRA?

As an employer-sponsored account, your employer will let you know how your HRA will be set up for employees at your organization. If you have an HRA provider like Lively, getting started is easy. Your employer will first confirm that you qualify for an HRA, enroll you, and then you will have access to manage your HRA via your Lively HRA account online.

Why would an employer offer an HRA?

An employer’s reasons for offering an HRA will likely vary on the type of HRA they choose to offer. In the case of Standard HRAs or Post-Deductible HRAs, employers offer these HRAs to improve their benefits package for retaining and attracting employees. Employees are interested in these types of HRAs because it’s essentially “free” money from the employer to help with eligible out-of-pocket healthcare costs. Plus, the funds received are not subject to income tax.