Transparent HSA pricing. Zero hidden fees.

INDIVIDUALS

$0.00

Simple, transparent HSA pricing at last.

Free for individuals & families

HSA cash balance is insured and interest bearing*

Choose when and how to invest (optional - additional fee may apply)

BUSINESSES

$0.00

Per Employee Per Month (PEPM)

(Subject to a $200 monthly minimum)

Streamline HSA administration for less.

Intuitive dashboard administration

Effortless contribution management

Personalized investment options

* Lively is not an FDIC or NCUA insured financial institution. Lively partners with financial institutions in order to provide its products. These financial institutions are FDIC or NCUA insured and your HSA account may be eligible for pass through insurance. Certain conditions must be satisfied for pass-through deposit insurance coverage to apply. Please contact Lively for more detailed information.

HSA Interest Rates and Fees

Interest is paid on cash balances within your Lively HSA. The annual percentage yield (APY) can be found here.

We believe in transparent, affordable pricing. Here is an overview of our fees for account holders.

Monthly Maintenance | $0 |

Account Opening Fee | $0 |

Account Closing Fee | $0 |

Funds Transfer (Out/In) Fee | $0 |

Debit Cards (Up to 3) | $0 |

Excess Contribution Fee | $0 |

Point of Sale Fee | $0 |

Minimum Balance Fee | $0 |

Reimbursement Fee | $0 |

Access to Schwab Health Savings Brokerage Account (optional) | $24 annual fee or $3,000 minimum cash balance |

Access to HSA Guided Portfolio (optional) | 0.50% annually |

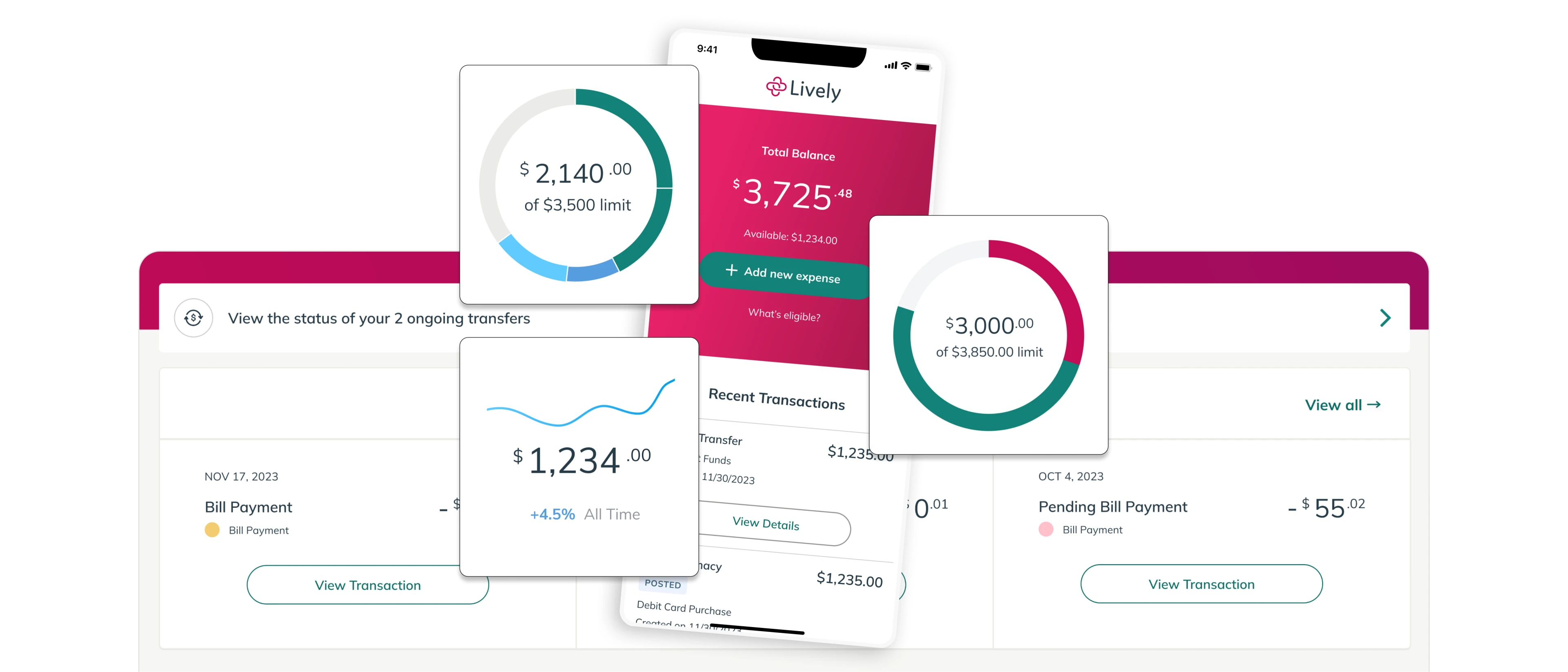

Affordable

Free for individuals and families with personalized investment options. Simple pricing for employers with no hidden fees.

Trusted

All HSA cash balance accounts are insured** and interest-bearing, and have access to our unparalleled customer service.

Intuitive

Our user-friendly software allows you to streamline how you invest in your health.

**Lively is not an FDIC or NCUA insured financial institution. FDIC or NCUA insurance covers the failure of the insured financial institution. Lively partners with financial institutions in order to provide its products. These financial institutions are FDIC or NCUA insured and your HSA account may be eligible for pass through insurance. Certain conditions must be satisfied for pass-through deposit insurance coverage to apply. Please contact Lively for more detailed information.

Employer Loss Calculator

See how your current HSA provider compares to the market average. Use this tool to find the hidden costs of high fees and manual HR work to see exactly how much you could be saving by switching your team to Lively.

What we’ll show you:

Tax Savings: How much you save when more employees join.

Reclaimed Time: How many hours your HR team gets back.

The Bottom Line: Your total yearly savings in dollars and cents.

Disclaimer: This calculator provides illustrative estimates based on industry benchmarks and Lively’s internal data from FY23–FY25. Results are not guaranteed and may vary based on your company’s unique setup. This tool is for informational purposes only and does not constitute tax, legal, or financial advice. Lively disclaims any liability for decisions made in reliance on these estimates.

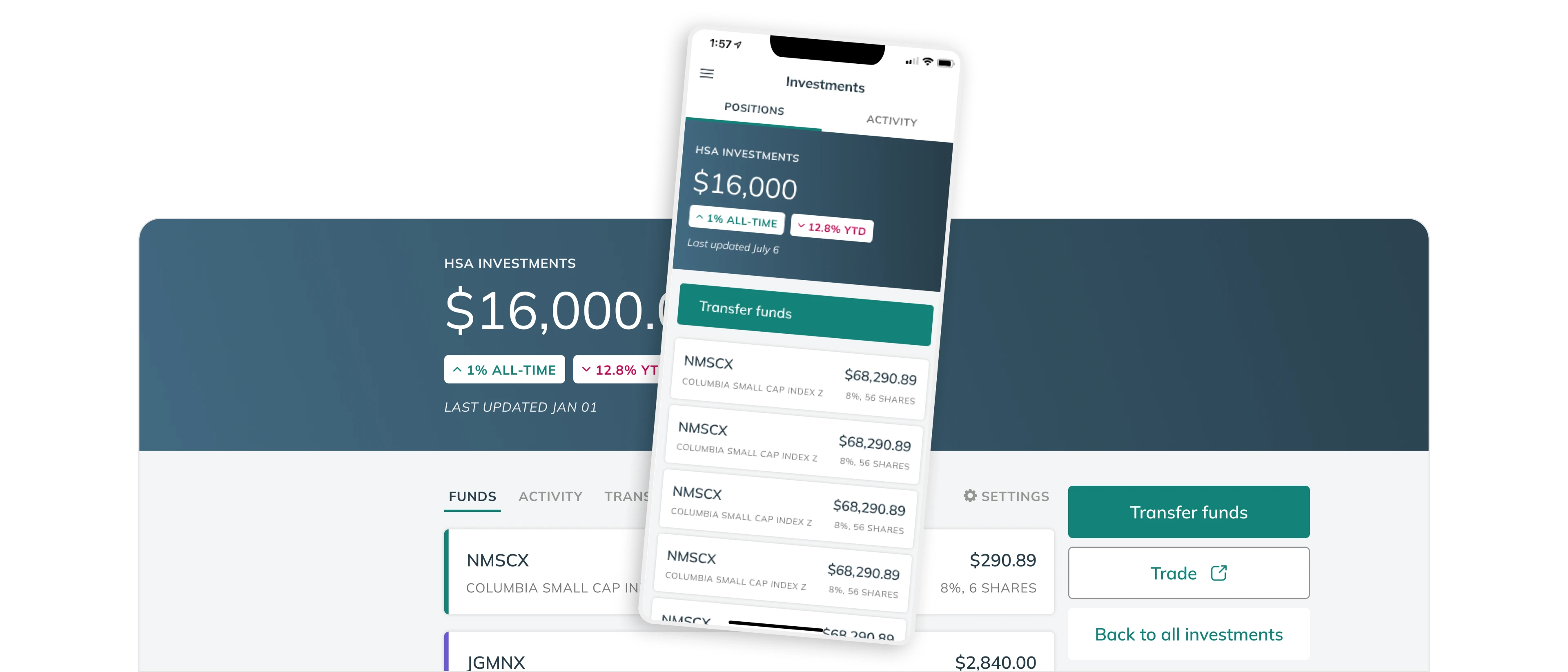

Invest your HSA funds

Choose from two industry-leading investment solutions: Schwab Health Savings Brokerage Account from Charles Schwab and HSA Guided Portfolio from Devenir.***

Control when and how to invest with different investment access options

Fund with one-time, sweep, or recurring transfers

Monitor from the convenience of your Lively dashboard

***Any investment products are not insured by the FDIC; not deposits or obligations of the bank or its affiliates; not guaranteed by the bank or its affiliates; and are subject to investment risk, including possible loss of principal.

Ready to get started?

Sign up for your Lively HSA in just a few minutes.

Frequently Asked Questions (FAQ)

Is there a fee to add investments?

Lively offers two ways to invest with our Schwab Health Savings Brokerage Account option: invest anything above $3,000 for no access fee or invest with no minimum requirements after a $24 annual access fee. (Additional fees from Charles Schwab may apply, see details here.)

Lively charges a 0.50% annual management fee for access to investment capabilities through the HSA Guided Portfolio by Devenir, including automated features such as rebalancing. The fee is based on invested assets and debited quarterly. (Additional expense ratio fees may apply, see details here.)

Be sure to consult with a financial planning and/or tax professional as needed to understand your options.

Can I transfer an existing HSA to Lively?

Yes, you can enter information related to a transfer during the enrollment process and at any point after your account is finalized.

My employer lets me pick my own HSA provider. What is the cost?

The cost is $0 for you and your employer. Please note: since we aren’t working with your employer directly, you will be managing contributions through them.

How safe is my money?

Your HSA cash funds are safely held and insured for up to $250,000 by our financial institution partners. The financial institution where your funds are deposited is determined at Lively's discretion.