Why Offer an FSA

Offer employees savings and flexibility

A Flexible Spending Account (FSA) is an employer-sponsored account offered to employees to help them pay for eligible healthcare and dependent expenses with pre-tax funds. FSAs offer:

Tax-deductible employer contributions

Employers can make contributions on top of employee contributions for additional tax savings.

Health plan flexibility

Unlike HSAs, which must be offered alongside an HDHP, an FSA can be offered alongside any medical or dental plan to offer employees additional flexibility, and accommodate a range of health plan needs.

Enhanced benefits package

According to BenefitsPro, FSAs are one of the top benefits employers should add to attract and retain talent, and can be used to round out your benefits package.

Get more out of your FSA

4 times better

Customer satisfaction is more than 3 times higher than the industry average.*

60 seconds or less

We don't keep you waiting. Over 95% of account holder calls are answered in less than 60 seconds.

90% first-touch approval

No back and forth. Over 90% of FSA claims are approved on the first review.

*Based on Net Promoter Score (NPS). NPS is a widely used metric that measures customer satisfaction. Lively's NPS score is three times higher than the industry average of 16-34.

Get more out of your FSA

*Based on Net Promoter Score (NPS). NPS is a widely used metric that measures customer satisfaction. Lively's NPS score is three times higher than the industry average of 16-34.

Lively FSA suite

Offer a range of options with expert guidance

Give your team the flexibility to choose the best plan for their needs. Lean on Lively’s industry experts to guide you through the eligibility, coverage, and contribution guidelines of each plan.

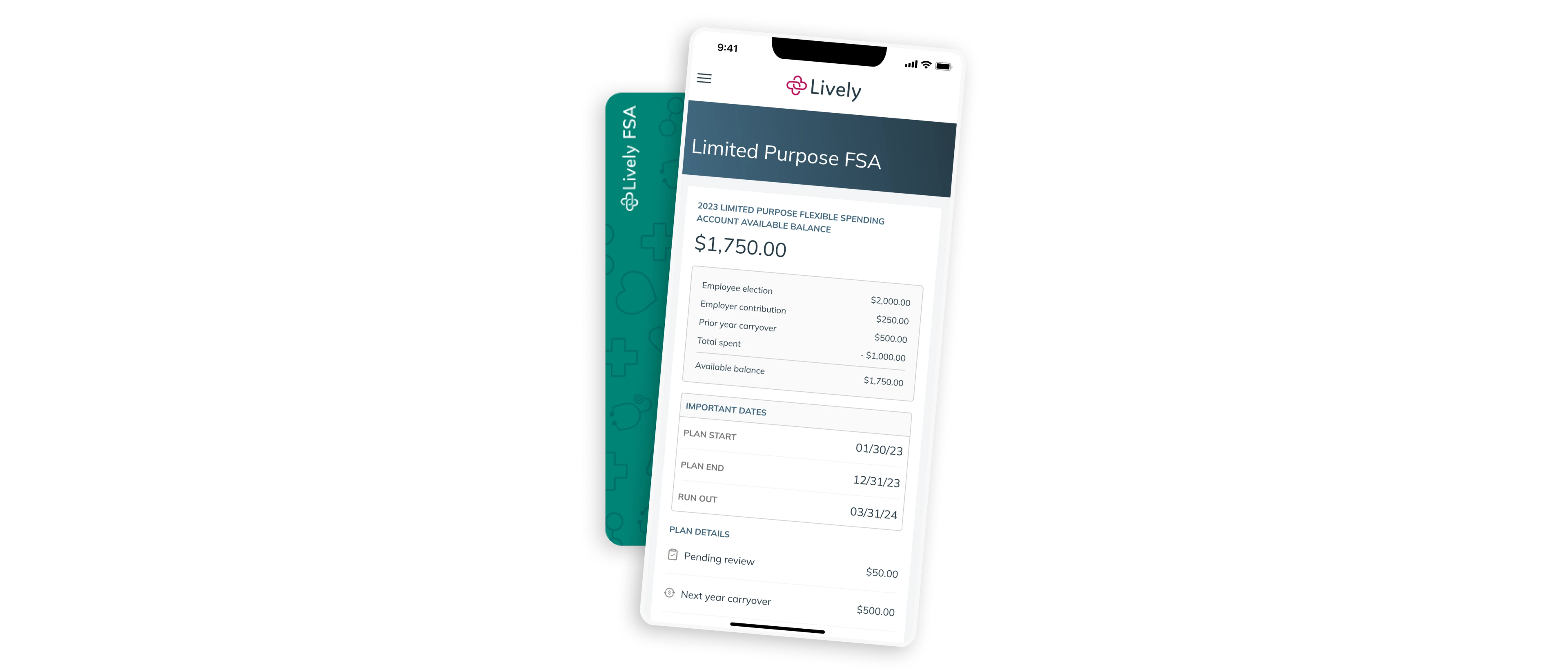

Limited Purpose Flexible Spending Account

LPFSAs cover eligible preventive, dental, and vision care expenses not covered by the employee’s health insurance.

Some qualified medical expenses for Limited Purpose FSAs include:

Eye glasses, contacts, and solution

Dentures and bridges

Orthodontia and guards for teeth grinding

Dependent Care FSA

Employees can save on care expenses for children up to age 13 and elderly or disabled adults claimed as federal tax dependents.

Some qualified expenses for Dependent Care FSAs include:

Physical care

In-home care

Child or adult day care given by qualified caregivers in an institutional setting

Guide

Master the FSA basics

Your comprehensive guide to Flexible Spending Accounts and answers to common questions for account holders, employers, and brokers.