The Lively Blog

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox

2020 HSA Spend Report: HSA Spending Amidst COVID-19

Shobin Uralil · February 4, 2021 · 3 min read

COVID-19’s impact on 2020 HSA spending and healthcare costs was significant. The pandemic interrupted the predictability of healthcare services and spending. Even with so much uncertainty and change, one element remained steady in 2020—Americans continued to use their HSA how it was intended: for standard, yearly medical expenses.

Healthcare costs continue to rise, unemployment is high, and health insurance premium volatility is at its peak. HSAs will continue to be vital for Americans to shelter themselves from rising out-of-pocket healthcare costs.

HSA Spending Habits

When it comes to HSA spending, two things matter and mimic trends in the healthcare space:

The average cost for regular and expected healthcare costs, such as trips to the doctor.

The HSA account holder’s age.

But, how did the pandemic impact HSA spending habits in 2020? Research for the 2020 HSA Spend Report found that elective procedures and preventative care visits early in the pandemic made HSA spending unpredictable. Many account holders reduced their spending, while others increased their spending in particular categories. What also changed were payment decisions. More individuals chose the most physically safe point of sale options.

Our research found that hospital care costs are changing, specific prescription spending locations are gaining market share, and HSA spending was impacted by COVID-19 throughout the year, among other findings.

Download our report to discover how HSA spending and healthcare costs were affected by COVID-19. Learn where consumers spent their funds regardless of the pandemic.

Lively HSA account holders continue to use their HSAs for regular and expected medical services. In doing so, they’re reducing their overall out-of-pocket healthcare spending when compared to Americans who don’t have access to an HSA and the triple-tax savings that comes with it.

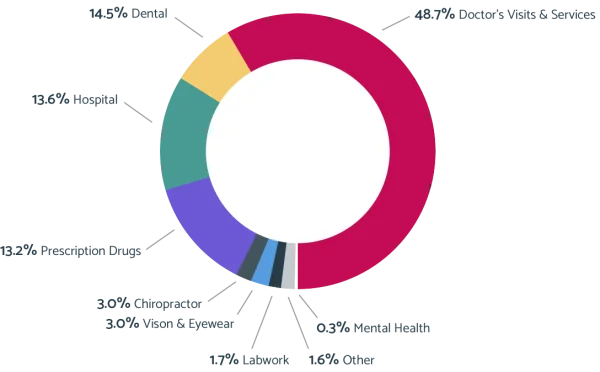

When expected medical, dental, and vision expenses are combined, over 71% of all HSA expenses were used for annual expenses. That jumps to 84% when adding prescription drug spending. We would expect this distribution to climb even further as yearly service-based medical costs continue to increase.

86% of annual HSA spending is being used for expected costs and routine visits.

Where were the spending surprises in 2020? The pandemic impacted all healthcare spending categories, but prescription spending, chiropractic care, and lab work all showed surprising results, as did mental health spending.

Finally, the impact of COVID-19 on 2021 premiums ranges from a 3.4% decrease to an 8.4% increase. The volatility has employers and employees seeking ways to cut the costs of fixed expenses, adding more pressure on the average American consumer who spends their savings on everyday health expenses. HSAs will continue to be vital for Americans to shelter themselves from rising out-of-pocket healthcare costs.

Download our report to discover how 2020 HSA spending compared to national healthcare spending.

Benefits

2025 and 2026 HSA Maximum Contribution Limits

Lively · May 9, 2024 · 3 min read

On May 9, 2024 the Internal Revenue Service announced the HSA contribution limits for 2025. For 2025 HSA-eligible account holders are allowed to contribute: $4,300 for individual coverage and $8,500 for family coverage. If you are 55 years or older, you’re still eligible to contribute an extra $1,000 catch-up contribution.

Benefits

What is the Difference Between a Flexible Spending Account and a Health Savings Account?

Lauren Hargrave · February 9, 2024 · 12 min read

A Health Savings Account (HSA) and Healthcare Flexible Spending Account (FSA) provide up to 30% savings on out-of-pocket healthcare expenses. That’s good news. Except you can’t contribute to an HSA and Healthcare FSA at the same time. So what if your employer offers both benefits? How do you choose which account type is best for you? Let’s explore the advantages of each to help you decide which wins in HSA vs FSA.

Health Savings Accounts

Ways Health Savings Account Matching Benefits Employers

Lauren Hargrave · October 13, 2023 · 7 min read

Employers need employees to adopt and engage with their benefits and one way to encourage employees to adopt and contribute to (i.e. engage with) an HSA, is for employers to match employees’ contributions.

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox