The Lively Blog

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox

How HSA Account Holders Navigated Rising Healthcare Costs in 2021

Lively · February 9, 2022 · 2 min read

In 2021, uncertainty continued to be the only certainty, an unwelcome carryover from the rollercoaster of 2020. Despite widespread vaccination and availability of vaccines, the COVID-19 pandemic has persisted, and new variants like Delta and Omicron caused infections to rise and fueled an uneven economic recovery.

In addition, consumers had to contend with rising inflation, prescription drug costs, and health insurance premiums. Inflation in the United States hit 6.2% in October, the highest level in 30 years and one of the highest rates in the world.

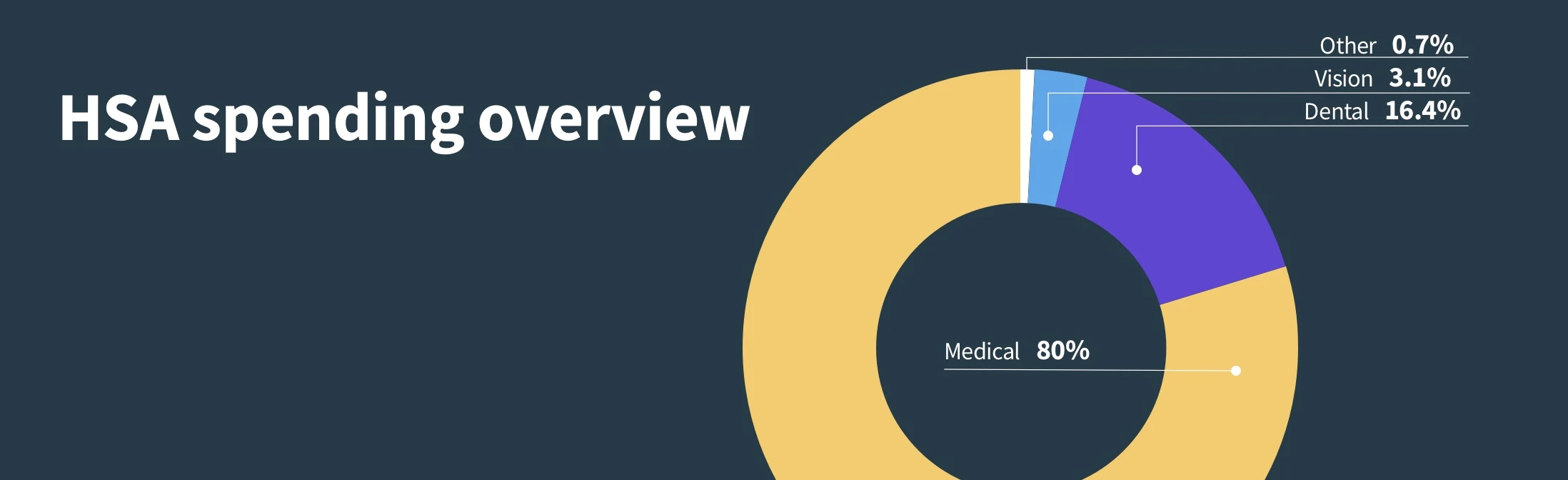

These, among other factors, influenced how Americans spend their healthcare dollars. In our new fourth annual HSA Spend Report Lively takes a look at the numbers, and spending patterns, of Lively HSA account holders in 2021 and offers insight into what these spending habits can show us about national healthcare trends.

The report examines:

How HSA account holders spend, especially on routine expenses versus major healthcare emergencies such as hospital visits.

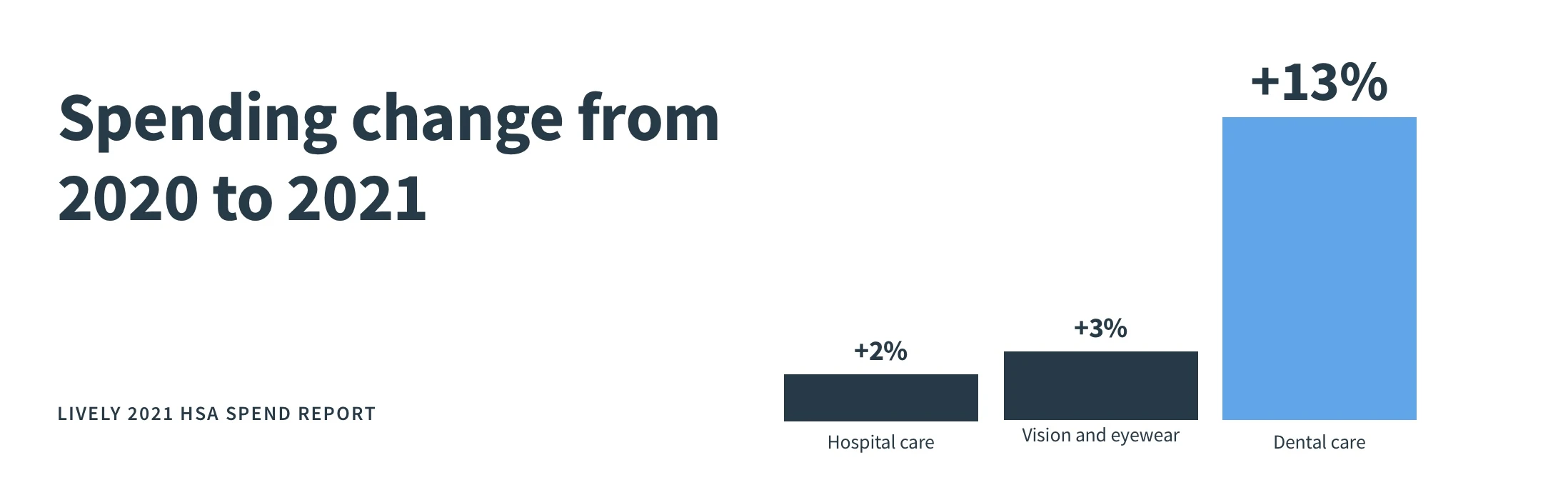

HSA consumer spending habits, including year-over-year changes since 2019, and highlights important patterns around mental health and dental spending.

Trends in consumer behavior, including shopping at pharmacies versus online, and Amazon’s increasing dominance in the healthcare space.

How HSA spending compares to overall healthcare spending in the United States.

Insurance brokers, consultants, and employers can use this report to understand how account holders are using their HSAs, and how they can support their clients and employees in navigating the rising costs of healthcare in the United States. They can also understand areas where additional HSA education may be needed, especially around eligibility and spending on mental healthcare. Download the report today for essential industry data and insights from Lively.

Benefits

2024 and 2025 HSA Maximum Contribution Limits

Lively · May 9, 2024 · 3 min read

On May 9, 2024 the Internal Revenue Service announced the HSA contribution limits for 2025. For 2025 HSA-eligible account holders are allowed to contribute: $4,300 for individual coverage and $8,500 for family coverage. If you are 55 years or older, you’re still eligible to contribute an extra $1,000 catch-up contribution.

Benefits

What is the Difference Between a Flexible Spending Account and a Health Savings Account?

Lauren Hargrave · February 9, 2024 · 12 min read

A Health Savings Account (HSA) and Healthcare Flexible Spending Account (FSA) provide up to 30% savings on out-of-pocket healthcare expenses. That’s good news. Except you can’t contribute to an HSA and Healthcare FSA at the same time. So what if your employer offers both benefits? How do you choose which account type is best for you? Let’s explore the advantages of each to help you decide which wins in HSA vs FSA.

Health Savings Accounts

Ways Health Savings Account Matching Benefits Employers

Lauren Hargrave · October 13, 2023 · 7 min read

Employers need employees to adopt and engage with their benefits and one way to encourage employees to adopt and contribute to (i.e. engage with) an HSA, is for employers to match employees’ contributions.

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox