The Lively Blog

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox

Find Eligible Expenses in a haystack and optimize healthcare spending, with Expense Scout

Lively · September 6, 2019 · 2 min read

Enhanced Reimbursement Experience

Today’s vast payment landscape allows employees to make monetary transactions in a variety of ways. However, the hidden cost of this flexibility may be missed opportunities for reimbursement on HSA-eligible expenses.

Whether an employee forgot their HSA debit card, preferred to use their rewards card, or simply didn’t know an expense was HSA-eligible, the end result is the same: spend extra time and energy to submit a manual submission, or miss out on the savings altogether.

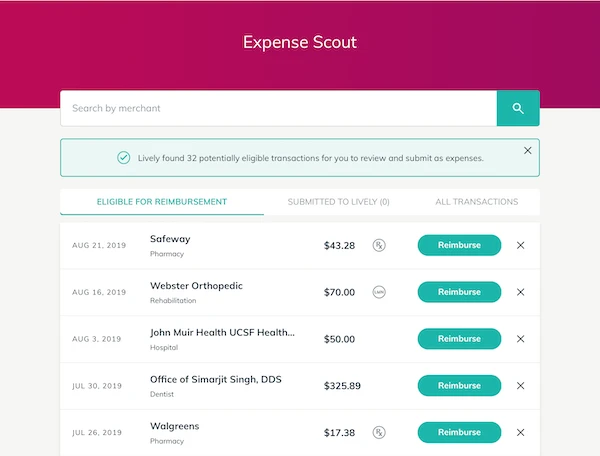

Lively is committed to helping employees optimize healthcare spending. In addition to our intuitive expense submission and reimbursable bank features, we have enhanced the process with “Expense Scout,” which proactively surfaces eligible expenses for reimbursement that may otherwise be overlooked.

How It Works

Expense Scout is an optional feature and can be set up in a few quick steps within the Lively platform:

Employee securely links external accounts they’d like to be reviewed

Lively automatically identifies potential eligible expenses and presents them for confirmation

Employee reviews each expense and has the option to reject or easily submit for reimbursement

Pay With Confidence

There are many things employees cannot control when it comes to healthcare spending. But with Lively, employees have the freedom to pay for their healthcare in the manner of their choosing, and the confidence of knowing they are maximizing the benefits of their HSA.

Benefits

2024 and 2025 HSA Maximum Contribution Limits

Lively · May 9, 2024 · 3 min read

On May 9, 2024 the Internal Revenue Service announced the HSA contribution limits for 2025. For 2025 HSA-eligible account holders are allowed to contribute: $4,300 for individual coverage and $8,500 for family coverage. If you are 55 years or older, you’re still eligible to contribute an extra $1,000 catch-up contribution.

Benefits

What is the Difference Between a Flexible Spending Account and a Health Savings Account?

Lauren Hargrave · February 9, 2024 · 12 min read

A Health Savings Account (HSA) and Healthcare Flexible Spending Account (FSA) provide up to 30% savings on out-of-pocket healthcare expenses. That’s good news. Except you can’t contribute to an HSA and Healthcare FSA at the same time. So what if your employer offers both benefits? How do you choose which account type is best for you? Let’s explore the advantages of each to help you decide which wins in HSA vs FSA.

Health Savings Accounts

Ways Health Savings Account Matching Benefits Employers

Lauren Hargrave · October 13, 2023 · 7 min read

Employers need employees to adopt and engage with their benefits and one way to encourage employees to adopt and contribute to (i.e. engage with) an HSA, is for employers to match employees’ contributions.

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox