The Lively Blog

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox

First Time Filing Taxes? Here’s Your Step-by-Step Guide

Lauren Hargrave · January 6, 2021 · 6 min read

Whether you’ve just graduated from college or it’s the first calendar year in which you’ve had a job, the thought of filing taxes can feel overwhelming. There are forms with letters and numbers, there are terms with which you might not be familiar-- it’s all very official and could leave you asking the question: Do I really need to do this? The answer? Most likely, yes.

First, every time you receive a tax document from an employer, that employer files a similar document with both your state and federal government, so they have a record of what you earned. Second, if you think your state and the IRS have bigger fish to fry than tracking down your tax return, you might be right for a year or two. But at some point, you’ll receive a friendly reminder to file those missing returns, likely with a late penalty tacked on. So it’s best to start your relationship with these government agencies off on the right foot.

Here are the basic steps to filing your tax return for the first time.

Step 1: Determine Your Filing Status

For tax purposes, there are several ways in which you can identify yourself (i.e. your “filing status”) and each carries a different set of rules regarding deductions and income limits.

Individual: you’re single and responsible for just yourself (no dependents).

Married, filing jointly: you’re married and you and your spouse are going to file taxes on the same tax return.

Married, filing separately: you’re married but you’re going to file your own tax returns.

Head of household: you’re unmarried, pay for more than half of the household bills, and you have at least one dependent who lives with you at least six months out of the calendar year.

Step 2: How Much Did You Earn?

Every year the IRS releases the amount of Adjusted Gross Income (i.e. the money you earned less the money you paid for health insurance premiums and other deductions) an individual or couple can earn before having to file their federal income taxes. The limits are set each year and depend whether you are filing as an individual, a married couple, or a head of household.

Even if you earned less than the income limit for your filing status, you might still have to file taxes if: you’re self-employed, your state requires it, or if you received a tax credit through the healthcare marketplace. Plus, you could be eligible for benefits like the Earned Income Tax Credit for low-income families, so it might make sense to file even if those three situations don’t apply to you.

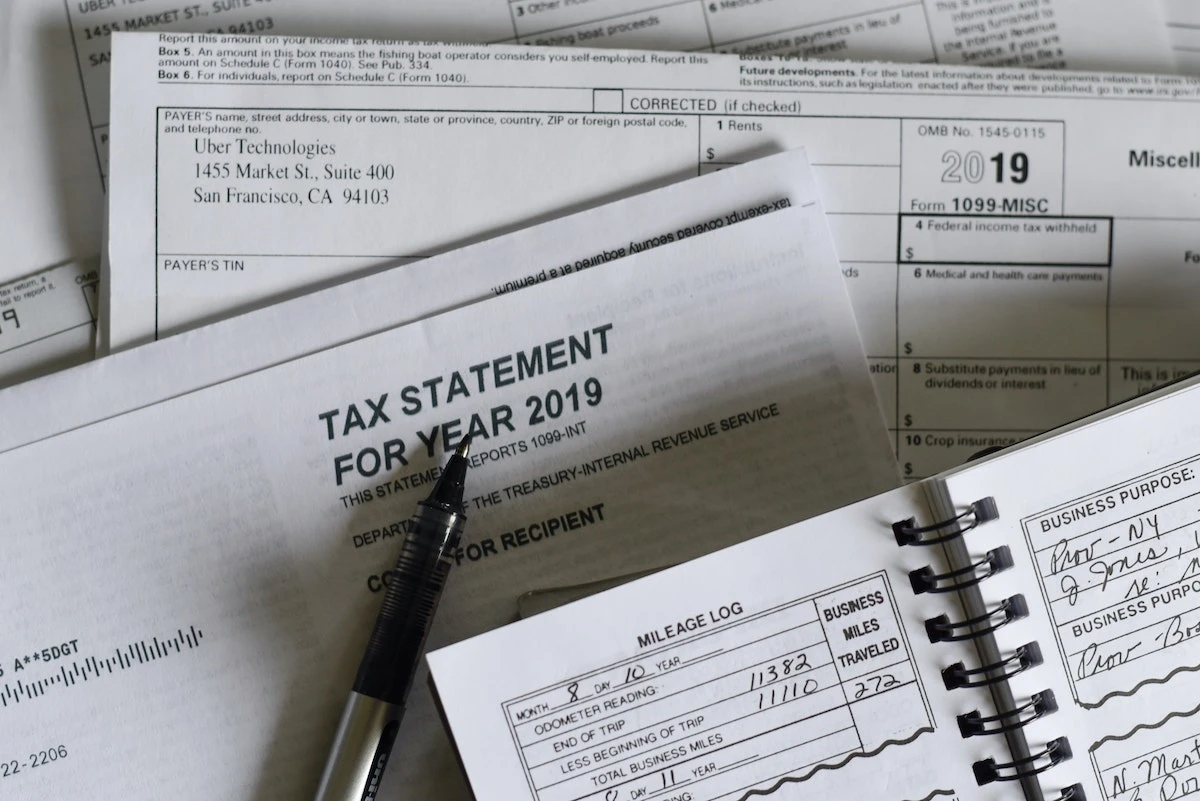

Step 3: The Forms

Filing your taxes usually requires three, four, or sometimes five of these five basic forms:

- W2: You will get this document if you are an employee of a company. If you were an employee of more than one company, you will receive a W2 from each. The document(s) will show your earnings and the taxes and other deductions like health insurance premiums already removed from your paychecks.

1099-MISC: You will receive this tax document from each client or company for which you completed freelance, gig or contract work. They will show the total amount the person or entity paid you for the calendar year.

W2G: You will receive this document for any gambling winnings.

1040: This is the form you will complete to file your federal taxes. If you’re filing your taxes for the first time, you will most likely only need this form. However, in the case you have itemized deductions, real estate holdings or other forms of income or write-offs, you’ll need to complete additional forms which will be referenced on Form 1040 and can be found on the IRS website.

Your state income tax form. Each state has a different naming system for the form with which you’ll file your state income taxes. The Federation of Tax Administrators has put together a list of links to all 50 states’ tax forms as well as the instructions on how to complete them.

Before you can begin the process of completing Form 1040 and your state tax document, you’ll need to collect all your earnings statements (W2s, 1099-MISCs and W2Gs) and have them handy. If you did not receive an earnings statement from any employer or client, contact them immediately. They may be able to send you a digital copy so you don’t have to wait for it to arrive via snail mail.

Step 4: Filing Your Taxes

There are three ways you can go about filing your income taxes:

DIY. If you have a simple tax return (e.g. one W2, no dependents, no itemized write-offs), then completing your federal and state taxes on your own could be the best course of action. If this is the road you choose to go down, the IRS has two different e-file options based on your income. You will have to check with your state to see if e-file options are available to you. Mailing in your tax documents is also an option, however because of staffing issues at the IRS, this could delay the processing of your returns. If you decide you want to mail in your tax returns, you will download the current year’s Form 1040 from the IRS website, and your state’s income tax form from your state’s website, complete them, then mail your Form 1040 and supporting documents to your state’s IRS office, and your state return to the appropriate state office.

Use a tax filing tool. There are several options which offer a free tax form completion and e-filing service for simple tax returns.

Have a professional file your taxes. If you don’t feel comfortable filing your own taxes, you can always hire a professional tax accountant to complete the forms and file them for you.

Most people don’t relish the process of completing and filing their tax returns but it’s a necessary part of living and working in the United States. The good news is, there are plenty of resources out there to help you and hopefully make the experience as painless as possible. If you have an HSA, consult Lively's comprehensive guide to filing your taxes when you have an HSA.

Benefits

2024 and 2025 HSA Maximum Contribution Limits

Lively · May 9, 2024 · 3 min read

On May 9, 2024 the Internal Revenue Service announced the HSA contribution limits for 2025. For 2025 HSA-eligible account holders are allowed to contribute: $4,300 for individual coverage and $8,500 for family coverage. If you are 55 years or older, you’re still eligible to contribute an extra $1,000 catch-up contribution.

Benefits

What is the Difference Between a Flexible Spending Account and a Health Savings Account?

Lauren Hargrave · February 9, 2024 · 12 min read

A Health Savings Account (HSA) and Healthcare Flexible Spending Account (FSA) provide up to 30% savings on out-of-pocket healthcare expenses. That’s good news. Except you can’t contribute to an HSA and Healthcare FSA at the same time. So what if your employer offers both benefits? How do you choose which account type is best for you? Let’s explore the advantages of each to help you decide which wins in HSA vs FSA.

Health Savings Accounts

Ways Health Savings Account Matching Benefits Employers

Lauren Hargrave · October 13, 2023 · 7 min read

Employers need employees to adopt and engage with their benefits and one way to encourage employees to adopt and contribute to (i.e. engage with) an HSA, is for employers to match employees’ contributions.

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox