The Lively Blog

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox

[Infographic] Why Telehealth is a Crucial Benefit Offering

Renee Sazci · October 8, 2020 · 2 min read

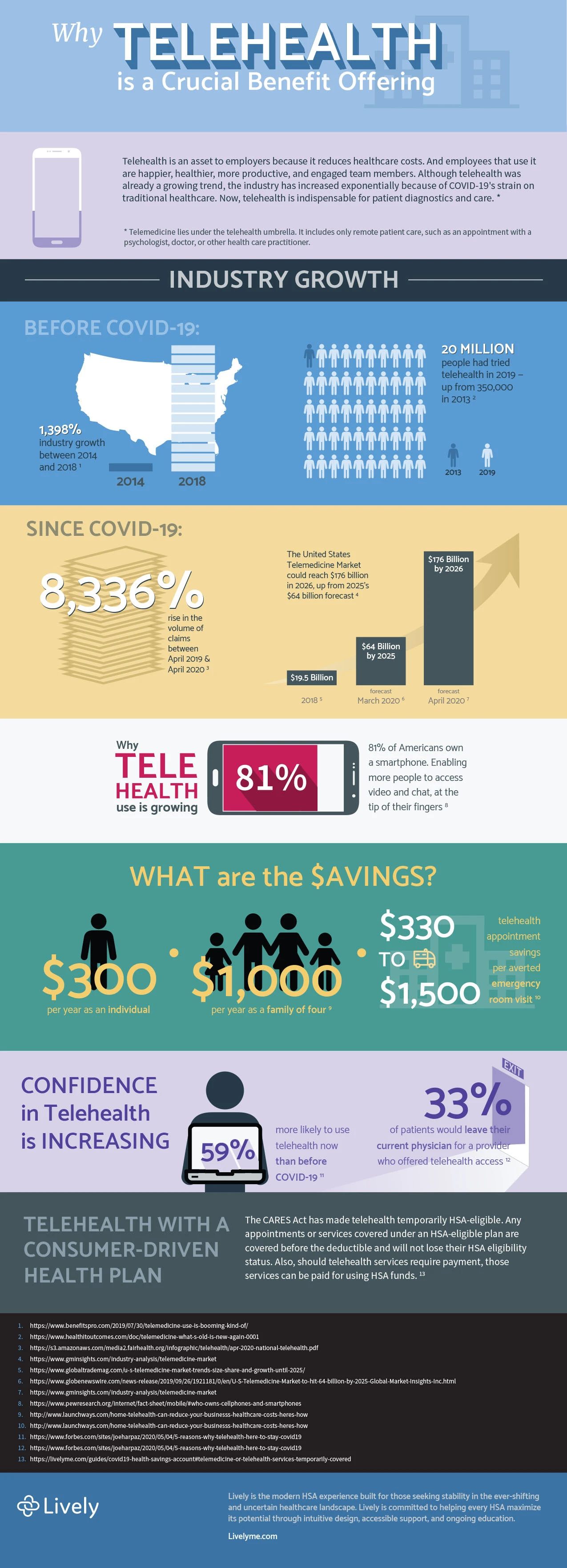

Telehealth is an asset to employers because it reduces healthcare costs. And employees that use it are happier, healthier, more productive, and engaged team members. Although telehealth was already a growing trend, the industry has increased exponentially because of COVID-19's strain on traditional healthcare. Now, telehealth visits are indispensable for patient diagnostics and care.

Employers and employees are seeking telehealth as part of a comprehensive benefits package. And thanks to the CARES Act, telehealth services are covered under Consumer-Driven Health Plans. This makes it an ideal time for brokers to address this critical employer and employee need.

Why Telehealth is a Crucial Benefit Offering Infographic

Telehealth technologies allow remote patient care, health education, research, and health care delivery. Services are typically administrative and do not include patient care, such as a doctor's appointment. Telemedicine lies under the telehealth umbrella. It includes only remote patient care, such as an appointment with a psychologist, doctor, or other health care practitioner.

Continue reading to learn how the telehealth industry has grown since COVID-19, and forecasts of what’s to come.

Industry Growth Before COVID-19

1,398% industry growth between 2014 and 2018

20 million people had tried telehealth in 2019—up from 350,000 in 2013.

Industry Growth Since COVID-19

8,336% rise in the volume of claims between April 2019 and April 2020.

The United States Telemedicine Market could reach $176 billion in 2026, up from 2025’s $64 billion forecast.

Why Telehealth Use is Growing

81% of Americans own a smartphone. Enabling more people to access video and chat, at the tip of their fingers.

What are the Savings?

Telehealth saves individual employees $300 per year, and a family of four saves $1,000 per year in medical costs.

Confidence in Telehealth is Increasing

59% say they are more likely to use telehealth now, than before COVID-19.

33% of patients would leave their current physician for a provider who offered telehealth access.

Telehealth with a Consumer-Driven Health Plan

The CARES Act has made telehealth temporarily HSA-eligible. Any appointments or services covered under an HSA-eligible plan are covered before the deductible and will not lose their HSA eligibility status. Also, should telehealth services require payment, those services can be paid for using HSA funds.

Download our infographic to discover how telehealth confidence and demand is building amongst employers and employees.

Benefits

2025 and 2026 HSA Maximum Contribution Limits

Lively · May 9, 2024 · 3 min read

On May 9, 2024 the Internal Revenue Service announced the HSA contribution limits for 2025. For 2025 HSA-eligible account holders are allowed to contribute: $4,300 for individual coverage and $8,500 for family coverage. If you are 55 years or older, you’re still eligible to contribute an extra $1,000 catch-up contribution.

Benefits

What is the Difference Between a Flexible Spending Account and a Health Savings Account?

Lauren Hargrave · February 9, 2024 · 12 min read

A Health Savings Account (HSA) and Healthcare Flexible Spending Account (FSA) provide up to 30% savings on out-of-pocket healthcare expenses. That’s good news. Except you can’t contribute to an HSA and Healthcare FSA at the same time. So what if your employer offers both benefits? How do you choose which account type is best for you? Let’s explore the advantages of each to help you decide which wins in HSA vs FSA.

Health Savings Accounts

Ways Health Savings Account Matching Benefits Employers

Lauren Hargrave · October 13, 2023 · 7 min read

Employers need employees to adopt and engage with their benefits and one way to encourage employees to adopt and contribute to (i.e. engage with) an HSA, is for employers to match employees’ contributions.

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox