The Lively Blog

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox

Comparing HSAs to 401(k)s for Retirement

Lauren Hargrave · January 5, 2021 · 7 min read

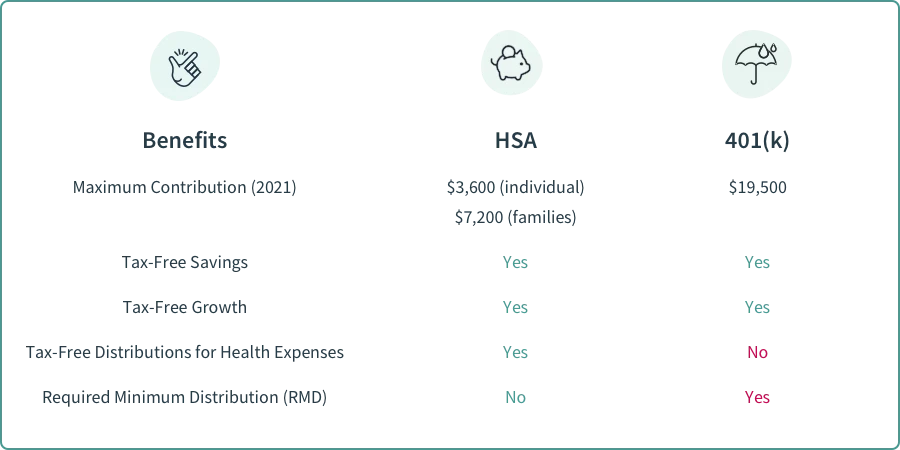

When you think of financial planning for retirement, a 401(k) is probably the first or second type of account that comes to mind. Almost a third of all Americans have a 401(k) and it offers a ton of benefits including tax deferred savings and tax-free growth. But healthcare costs are a big concern in retirement. In fact, the average 65-year old couple can expect to spend almost $300,000 for healthcare for the remainder of their lives. So a Health Savings Account (HSA) makes a lot of sense as well.

The ins and outs of HSAs

HSAs are savings accounts for qualified medical expenses. You contribute money from your paycheck, either via your employer pre-income tax, or direct from your bank account. If you fund your HSA from your bank account, you deduct your contributions from your gross income when you file your taxes. Then you withdraw money as you need it for things like copays, coinsurance, deductibles, eye glasses, dental care, etc.

Your withdrawals for qualified medical expenses are tax-free as well any growth your account experiences from interest or investments. That means there’s a triple tax advantage for HSAs: tax-free contributions, tax-free growth and tax-free withdrawals (for qualified medical expenses). If you withdraw money for anything other than qualified medical expenses, you’ll pay income taxes on the withdrawn amount as well as a 20% penalty.

You can open an HSA through your employer or the open market, the only two qualifying conditions are:

You’re under the age of 65.

You’re enrolled in a High Deductible Health Plan (HDHP) as your only health insurance. So no supplemental coverage from a spouse’s health plan. An HDHP is a health insurance plan with a minimum deductible of $1,400 for an individual and $2,800 for a family plan.

Making contributions to your HSA

Your annual contribution limit is determined by your plan type as well. The maximum annual contribution is set each year by the IRS and differs for individuals and families. If you’re 55 or older, you can contribute an additional $1,000 per year. There are five different ways to make a contribution to your HSA:

Payroll deductions

Employer contributions

Individual recurring contributions

Individual one-time contributions

Third-party contributions

Something to keep in mind: your max contribution includes ALL contributions to your account. And since anyone can deposit money into your HSA, it’s important to keep track of how much has been deposited.

In terms of contributions, HSAs offer the ultimate flexibility. You can choose to contribute your entire annual limit in January, or spread it out over the year. If you’re going to have a little extra left over one month, you can throw it in your HSA instead of spending it on something frivolous. You can even stop contributions altogether without closing the account.

Investment options for your HSA

HSAs come in three forms: traditional savings accounts, self-directed investment accounts and guided portfolio investment accounts and the former two enable you to invest your savings. Ideally, you will have an HSA that allows you to invest easily, either through a self-directed or managed portfolio option. If you have a Self-Directed HSA you can choose from a wide range of assets like real estate, bonds, ETFs, private companies and even loans in the form of promissory notes.

If you invest your contributions, you will have two actual accounts underneath your HSA umbrella. You will have your cash account and your investment account. Your cash account is where your contributions will be deposited and from where you will pay for qualified medical expenses. Your investment account is what you will use to buy and sell investments. Investing your HSA can enable your money to grow faster, tax-free, and play the long-game while you save for retirement.

How 401(k)s work

401(k)s are an employer-offered retirement account. Your employer takes your contribution from your paycheck (pre-tax) and deposits it into your 401(k). Your employer might even offer to match your contribution up to a certain limit. You’ll be given the option to invest your money in different types of funds and as your account starts to grow, you won’t pay taxes on that growth either.

Making contributions to your 401(K)

Contribution limits for 401(K)s are also set annually by the IRS. Similar to HSA contribution limits, you can contribute more annually if you are over 50. Your employer decides how many times you can change your contribution amount throughout the year. So make sure you know the rules before you set your contribution schedule.

Investing your 401(K)

Most 401(K) plans offer an investment selection chosen by your plan provider that offer a variety of investment options in mutual funds, the mix of which offer different options based on your risk appetite and account-growth needs. It’s usually advisable to spread out your investment through different types of funds, such as large US companies (referred to as “U.S. large cap”), small US companies (U.S. small cap), international markets, and emerging markets or natural resources.

Index funds, which are indexed to a specific market, are often a cheaper 401(K) investment option than mutual funds. Index funds are indexed to a specific market as opposed to managed by professional, and thus incur lower fees.

Comparing distributions from your HSA and 401(K)

The intention of the 401(k) is to save for retirement. As such, withdrawals are highly discouraged before the age of 59 ½ . If you do take a withdrawal beforehand, even if you’re retired, you’ll owe federal and state income taxes on the withdrawal in addition to a 10% penalty.

On the flip side, if you haven’t started taking withdrawals at the age of 72, you will have to start taking your Required Minimum Distribution (RMD). If you don’t, the IRS could charge you a penalty of up to 50% of the amount that should have been withdrawn. The IRS calculates your RMD based on your life expectancy. The exception is if you’re still working at the company which sponsors your 401(k) at the age of 70. If that’s the case, you can delay taking your RMD until you’ve retired.

HSAs offer great flexibility in terms of distributions — unlike a 401(k), an HSA has no mandatory distributions in retirement. You get to decide when and if to use those pre-tax assets or sell investments in your HSA. Once you turn 65, your HSA functions more like a traditional retirement account in that you can use your savings for any purpose. Withdrawals taken for medical expenses still retain their tax-free status, while withdrawals for other expenses are subject to regular income tax.

You can have both an HSA and a 401(k)

As you can see, a 401(k) offers the ability to save more money each year. But an HSA offers more flexibility. The good news is, you don’t have to choose between them. If you have the opportunity to contribute to both an HSA and a 401(k), and can afford to do so, by all means, max out both and build your retirement savings!

If you can’t afford to save $23,000 or more a year, then you’ll have to choose the contribution schedule that makes sense for you. Maybe you have a set monthly schedule for your 401(k), and you put any extra money you have at the end of the month into your HSA. Or, if medical expenses are your chief concern, you ensure you’ve saved enough to cover those, and see what’s left in your budget for your 401(k).

With rising healthcare costs and cost of living, saving for retirement is more important than ever. Reach out to your Human Resources Department if you have questions about your employer’s specific plans.

To get started saving for retirement and healthcare expenses, open a free Lively HSA today.

Benefits

2026 Maximum HSA Contribution Limits

Lively · February 1, 2025 · 3 min read

For 2026, the HSA contribution limits are $4,400 for individual coverage and $8,750 for family coverage. These limits increased from 2025, when the caps were $4,300 and $8,550. If you’re age 55 or older, you can still contribute an additional $1,000 as a catch-up contribution.

Benefits

What is the Difference Between a Flexible Spending Account and a Health Savings Account?

Lauren Hargrave · February 9, 2024 · 12 min read

A Health Savings Account (HSA) and Healthcare Flexible Spending Account (FSA) provide up to 30% savings on out-of-pocket healthcare expenses. That’s good news. Except you can’t contribute to an HSA and Healthcare FSA at the same time. So what if your employer offers both benefits? How do you choose which account type is best for you? Let’s explore the advantages of each to help you decide which wins in HSA vs FSA.

Health Savings Accounts

Ways Health Savings Account Matching Benefits Employers

Lauren Hargrave · October 13, 2023 · 7 min read

Employers need employees to adopt and engage with their benefits and one way to encourage employees to adopt and contribute to (i.e. engage with) an HSA, is for employers to match employees’ contributions.

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox