The Lively Blog

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox

Rising Healthcare Costs and the Great Resignation

Lively · June 14, 2022 · 2 min read

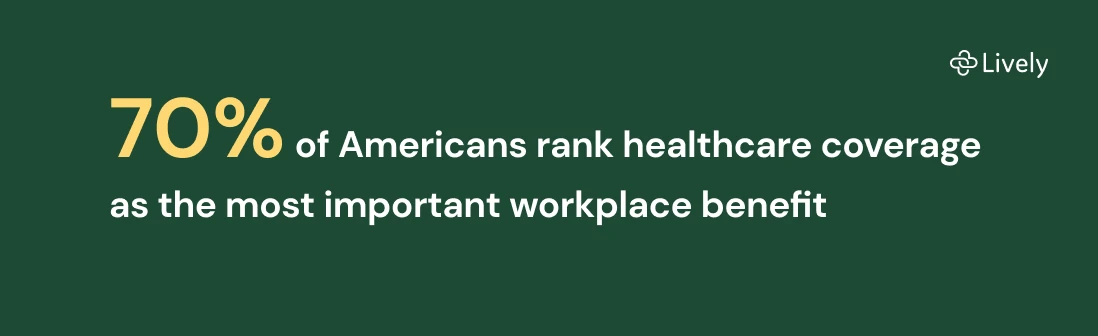

As Americans contend with rising prices, economic volatility, and ongoing stress and burnout, how can employer-sponsored benefits help? In this climate, where employees are quitting their jobs in record numbers, healthcare has emerged as the most important benefit that employers can offer. It is also a benefit that can help employers hire and retain talented employees amidst the Great Resignation.

Lively’s report, Benefits and the Great Resignation, our third annual Wellness and Wealth Report, examines the role workplace benefits play in Americans’ lives. It enables brokers, benefit consultants, and employers to understand the needs of Americans and offer a competitive benefits package.

The report offers insights into:

How rising healthcare costs are preventing the majority of Americans from achieving their financial goals

Why healthcare is the most important benefit that employers can offer and top of mind for employees when switching jobs

The gaps in access to mental health care, despite increased focus

The report outlines action items brokers, benefit consultants, and employers can take to remain competitive and help Americans meet their financial and wellness goals by:

Offering a holistic financial wellness benefits package

Selecting benefits platforms based on education and ease of use

Investing in benefits education

Giving employees options for accessing and paying for mental health care

For deeper insights into Americans’ understanding of healthcare and benefits, and how brokers, consultants, and employers can better position their benefits offering and help boost hiring and retention, download the report.

Benefits

2026 Maximum HSA Contribution Limits

Lively · February 1, 2025 · 3 min read

For 2026, the HSA contribution limits are $4,400 for individual coverage and $8,750 for family coverage. These limits increased from 2025, when the caps were $4,300 and $8,550. If you’re age 55 or older, you can still contribute an additional $1,000 as a catch-up contribution.

Benefits

What is the Difference Between a Flexible Spending Account and a Health Savings Account?

Lauren Hargrave · February 9, 2024 · 12 min read

A Health Savings Account (HSA) and Healthcare Flexible Spending Account (FSA) provide up to 30% savings on out-of-pocket healthcare expenses. That’s good news. Except you can’t contribute to an HSA and Healthcare FSA at the same time. So what if your employer offers both benefits? How do you choose which account type is best for you? Let’s explore the advantages of each to help you decide which wins in HSA vs FSA.

Health Savings Accounts

Ways Health Savings Account Matching Benefits Employers

Lauren Hargrave · October 13, 2023 · 7 min read

Employers need employees to adopt and engage with their benefits and one way to encourage employees to adopt and contribute to (i.e. engage with) an HSA, is for employers to match employees’ contributions.

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox