The Lively Blog

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox

Understand the Employee Benefits That Make the Most Impact

Lively · October 6, 2023 · 2 min read

In an environment of economic volatility and rapidly shifting employee expectations, the pressure is on HR leaders, and the benefits brokers that serve them, to offer employee benefits that make an impact when it comes to employee retention, recruitment, and cost savings. Lively’s second annual Employee Benefits Pulse Check captures and shares the decisions that HR leaders are making around benefits right now. In partnership with CITE research, we anonymously surveyed 250 HR leaders across the United States and multiple industries to capture key data and understand current trends around what employee benefits.

The report provides data driven responses to the following questions:

What are the reasons behind why employers are adding new benefits or improving existing benefits?

What benefits are the most effective for attracting and retaining employees?

What are the most challenging aspects of benefits administration and how can employers drive better benefits adoption?

The report identifies four key trends around how employers are:

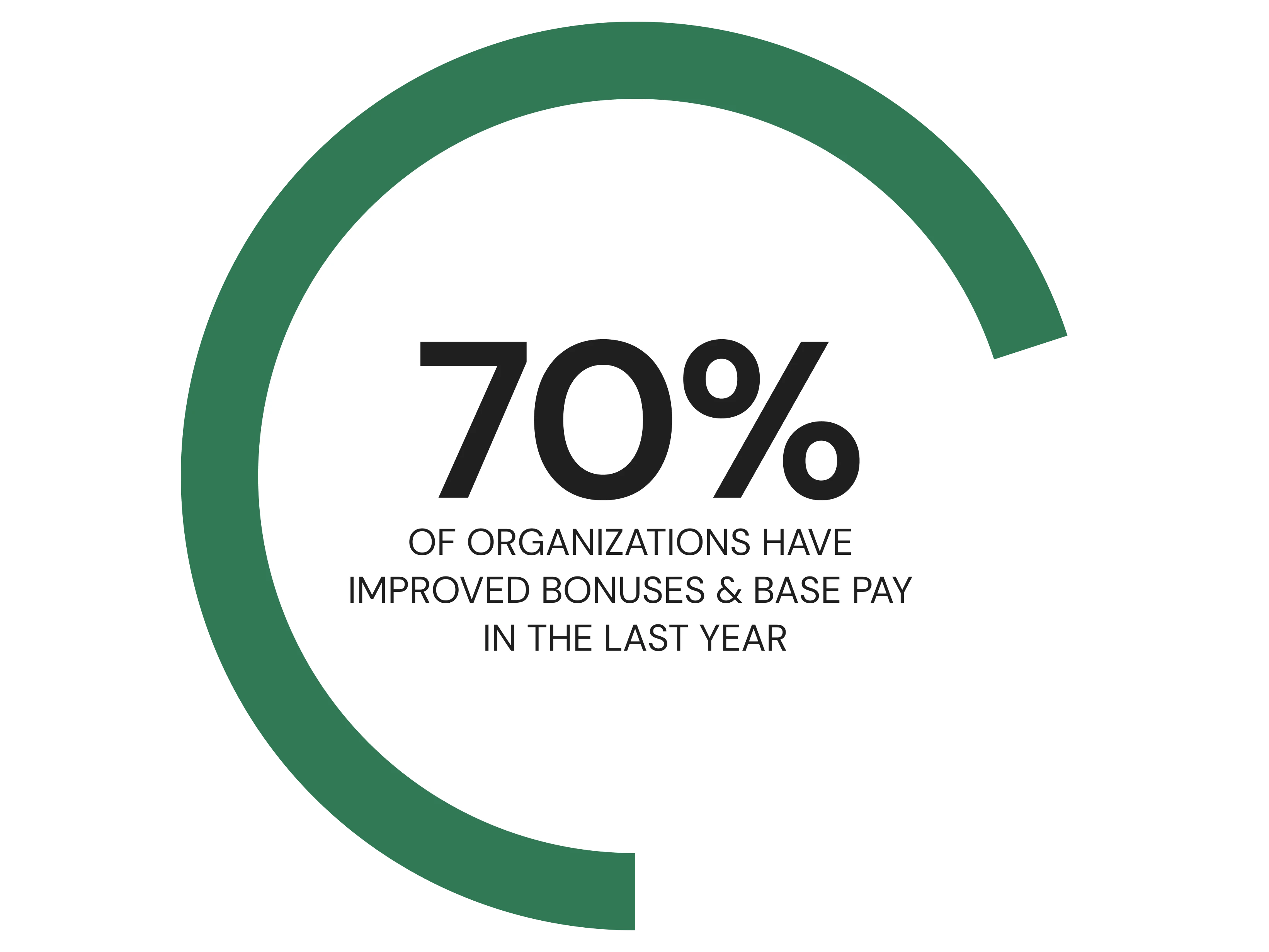

Adding bonuses, 401(k) matching and other incentives to retain employees

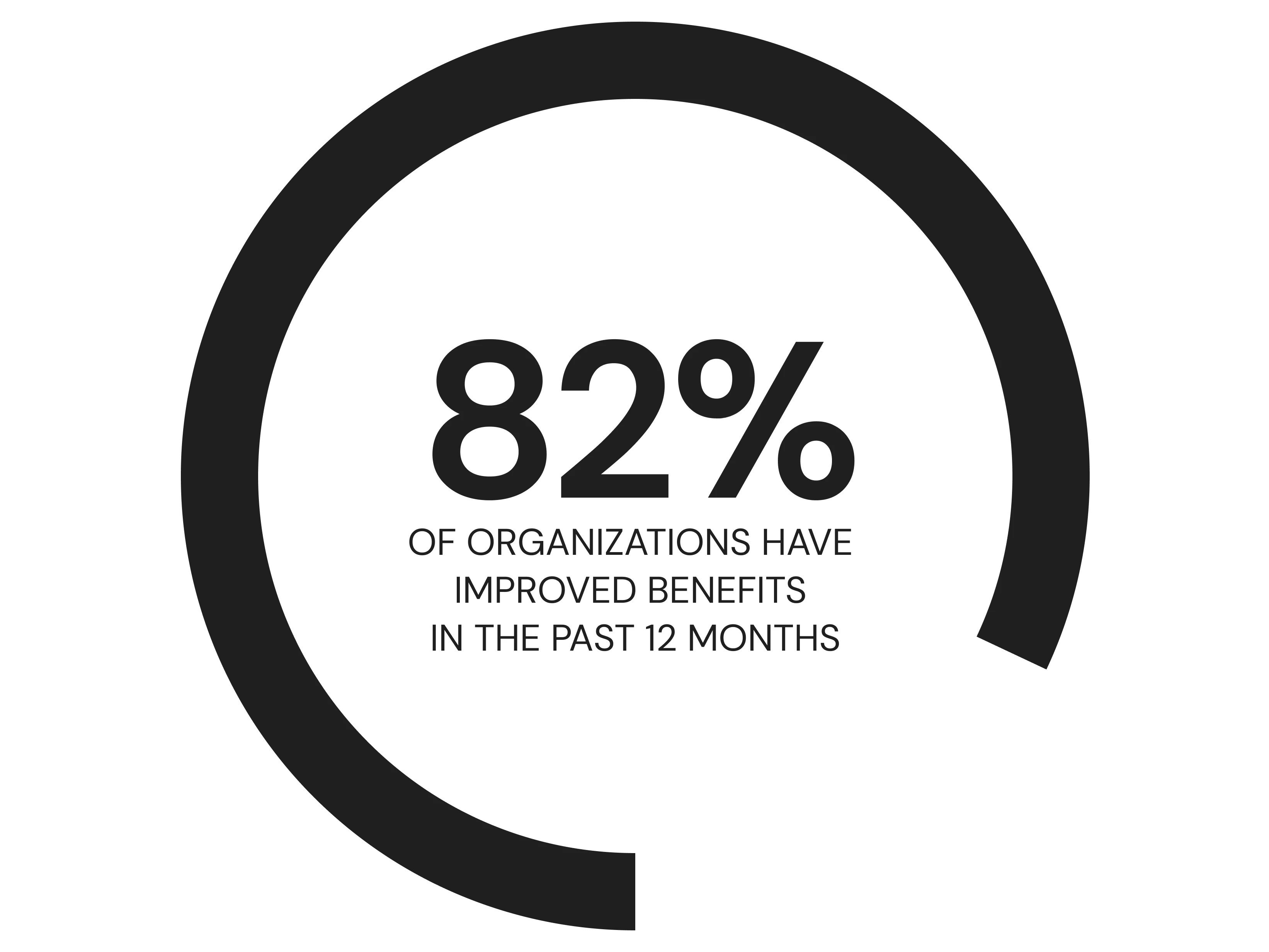

Offering innovative benefits such as Lifestyle Spending and Medical Travel Accounts and where these can be improved

Leveraging benefits to combat employee financial stress

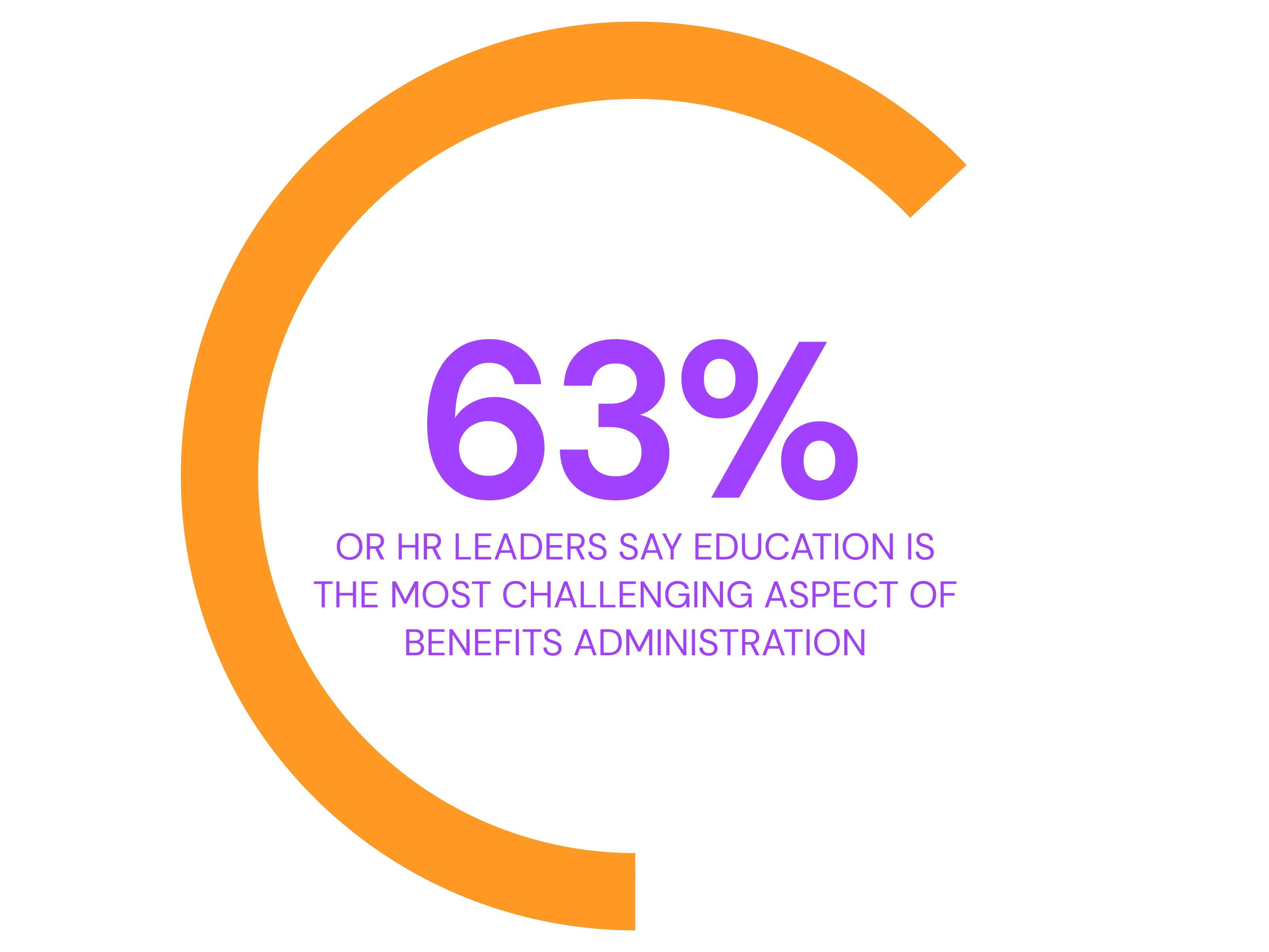

Utilizing benefits education and working with benefits providers to drive adoption

It provides key action items for brokers and employers to enable them to:

Understand what’s most valuable to employees and respond to employee needs

Identify benefits to add or improve, while staying within budget

Consider adding Lifestyle Spending and Medical Travel Accounts to further meet employee needs and create an inclusive workplace culture

Identify benefits providers that support employee education and benefits adoption during open enrollment and all year long

Read the full report in order to understand how to choose the most impactful, and cost effective, benefits for employees and to better keep up with client and employee demand during open enrollment and as you plan benefits strategies for 2024.

Benefits

2026 Maximum HSA Contribution Limits

Lively · February 1, 2025 · 3 min read

For 2026, the HSA contribution limits are $4,400 for individual coverage and $8,750 for family coverage. These limits increased from 2025, when the caps were $4,300 and $8,550. If you’re age 55 or older, you can still contribute an additional $1,000 as a catch-up contribution.

Benefits

What is the Difference Between a Flexible Spending Account and a Health Savings Account?

Lauren Hargrave · February 9, 2024 · 12 min read

A Health Savings Account (HSA) and Healthcare Flexible Spending Account (FSA) provide up to 30% savings on out-of-pocket healthcare expenses. That’s good news. Except you can’t contribute to an HSA and Healthcare FSA at the same time. So what if your employer offers both benefits? How do you choose which account type is best for you? Let’s explore the advantages of each to help you decide which wins in HSA vs FSA.

Health Savings Accounts

Ways Health Savings Account Matching Benefits Employers

Lauren Hargrave · October 13, 2023 · 7 min read

Employers need employees to adopt and engage with their benefits and one way to encourage employees to adopt and contribute to (i.e. engage with) an HSA, is for employers to match employees’ contributions.

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox