The Lively Blog

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox

Personalize Investments with HSA Guided Portfolio

Lively · August 5, 2020 · 2 min read

One of the most unique and valuable benefits of owning an HSA is the option to invest your funds tax-free. Yet, it’s often underutilized, due to restrictive investment thresholds and clunky experiences. Now, we have partnered with Devenir to bring a second investment solution to our account holders.

A simple, low-effort way to invest

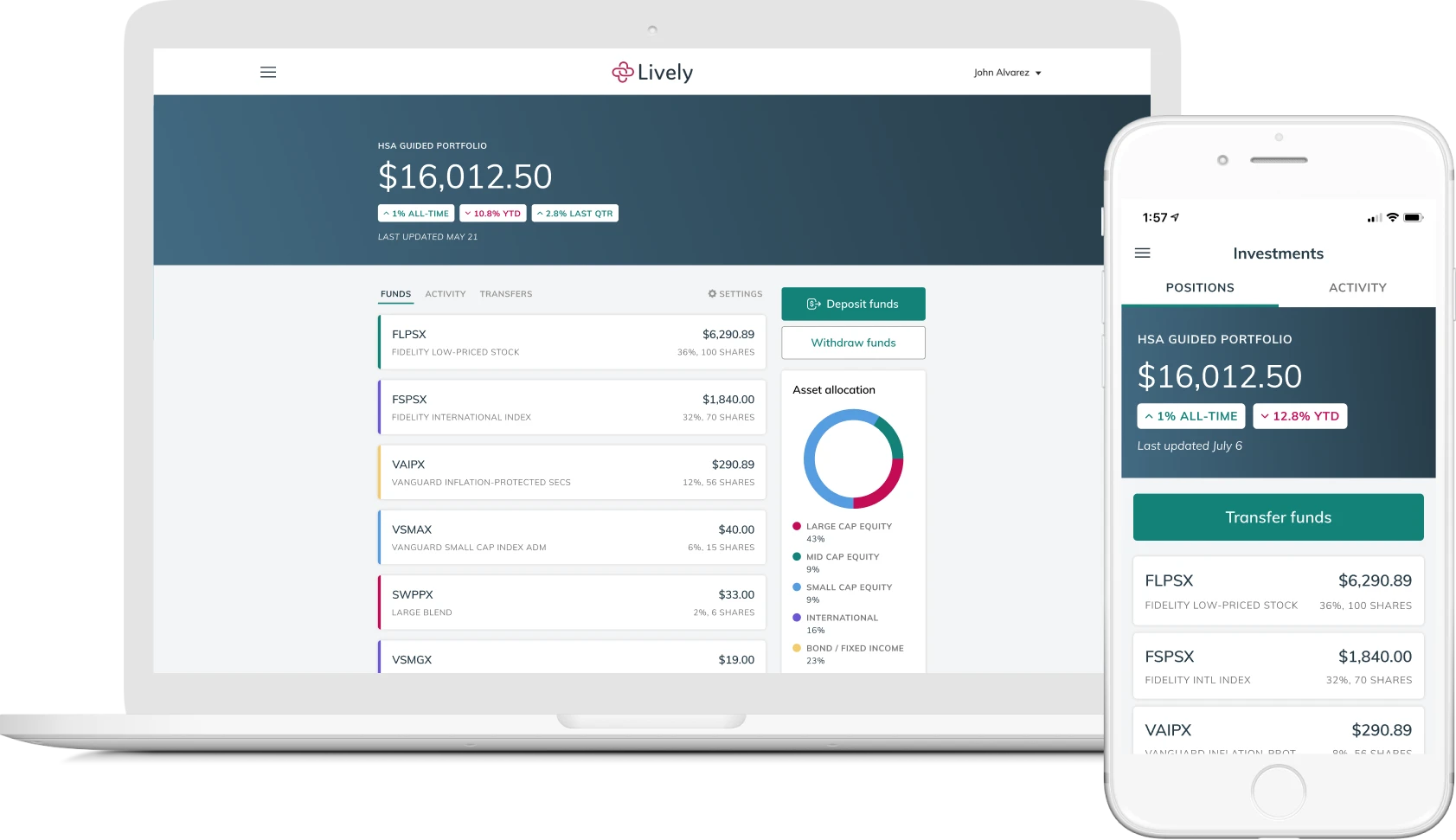

HSA Guided Portfolio by Devenir, a national leader in investment solutions for health-based accounts, guides you in designing a well-diversified portfolio that’s tailored to your personal profile, risk preferences, and financial goals. HSA Guided Portfolio employs a low-effort investing strategy that optimizes for maximum long-term returns. And the automatic rebalancing feature keeps your portfolio on track over time with no action needed from you.

How it works

Answer a few questions about yourself to receive a suggested portfolio mix

Choose from a curated menu of diverse, low cost funds

Deposit funds from your HSA to invest

Enable automated features, such as rebalancing and recurring transfers

Monitor your investments directly from your Lively account

HSA Guided Portfolio is securely integrated into your Lively HSA experience, and there is no cash minimum requirement to start investing.

Build toward your financial goals

Accessible HSA investing has never been more important. Approximately 1.2 million Americans were investing a portion of their HSA dollars at the end of 2019, and invested HSA assets are expected to exceed $20 billion in 2021*. Adding HSA Guided Portfolio to our robust investment platform is just another way Lively is working to always deliver you the most innovative HSA experience and help your health savings work harder.

Read more about our investment solutions.

* Devenir. “2019 Year-End Devenir HSA Research Report.” March 2020.

Benefits

2024 and 2025 HSA Maximum Contribution Limits

Lively · May 9, 2024 · 3 min read

On May 9, 2024 the Internal Revenue Service announced the HSA contribution limits for 2025. For 2025 HSA-eligible account holders are allowed to contribute: $4,300 for individual coverage and $8,500 for family coverage. If you are 55 years or older, you’re still eligible to contribute an extra $1,000 catch-up contribution.

Benefits

What is the Difference Between a Flexible Spending Account and a Health Savings Account?

Lauren Hargrave · February 9, 2024 · 12 min read

A Health Savings Account (HSA) and Healthcare Flexible Spending Account (FSA) provide up to 30% savings on out-of-pocket healthcare expenses. That’s good news. Except you can’t contribute to an HSA and Healthcare FSA at the same time. So what if your employer offers both benefits? How do you choose which account type is best for you? Let’s explore the advantages of each to help you decide which wins in HSA vs FSA.

Health Savings Accounts

Ways Health Savings Account Matching Benefits Employers

Lauren Hargrave · October 13, 2023 · 7 min read

Employers need employees to adopt and engage with their benefits and one way to encourage employees to adopt and contribute to (i.e. engage with) an HSA, is for employers to match employees’ contributions.

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox