The Lively Blog

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox

Never Ask “Have I Hit My deductible?” Again

Lively · July 9, 2019 · 3 min read

Track your healthcare spending with Lively

By now, you probably know that your Lively HSA is the easiest way to save money for healthcare. It’s paperless, automated, and 100% tax-free.

But your HSA works in conjunction with certain healthcare plans, like a High Deductible Health Plan. In order to better predict your healthcare costs, you need to understand your health insurance costs and HSA savings.

As an independent HSA provider, you can sign up with Lively and your healthcare provider to get the best in class healthcare experience. The result is an expert in both healthcare and health savings.

96% of HSA contributions are spent each year. The majority of these expenses are for regular and expected yearly healthcare expenses, like doctor’s visits. We continue to expand our product offerings to help our customers not only use their HSA, but also increase their health spending knowledge.

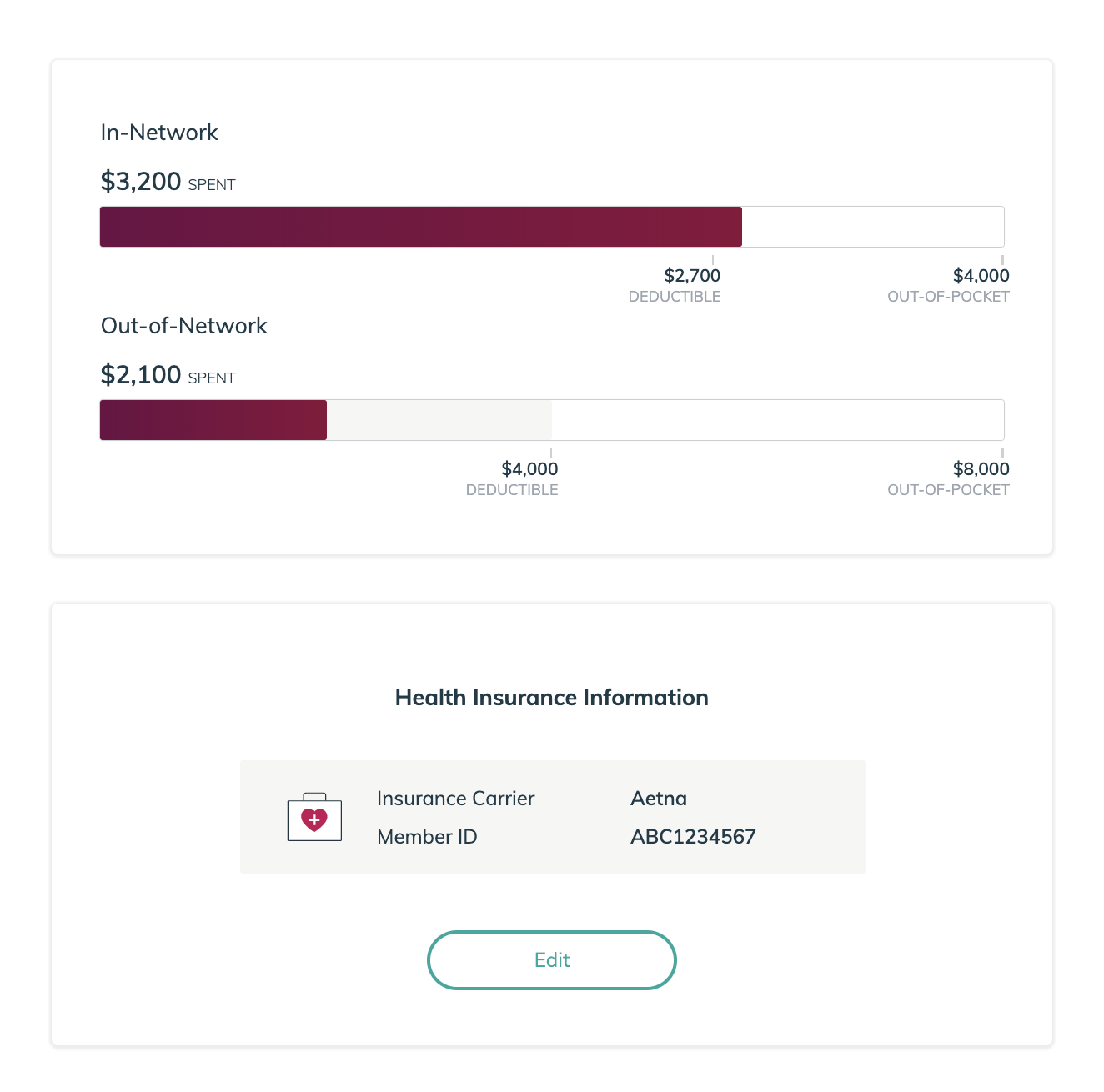

With Lively you can open one HSA for the rest of your life. Even if you switch health insurance plans it’s no problem (and with how fast health plans are changing, you might be enrolling in a new plan each year). We make it easier to understand your healthcare spending in our HSA dashboard, because more clarity means more healthcare transparency (and keeping track of all the hard to understand classifications like in-network vs. out-of-network designations and out-of-pocket costs).

Lively has made it easy to see what you have paid and what you might have to pay if you incur any healthcare expenses. Today, we are pleased to announce the launch of a real-time health insurance deductible check within your Lively HSA. We have been hard at work integrating data from a variety of sources to help provide useful information back to our users. We have over 90% coverage and growing for health plans.

Here Is How It Works:

From your browser, in the Lively dashboard, Add Your Health Plan Details

Automatically Track Your Real-Time Deductible Spending

Understand Your Future Spend (remaining deductible)

Determine What You Need to Save

Please note, we will be adding iOS integration shortly.

It only takes a few clicks to set up, all you need is your health plan details (Insurance Carrier and Member ID). From there, you can see what you have spent and what remains, no matter your healthcare provider. With this knowledge, Lively enables you to build an HSA safety net for potential out-of-pocket costs and have the peace of mind of knowing that you’re covered. Can’t find your health plan information? No problem! Tell us the name of your health insurance provider as our team is constantly updating and improving the information that is available to our users.

Clarity in the healthcare space is hard to find. We strive to make that easier. More cost transparency means you can make better health spending decisions. Not just for this year, but as you move jobs (and health insurance providers), and lifestyle changes that affect your healthcare spending. It’s even easier if this information is all in one place. Take control of your healthcare expenses today!

Benefits

2026 Maximum HSA Contribution Limits

Lively · February 1, 2025 · 3 min read

For 2026, the HSA contribution limits are $4,400 for individual coverage and $8,750 for family coverage. These limits increased from 2025, when the caps were $4,300 and $8,550. If you’re age 55 or older, you can still contribute an additional $1,000 as a catch-up contribution.

Benefits

What is the Difference Between a Flexible Spending Account and a Health Savings Account?

Lauren Hargrave · February 9, 2024 · 12 min read

A Health Savings Account (HSA) and Healthcare Flexible Spending Account (FSA) provide up to 30% savings on out-of-pocket healthcare expenses. That’s good news. Except you can’t contribute to an HSA and Healthcare FSA at the same time. So what if your employer offers both benefits? How do you choose which account type is best for you? Let’s explore the advantages of each to help you decide which wins in HSA vs FSA.

Health Savings Accounts

Ways Health Savings Account Matching Benefits Employers

Lauren Hargrave · October 13, 2023 · 7 min read

Employers need employees to adopt and engage with their benefits and one way to encourage employees to adopt and contribute to (i.e. engage with) an HSA, is for employers to match employees’ contributions.

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox