The Lively Blog

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox

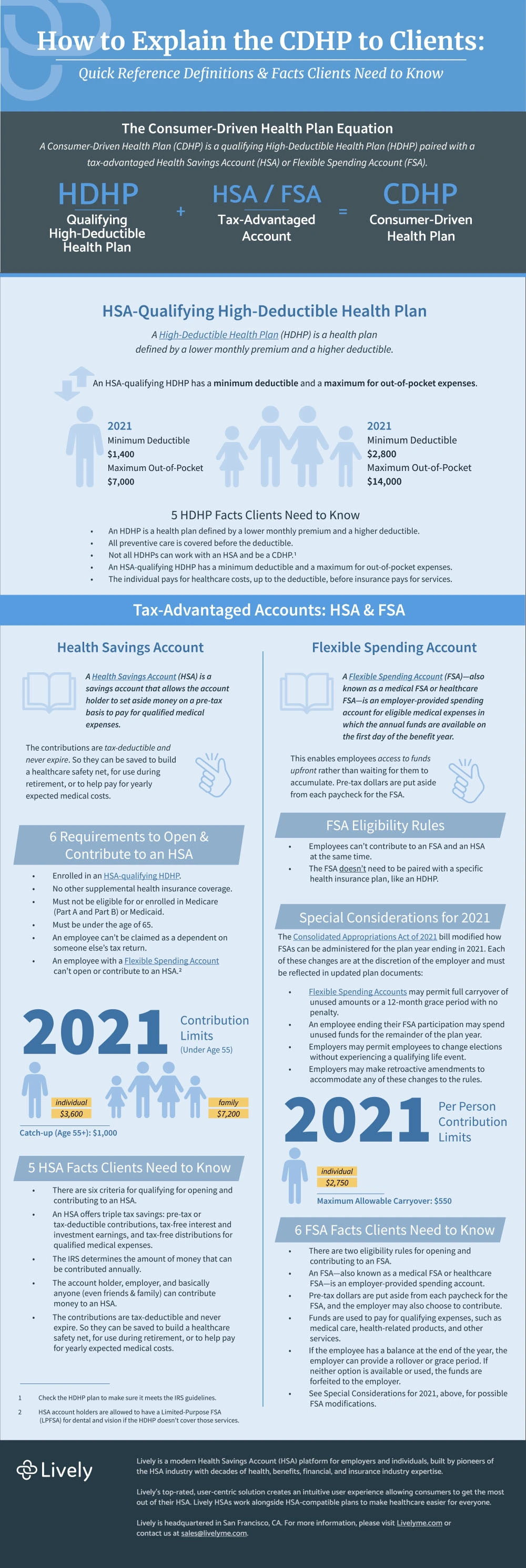

Quick Reference Definitions and Facts Clients Need to Know

Renee Sazci · January 25, 2021 · 5 min read

When you introduce a Consumer-Driven Health Plan (CDHP) to clients for the first time, how do you explain it? Are you consistent with your definitions, requirements and rules, and the essential facts? And can you find them all located in one convenient spot?

To help cut down on the time spent searching and condensing the essentials of CDHPs, we’ve created this quick-reference visual guide.

How to Explain the CDHP to Clients Infographic: Quick Reference Definitions and Facts Clients Need to Know

Continue scrolling to view the entire How to Explain the CDHP to Clients infographic. And for helpful links for further reading.

Download our infographic in PDF. Regain precious time spent gathering information, and know that you’re sharing the latest definitions, requirements, and facts about CDHPs.

The Consumer-Driven Health Plan Equation

A Consumer-Driven Health Plan (CDHP) is a qualifying High-Deductible Health Plan (HDHP) paired with a tax-advantaged Health Savings Account (HSA) or Flexible Spending Account (FSA).

HSA-Qualifying High-Deductible Health Plan

A High-Deductible Health Plan (HDHP) is a health plan defined by a lower monthly premium and a higher deductible. An HSA-qualifying HDHP has a minimum deductible and a maximum for out-of-pocket expenses.

5 HDHP Facts Clients Need to Know

An HDHP is a health plan defined by a lower monthly premium and a higher deductible.

All preventive care is covered before the deductible.

Not all HDHPs can work with an HSA and be a CDHP. Check the HDHP plan to make sure it meets the IRS guidelines.

An HSA-qualifying HDHP has a minimum deductible and a maximum for out-of-pocket expenses.

The individual pays for healthcare costs, up to the deductible, before insurance pays for services.

Tax-Advantaged Accounts: HSA & FSA

Health Savings Account

A Health Savings Account (HSA) is a savings account that allows the account holder to set aside money on a pre-tax basis to pay for qualified medical expenses. The contributions are tax-deductible and never expire. So they can be saved to build a healthcare safety net, for use during retirement, or to help pay for yearly expected medical costs.

6 Requirements to Open & Contribute to an HSA

Enrolled in an HSA-qualifying HDHP.

No other supplemental health insurance coverage.

Must not be eligible for or enrolled in Medicare (Part A and Part B) or Medicaid.

Must be under the age of 65.

An employee can’t be claimed as a dependent on someone else’s tax return.

An employee with a Healthcare FSA (HCFSA) can’t open or contribute to an HSA. HSA account holders are allowed to have a Limited-Purpose FSA (LPFSA) for dental and vision if the HDHP doesn’t cover those services.

2021 Contribution Limits for Individuals and Family Health Plan Coverage

An individual under the age of 55 can contribute up to $3,600, while those enrolled in a family health plan can contribute up to $7,200. Those aged 55 or older can contribute an extra $1,000—in addition to the individual or family health plan contribution limits.

5 HSA Facts Clients Need to Know

There are six criteria for qualifying for opening and contributing to an HSA.

An HSA offers triple tax savings: pre-tax or tax-deductible contributions, tax-free interest and investment earnings, and tax-free distributions for qualified medical expenses.

The IRS determines the amount of money that can be contributed annually.

The account holder, employer, and basically anyone (even friends and family) can contribute money to an HSA.

The contributions are tax-deductible and never expire. So they can be saved to build a healthcare safety net, for use during retirement, or to help pay for yearly expected medical costs.

Flexible Spending Account

A Flexible Spending Account (FSA)—also known as a medical FSA or healthcare FSA—is an employer-provided spending account for eligible medical expenses in which the annual funds are available on the first day of the benefit year. This enables employees access to funds upfront rather than waiting for them to accumulate. Pre-tax dollars are put aside from each paycheck for the FSA.

Two Healthcare FSA Eligibility Rules

Employees can’t contribute to a Healthcare FSA and an HSA at the same time.

The FSA doesn’t need to be paired with a specific health insurance plan, like an HDHP.

Special Considerations for 2021

The Consolidated Appropriations Act of 2021 bill modified how Healthcare FSAs can be administered for the plan year ending in 2021. Each of these changes are at the discretion of the employer and must be reflected in updated plan documents:

Flexible Spending Accounts may permit full carryover of unused amounts or a 12-month grace period with no penalty.

An employee ending their Healthcare FSA participation may spend unused funds for the remainder of the plan year.

Employers may permit employees to change elections without experiencing a qualifying life event.

Employers may make retroactive amendments to accommodate any of these changes to the rules.

2021 Healthcare FSA Contribution Limit

The maximum per person contribution to a Healthcare FSA is $2,750 and the maximum allowable carryover is $500.

5 Healthcare FSA Facts Clients Need to Know

An FSA—also known as a medical FSA or healthcare FSA—is an employer-provided spending account.

There are two eligibility rules for opening and contributing to a Healthcare FSA.

Pre-tax dollars are put aside from each paycheck for the Healthcare FSA, and the employer may also choose to contribute.

Funds are used to pay for qualifying expenses, such as medical care, health-related products, and other services.

If the employee has a balance at the end of the year, the employer can provide a rollover or grace period. If neither option is available or used, the funds are forfeited to the employer.

See Special Considerations for 2021 for possible Healthcare FSA modifications.

Download our infographic in PDF. Regain precious time spent gathering information, and know that you’re sharing the latest definitions, requirements, and facts about CDHPs.

Benefits

2026 Maximum HSA Contribution Limits

Lively · February 1, 2025 · 3 min read

For 2026, the HSA contribution limits are $4,400 for individual coverage and $8,750 for family coverage. These limits increased from 2025, when the caps were $4,300 and $8,550. If you’re age 55 or older, you can still contribute an additional $1,000 as a catch-up contribution.

Benefits

What is the Difference Between a Flexible Spending Account and a Health Savings Account?

Lauren Hargrave · February 9, 2024 · 12 min read

A Health Savings Account (HSA) and Healthcare Flexible Spending Account (FSA) provide up to 30% savings on out-of-pocket healthcare expenses. That’s good news. Except you can’t contribute to an HSA and Healthcare FSA at the same time. So what if your employer offers both benefits? How do you choose which account type is best for you? Let’s explore the advantages of each to help you decide which wins in HSA vs FSA.

Health Savings Accounts

Ways Health Savings Account Matching Benefits Employers

Lauren Hargrave · October 13, 2023 · 7 min read

Employers need employees to adopt and engage with their benefits and one way to encourage employees to adopt and contribute to (i.e. engage with) an HSA, is for employers to match employees’ contributions.

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox