The Lively Blog

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox

How Lively Account Holders Save, Spend, and Invest Their HSA money

Lively · April 4, 2024 · 2 min read

It’s no secret that prices on everyday items and services that Americans rely on have been increasing. In fact, the prices of prescription alone drugs rose 15.2% in 2023. While HSAs used to be considered a “secret” way to save on healthcare, Health Savings Accounts are now a key component of Americans’ budgeting, saving, and investing.

HSAs help Americans save on both everyday and emergency health expenses, as well as plan for long-term savings and retirement. Lively’s sixth-annual HSA Snapshot report looks at Lively’s HSA account holders’ saving, spending, and investing habits in 2023. It also compares Lively account holder activity to industry averages as reported by Devenir in their 2023 annual report. Most crucially, the report analyzes what this data means for brokers, consultants, and companies and provides critical action items to help maximize HSA usage and understanding among employees.

Key findings in the report include:

Lively’s annual account balance of funded accounts is $4,885, which is 17% higher than the industry average of $4,177. Lively account balances increased 10% from last year.

Investments drive HSA balance growth and Lively account holders invest nearly 2x the industry average, at 15% as compared to 8% as reported by Devenir.

Lively account holders are active users, using their HSAs to save on health-related expenses, as Lively’s average annual HSA withdrawals increased by 23% to $1,162 from $943 in 2022. Devenir reported withdrawals grew 13% industry wide.

Despite increased withdrawal activity, Lively account holders retain more of their HSA assets than the industry average at 25% compared to 23% industry wide.

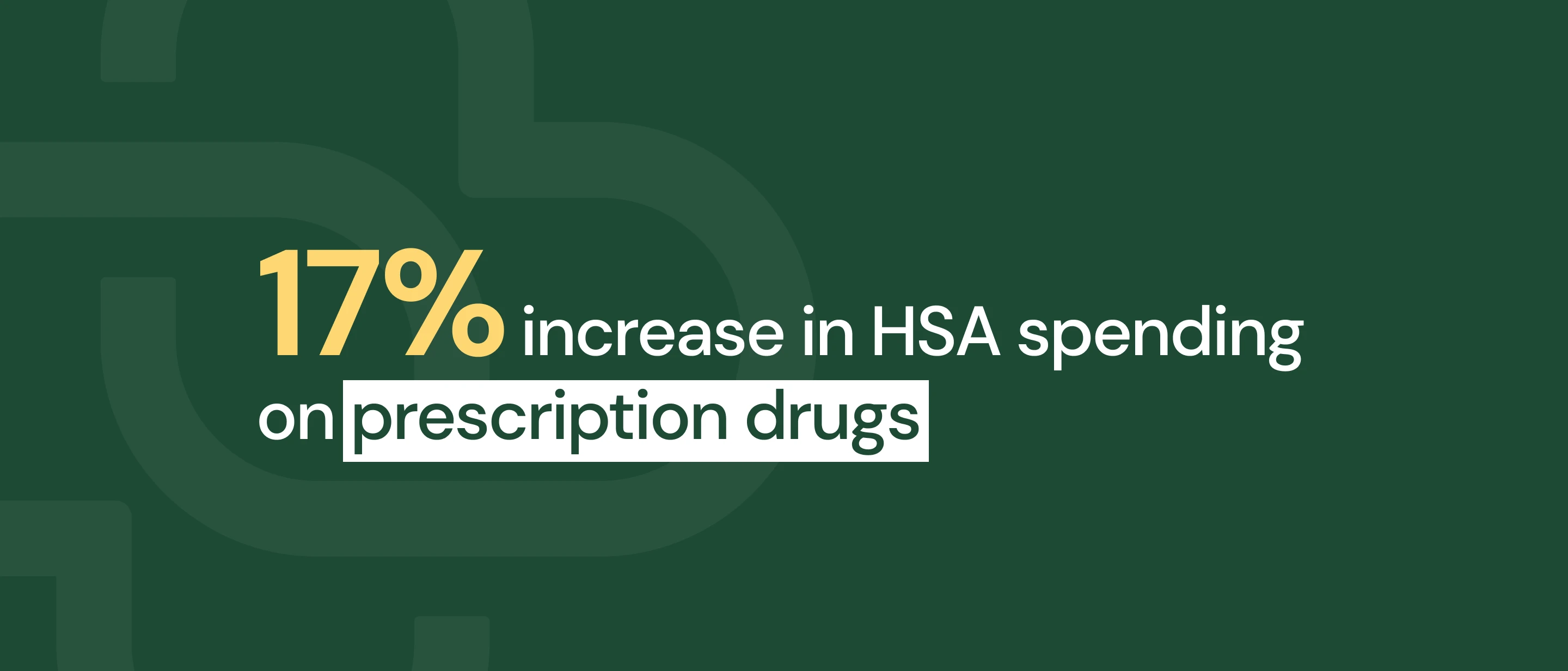

Lively’s HSA spending on prescription drugs rose 17% in 2023, reflecting higher prescription drug prices overall.

Crucial action items for brokers, consultants, and benefits leaders include:

How benefits brokers and HR administrators can offer a flexible, competitive, and cost-effective better benefits package with HSAs at the center.

How to help account holders leverage HSAs to save on everyday and emergency medical costs.

How to choose an HSA provider that offers flexible, easy-to-use options for administrators and account holders, including account holder education and investment options.

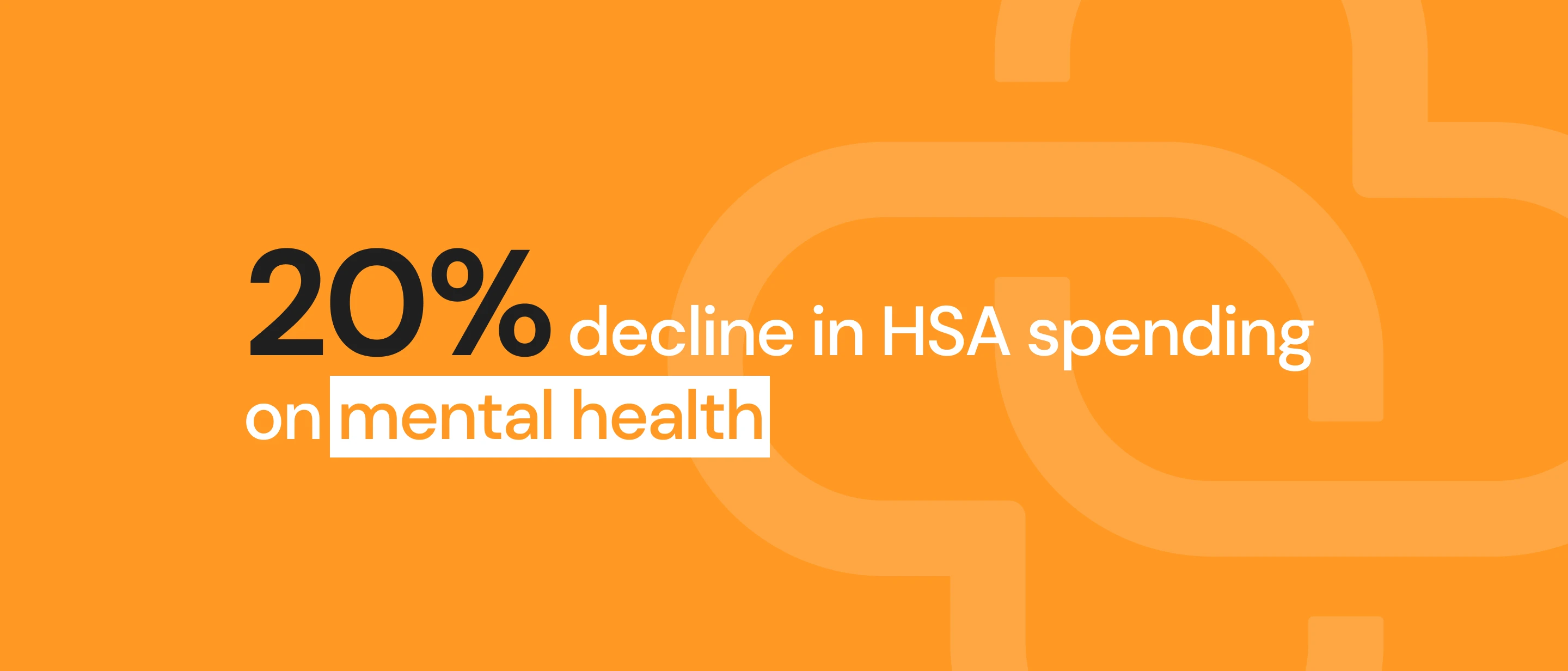

How to use HSAs to help ease employees financial stress and support employee mental health.

For more insight and action items, read the report.

Benefits

2026 Maximum HSA Contribution Limits

Lively · February 1, 2025 · 3 min read

For 2026, the HSA contribution limits are $4,400 for individual coverage and $8,750 for family coverage. These limits increased from 2025, when the caps were $4,300 and $8,550. If you’re age 55 or older, you can still contribute an additional $1,000 as a catch-up contribution.

Benefits

What is the Difference Between a Flexible Spending Account and a Health Savings Account?

Lauren Hargrave · February 9, 2024 · 12 min read

A Health Savings Account (HSA) and Healthcare Flexible Spending Account (FSA) provide up to 30% savings on out-of-pocket healthcare expenses. That’s good news. Except you can’t contribute to an HSA and Healthcare FSA at the same time. So what if your employer offers both benefits? How do you choose which account type is best for you? Let’s explore the advantages of each to help you decide which wins in HSA vs FSA.

Health Savings Accounts

Ways Health Savings Account Matching Benefits Employers

Lauren Hargrave · October 13, 2023 · 7 min read

Employers need employees to adopt and engage with their benefits and one way to encourage employees to adopt and contribute to (i.e. engage with) an HSA, is for employers to match employees’ contributions.

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox