Save for free

Open a no-fee HSA with Lively for the self-employed and keep more of your money working for you

Save more for your health

Every dollar you contribute is tax deductible, lowering your taxable income and helping you pay less for healthcare.

Health safety net

Your HSA funds roll over year after year, so your savings are always there when you need them — whether that’s next month or in retirement.

Why Self-Employed Professionals Choose an HSA

When you’re paying out of pocket for health insurance, every dollar counts. With a Lively HSA, you can:

Cut your tax bill — Contribute pre-tax dollars and reduce your taxable income.

Pay for qualified medical expenses tax-free — from prescriptions to dental visits to vision care.

Grow your savings long-term — Invest your HSA funds for future healthcare or retirement needs.

Stay in control Spend when you need to and save when you don’t. Your money is always yours.

No-Fee HSAs for Independent Earners

If you’re self-employed and paying out of pocket for health insurance, a Lively Health Savings Account (HSA) helps you lower your healthcare costs and keep more of what you earn. We never charge monthly maintenance fees for a basic HSA — so every contribution stays in your account, ready to cover qualified medical expenses or grow for the future.

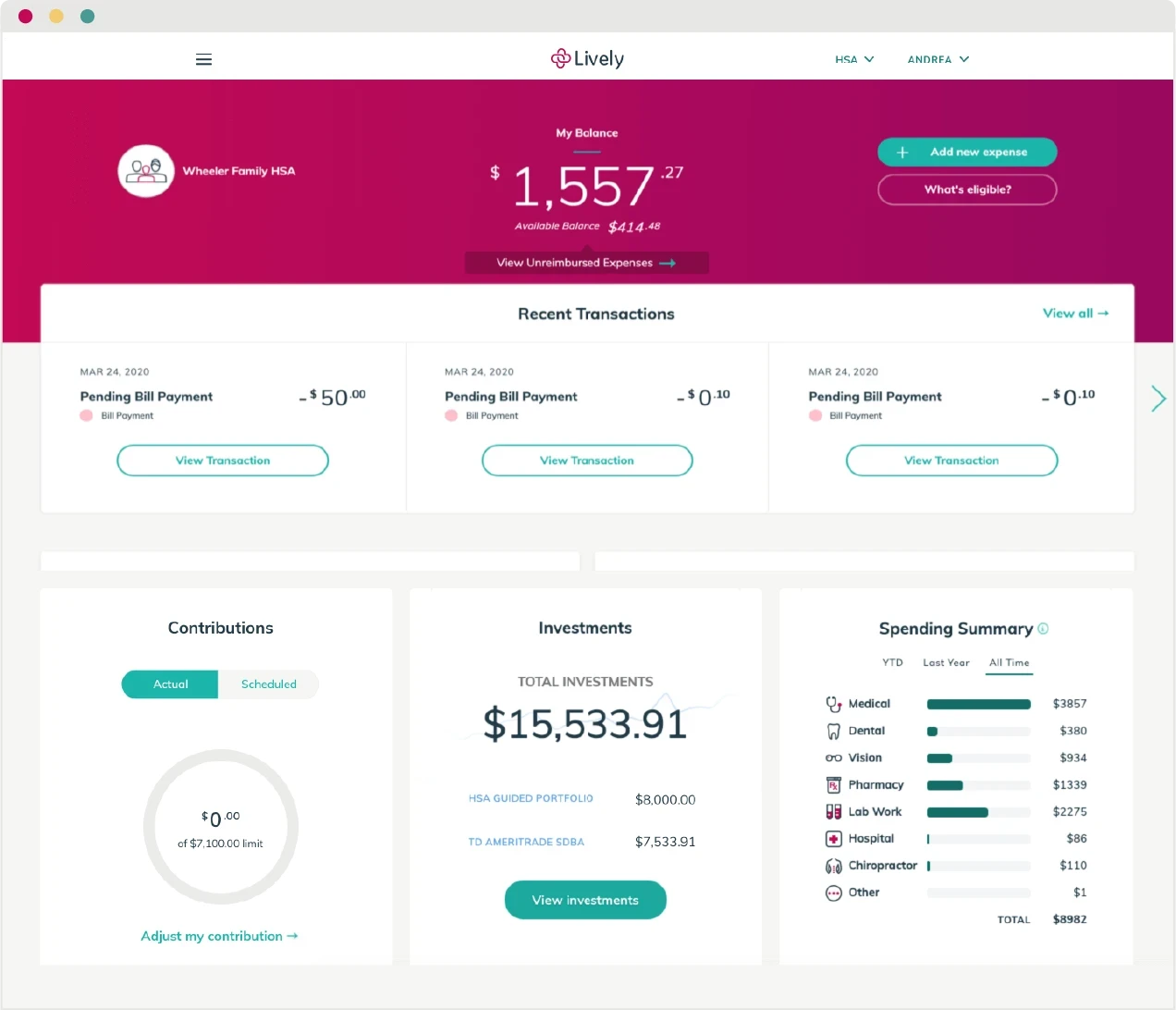

Stay Organized and Maximize Your Benefits

Manage your account and expenses in one place so you’re always ready for tax time or reimbursements.

Upload and store receipts for eligible healthcare purchases.

Categorize spending to see exactly where your healthcare dollars go.

Access records anytime from your dashboard, whenever you need them.

Clear, organized records make it easier to track deductible healthcare expenses, maximize tax savings, and keep your account IRS-compliant year after year.

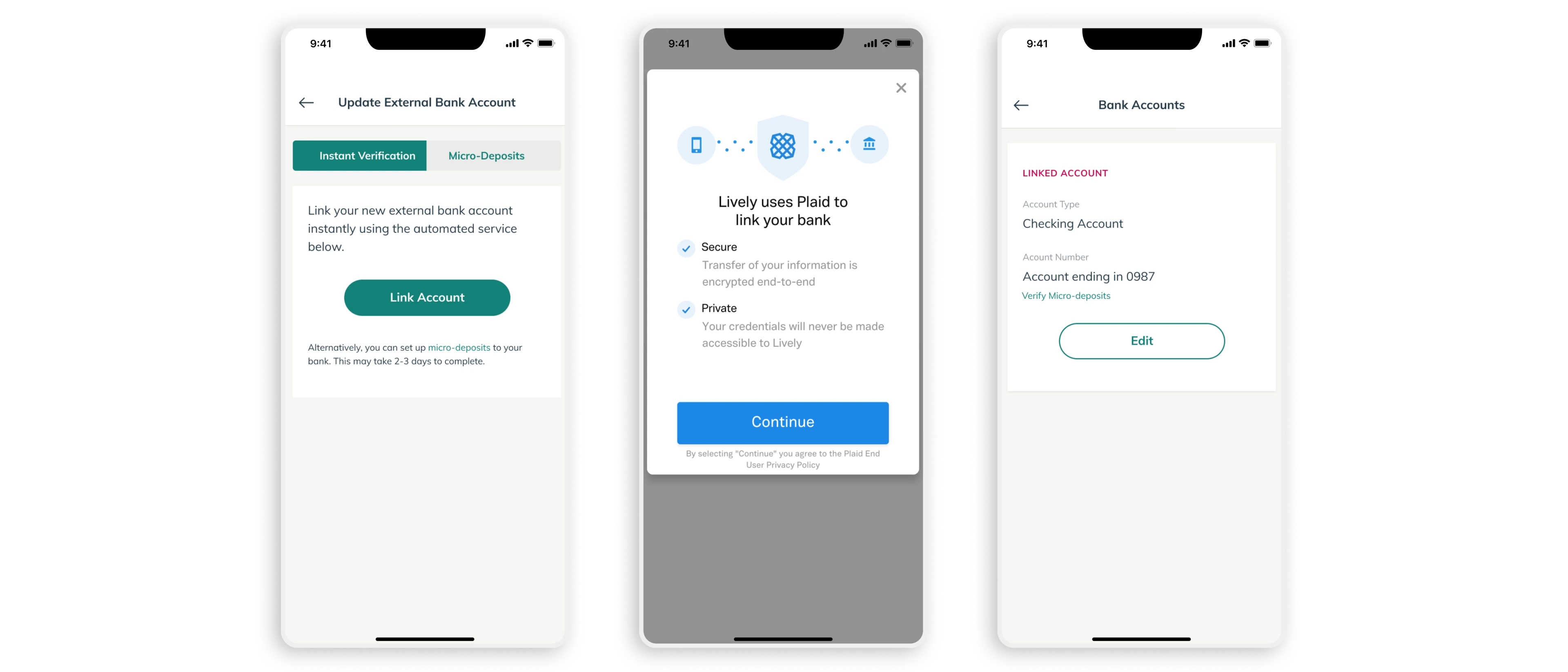

Manage and Access Your HSA Funds Anytime

Your HSA isn’t just for tax season — it’s a year-round tool. With Lively, you can check your balance, pay providers directly, transfer funds, and request reimbursements anytime from your dashboard. Perfect for self-employed professionals who need quick, on-the-go access to their healthcare savings.

Get quick access to tools & support

Managing benefits as a self employed individual? We make it simple with clear guidance and real people when you need them.

Live help via chat, email, or phone

Step-by-step guides on HSA eligibility, HDHP requirements, and contribution rules

Dashboard tools for receipt storage, categorized spending, and downloadable statements/year-end forms

Investment education & FAQs for when you’re ready to grow your HSA

Resource library with examples for common self-employed scenarios (pay a provider, reimburse yourself, dental/vision, and more)

Get answers fast and move forward with confidence. Everything you need to manage your HSA is in one place—on your schedule.

Open a No-Fee HSA for the Self-Employed

Working for yourself means benefits must flex with your cash flow. A Lively HSA helps freelancers, contractors, and small business owners lower taxes, pay providers directly or reimburse later, and manage everything online—no monthly fees; your dashboard organizes receipts and reports, and real people help when needed. Open your HSA today to keep more of what you earn.