The Lively Blog

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox

The Three Employee Benefit Trends You Need to Know in 2024

Lively · January 24, 2024 · 2 min read

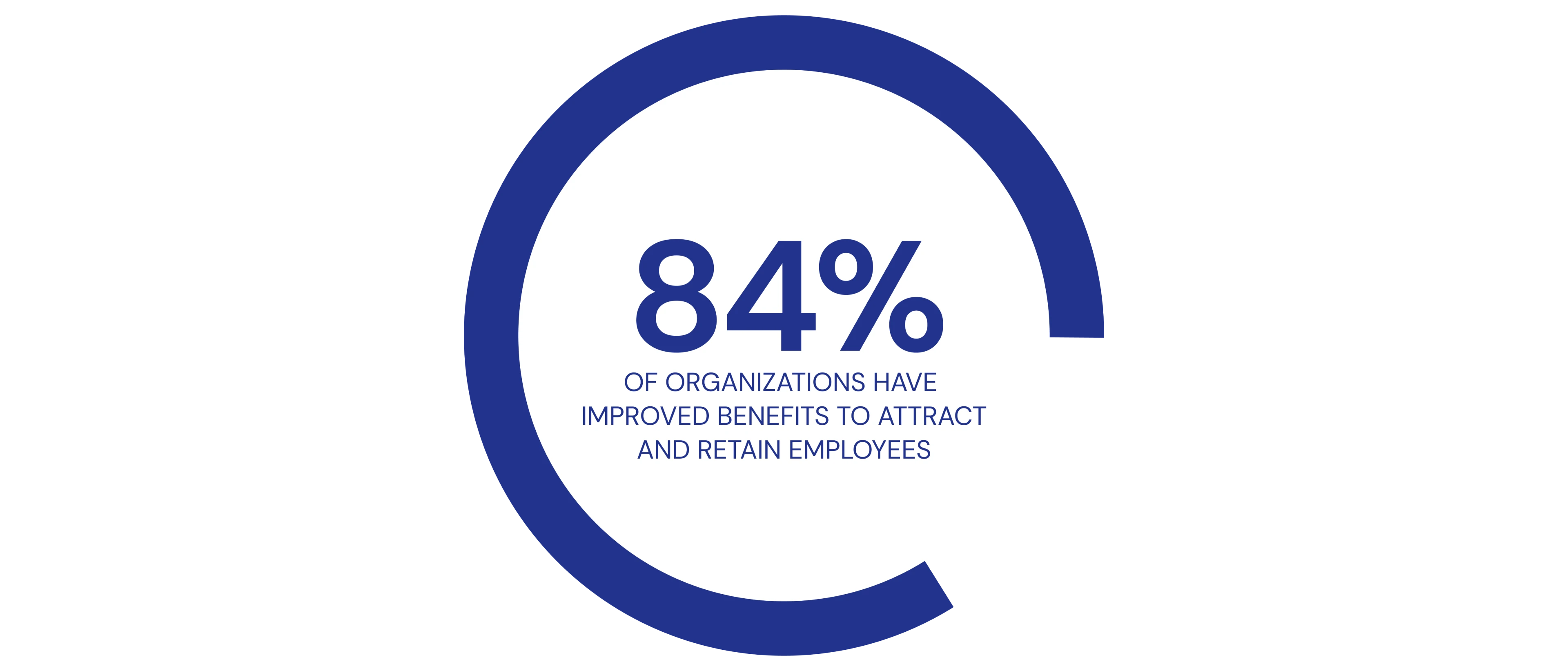

As 2024 begins, organizations are facing economic uncertainty, cost-pressure, and a rapidly changing workforce. While inflation is beginning to cool and the economy picks up, economic confidence remains shaky. Despite a strong job market, workers’ confidence remains low, especially as they contend with diminishing savings and increased financial stress. Benefits leaders are still under pressure to do more with less, while still providing flexible benefits that meet diverse needs of their employees.

To help Benefits leaders and the brokers and consultants that serve them better navigate the cultural, demographic, and financial changes that are taking place this year, Lively has put together our 2024 Employee Benefits Trends Report.

This report captures three critical trends and is informed by industry trends we’ve observed as a consumer-driven benefits provider, with data drawn from Lively’s proprietary research and reports.

The report outlines how in 2024 businesses must:

Focus on retaining employees as workplace demographics shift

Invest in flexible benefits to meet culture and budget goals

Emphasize employee benefits education

In this report we break down these three trends and provide crucial action items that Benefits leaders and the benefits brokers that serve them can take to meet employee needs, respond to cost pressure, and support their culture, recruiting, and retention goals in the year ahead.

For more detailed analysis on these trends and how to flexibly and cost effectively respond to them, access the report.

Benefits

2025 and 2026 Maximum HSA Contribution Limits

Lively · June 20, 2025 · 3 min read

On May 1, 2025, the IRS announced the HSA contribution limits for 2026: $4,400 for individual coverage and $8,750 for family coverage. That’s a $100–$200 increase from the 2025 limits, which are $4,300 and $8,550 respectively. If you’re 55 or older, you can still contribute an extra $1,000.

Benefits

What is the Difference Between a Flexible Spending Account and a Health Savings Account?

Lauren Hargrave · February 9, 2024 · 12 min read

A Health Savings Account (HSA) and Healthcare Flexible Spending Account (FSA) provide up to 30% savings on out-of-pocket healthcare expenses. That’s good news. Except you can’t contribute to an HSA and Healthcare FSA at the same time. So what if your employer offers both benefits? How do you choose which account type is best for you? Let’s explore the advantages of each to help you decide which wins in HSA vs FSA.

Health Savings Accounts

Ways Health Savings Account Matching Benefits Employers

Lauren Hargrave · October 13, 2023 · 7 min read

Employers need employees to adopt and engage with their benefits and one way to encourage employees to adopt and contribute to (i.e. engage with) an HSA, is for employers to match employees’ contributions.

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox