The Lively Blog

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox

What Is a Limited Purpose FSA & How It Could Help You Save

Lively Team · October 6, 2020 · 7 min read

A Limited Purpose FSA (LPFSA) is a flexible way to pay for dental and vision expenses using pre-tax dollars. If you're already contributing to a Health Savings Account (HSA), an LPFSA gives you another opportunity to save on eligible out-of-pocket costs, without touching your HSA funds. Here's how it works and how it can fit into your overall benefits strategy.

What is a Limited Purpose Flexible Spending Account (LPFSA)?

A Limited Purpose FSA (LPFSA) is a specialized type of FSA that provides a way to pay for dental and vision expenses using pre-tax dollars. If you're already contributing to a Health Savings Account (HSA), an LPFSA gives you another opportunity to save on out-of-pocket costs — without touching your HSA funds. This guide walks through how an LPFSA works and how it can complement your overall health savings strategy.

What does a Limited Purpose FSA cover?

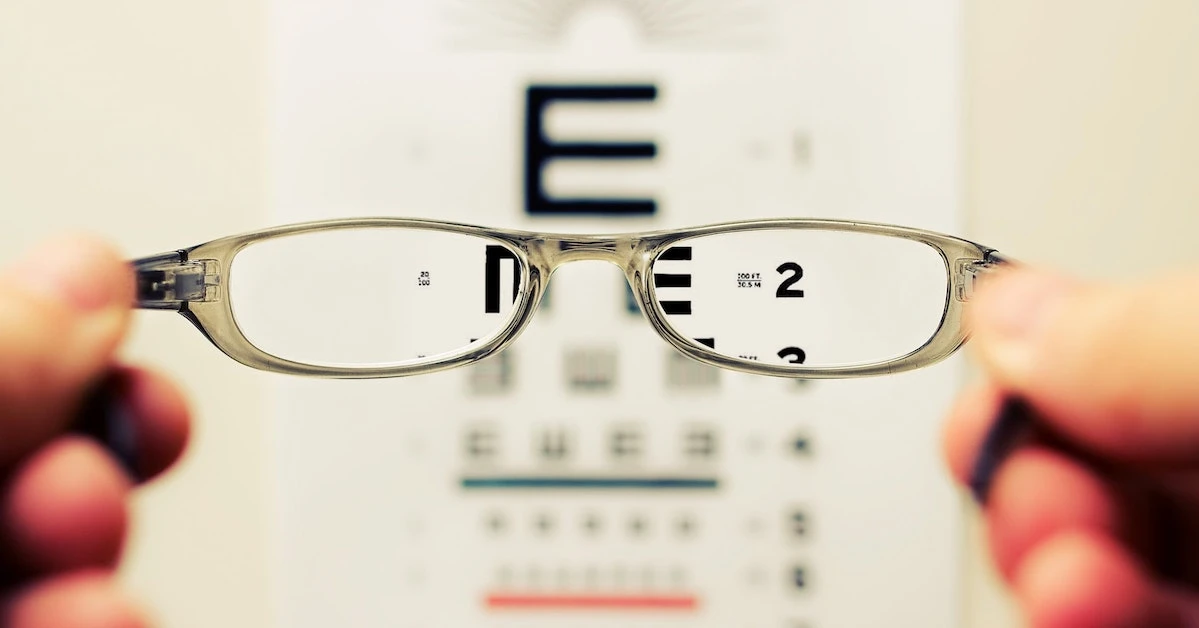

A Limited Purpose FSA covers eligible out-of-pocket dental and vision expenses, such as eye exams, prescription glasses, contact lenses, dental cleanings, braces, and more. You can use the funds for yourself, your spouse, and your dependents.

Because it only applies to dental and vision care, it’s considered “limited purpose.” But when used alongside a Health Savings Account (HSA), an LPFSA becomes a smart way to manage everyday healthcare costs while preserving your HSA savings for the future.

How does a Limited Purpose FSA work?

An LPFSA is offered through your employer, usually as part of a benefits package that includes a High Deductible Health Plan (HDHP) and a health savings account. You decide how much to contribute for the year during open enrollment. That amount is evenly deducted from your paychecks before taxes.

You can then use those funds for eligible dental and vision expenses throughout the year.

Can I have an HSA and an LPFSA?

Yes, you can have both a Health Savings Account (HSA) and a Limited Purpose FSA at the same time. This combination is allowed because a Limited Purpose FSA is restricted to dental and vision expenses, so it does not disqualify you from contributing to an HSA. Many people use their LPFSA to pay for current dental and vision costs while letting their HSA balance grow for future healthcare needs.

Tip: You can’t use both accounts to reimburse the same expense. Choose one account per transaction.

How can I get a Limited Purpose FSA?

To open an LPFSA, your employer must offer one as part of its benefits package. These accounts are usually available if your company offers an HSA and a High Deductible Health Plan (HDHP). If it’s available, you can sign up during your employer’s open enrollment period or after a qualifying life event. You’ll choose your annual contribution at that time, and your employer will deduct that amount evenly from your paychecks throughout the year.

Who’s eligible for a Limited Purpose FSA?

To be eligible for a Limited Purpose FSA, you must work for an employer that offers one as part of its benefits package. These accounts are typically available to employees who are enrolled in a High Deductible Health Plan (HDHP) and a Health Savings Account (HSA). You can sign up during your company’s open enrollment period or if you experience a qualifying life event, such as marriage or the birth of a child.

How do I get a Limited Purpose FSA?

You can get a Limited Purpose FSA through your employer if it’s offered as part of your benefits package. These accounts are typically available alongside a High Deductible Health Plan (HDHP) and Health Savings Account (HSA). To sign up, you’ll need to enroll during your company’s open enrollment period or after a qualifying life event like marriage or the birth of a child.

During enrollment, you’ll choose your annual contribution amount. That amount will be divided evenly across your paychecks and deducted pre-tax throughout the year.

How much can I contribute to my Limited Purpose FSA?

According to the IRS, in 2025 you can contribute up to $3,300 to an LPFSA. This is an individual limit. If your spouse also has access to an LPFSA, they can contribute up to the same amount in their own account.

Employer contributions don’t count toward the $3,300 limit.

Contribution limits are adjusted annually by the IRS.

See the latest contributions limits here.

How do I choose how much to contribute to my Limited Purpose FSA?

The right amount depends on your past and expected dental and vision costs. Here’s how to estimate:

Review your dental and vision expenses from the past year.

Estimate what you might spend in the upcoming year.

Choose a contribution amount that fits comfortably in your budget.

Most LPFSAs follow a use-it-or-lose-it rule. Unused funds may be forfeited at year-end unless your employer offers one of these options:

A 2.5-month grace period, or

A rollover of up to $660 in 2025.

Learn more about FSA rollovers vs. grace periods.

What can I use my Limited Purpose FSA for?

You can use LPFSA funds to cover qualified expenses for yourself, your spouse, and dependents. The IRS defines what counts as an eligible dental or vision expense.

Eligible dental expenses include:

Exams, cleanings, and X-rays

Fillings, crowns, braces

Dentures and oral surgery

Night guards for teeth grinding

Eligible vision expenses include:

Eye exams and vision tests

Prescription glasses and contact lenses

LASIK or laser eye surgery

Contact lens solution and cleaning supplies

See the full list of eligible expenses.

How do I use LPFSA funds?

You can use LPFSA funds with a debit card provided by your employer to pay for eligible dental and vision expenses directly at the provider’s office. If your plan doesn’t include a card, you’ll need to pay out of pocket and submit receipts to your FSA administrator for reimbursement.

What happens if I leave my employer?

If you leave your job mid-year, what happens to your Limited Purpose FSA depends on how much of the funds you’ve used.

Situation 1: You've used all of your LPFSA funds. Your LPFSA is pre-funded by your employer at the start of the plan year, and you repay the amount throughout the year via payroll deductions. If you leave mid-year and have already spent the full balance, you generally don’t owe anything back. Your employer covers the remaining cost.

Situation 2: You haven’t used all your LPFSA funds. If you leave before using your full LPFSA balance, you may lose any unused funds unless you opt into COBRA continuation coverage. If you're planning a job change, it’s smart to use your LPFSA funds ahead of time on qualified dental or vision care.

Is a Limited Purpose FSA right for you?

If you’re already contributing to an HSA and want to save even more on qualified expenses, an LPFSA can be a smart addition to your benefits strategy.

Pros:

Tax savings on eligible expenses (potentially up to 30%)

Works alongside an HSA

Can be used for expenses for your spouse or dependents

Cons:

Limited to dental and vision expenses

Subject to use-it-or-lose-it policy

Must be offered by your employer

Final Thoughts

A Limited Purpose FSA helps you plan ahead for expected dental and vision costs using pre-tax dollars. It’s especially valuable if you want to grow your HSA balance while still managing routine care expenses. If your employer offers one, consider it a smart tool in your overall benefits toolkit.

Want to better understand how LPFSAs fit into your benefits strategy? Check out our FSA Guide.

Benefits

2026 Maximum HSA Contribution Limits

Lively · February 1, 2025 · 3 min read

For 2026, the HSA contribution limits are $4,400 for individual coverage and $8,750 for family coverage. These limits increased from 2025, when the caps were $4,300 and $8,550. If you’re age 55 or older, you can still contribute an additional $1,000 as a catch-up contribution.

Benefits

What is the Difference Between a Flexible Spending Account and a Health Savings Account?

Lauren Hargrave · February 9, 2024 · 12 min read

A Health Savings Account (HSA) and Healthcare Flexible Spending Account (FSA) provide up to 30% savings on out-of-pocket healthcare expenses. That’s good news. Except you can’t contribute to an HSA and Healthcare FSA at the same time. So what if your employer offers both benefits? How do you choose which account type is best for you? Let’s explore the advantages of each to help you decide which wins in HSA vs FSA.

Health Savings Accounts

Ways Health Savings Account Matching Benefits Employers

Lauren Hargrave · October 13, 2023 · 7 min read

Employers need employees to adopt and engage with their benefits and one way to encourage employees to adopt and contribute to (i.e. engage with) an HSA, is for employers to match employees’ contributions.

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox