The Lively Blog

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox

ZendyHealth Joins Lively's HSA Marketplace

Lively · September 19, 2018 · 2 min read

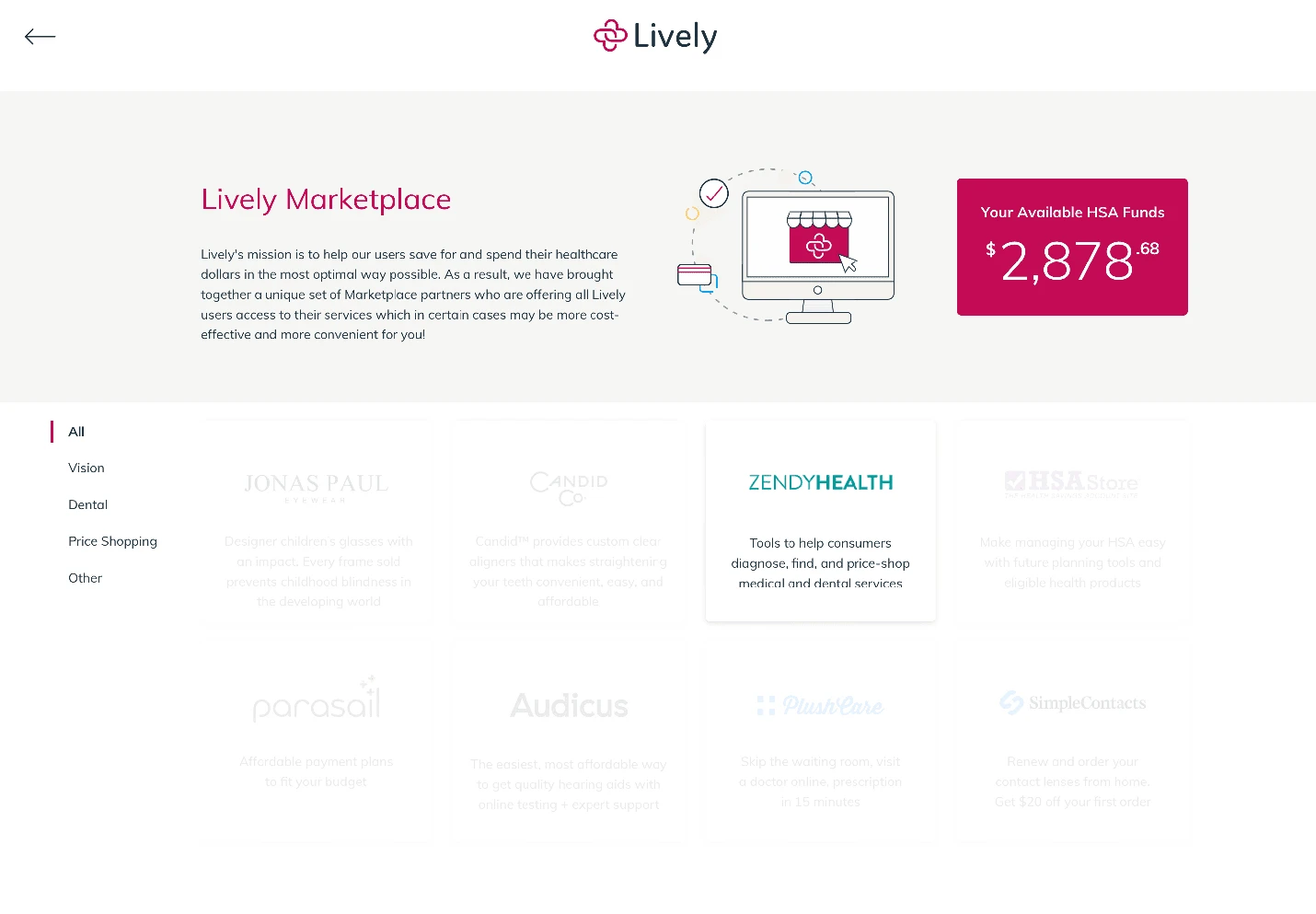

Lively is pleased to add ZendyHealth as one of our cornerstone HSA marketplace partners. ZendyHealth allows you to use your HSA funds to negotiate your health and dental bills upfront so you can save 20-80% on popular procedures.

The Forgotten HSA Eligible Expense

You can use your HSA money on all qualified medical expenses as defined by the IRS. By using your HSA funds for these expenses, you are effectively saving 25% off the retail cost using pre-tax dollars (assumes combined federal and state income taxes of 25% or more).

What you might not know is that dental expenses are on the list. Your HSA can help you save on your dental services, procedures, and check-ups. You can see the full list of HSA eligible expenses here. Let us show you how to use ZendyHealth to save even more on dental expenses.

ZendyHealth Overview

ZendyHealth makes it easier to find popular and highly effective dental and health procedures at exclusively low prices without sacrificing quality.

Why Should I Use ZendyHealth?

ZendyHealth presents a new way search, shop, and save in healthcare. With Virtual Care and Price Shopping tools, you are empowered to access the best treatments and at the best price.

Pick Your Price – With ZendyHealth, you pick the service at your price — when and where you want. Make a cash offer according to your budget, and we will make every effort to match you with a top tier provider near you.

Find Your Provider and Request a Quote – Want to search for a top provider for your health or dental need? Choose from ZendyHealth’s list of top-tier providers, select your procedure, and request a price quote.

Virtual Care – As an added feature, explore the Virtual Care tools including our Treatment Guidance, Virtual Primary Care, and Discount Online Pharmacy tools and more.

Combining the tax-savings of your HSA and the convenience of the Lively HSA marketplace with the savings power of ZendyHealth leaves you a step ahead of rising health costs. Saving money and time with Lively and ZendyHealth means empowers you to keep more of your hard-earned money in your pocket and access popular health and dental services you want more efficiently and affordably.

For more information on ZendyHealth please visit zendyhealth.com or follow them on Twitter (@zendyhealth).

Benefits

2025 and 2026 Maximum HSA Contribution Limits

Lively · June 20, 2025 · 3 min read

On May 1, 2025, the IRS announced the HSA contribution limits for 2026: $4,400 for individual coverage and $8,750 for family coverage. That’s a $100–$200 increase from the 2025 limits, which are $4,300 and $8,550 respectively. If you’re 55 or older, you can still contribute an extra $1,000.

Benefits

What is the Difference Between a Flexible Spending Account and a Health Savings Account?

Lauren Hargrave · February 9, 2024 · 12 min read

A Health Savings Account (HSA) and Healthcare Flexible Spending Account (FSA) provide up to 30% savings on out-of-pocket healthcare expenses. That’s good news. Except you can’t contribute to an HSA and Healthcare FSA at the same time. So what if your employer offers both benefits? How do you choose which account type is best for you? Let’s explore the advantages of each to help you decide which wins in HSA vs FSA.

Health Savings Accounts

Ways Health Savings Account Matching Benefits Employers

Lauren Hargrave · October 13, 2023 · 7 min read

Employers need employees to adopt and engage with their benefits and one way to encourage employees to adopt and contribute to (i.e. engage with) an HSA, is for employers to match employees’ contributions.

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox