The Lively Blog

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox

Understanding High Deductible Health Plans (HDHP)

Lauren Hargrave · May 2, 2024 · 6 min read

In a world of text, chat and email it can feel like everything is (or has) an acronym. Health insurance plans are no exception. You may have come across the acronym HDHP and are wondering "What is a High Deductible Health Plan (HDHP)?" Continue reading to learn how choosing an HDHP could benefit you. Provided it gives you the coverage you need.

To start, an HDHP is a health insurance plan defined by lower premiums and a higher deductible. But don't let "higher deductible" scare you off. Here are two reasons why an HDHP could make sense for you: 1. All preventative care is covered before the deductible, and 2. HDHPs are an affordable way to get the coverage you need without paying more for extras you may not need. HDHPs are also the only health insurance option that can be paired with a Health Savings Account (HSA). An HSA can help pay for the high-deductible or to save money for future medical costs.

What is considered eligible?

Annually, the IRS redefines what it considers an HDHP (adjusting for inflation). They set annual deductible and out of pocket maximums. There's one other qualifying characteristic of HDHPs. The individual pays for the cost of healthcare, up to the deductible, before insurance pays for services. The one caveat here is preventative care. All preventative care is covered before the deductible.

How do they work?

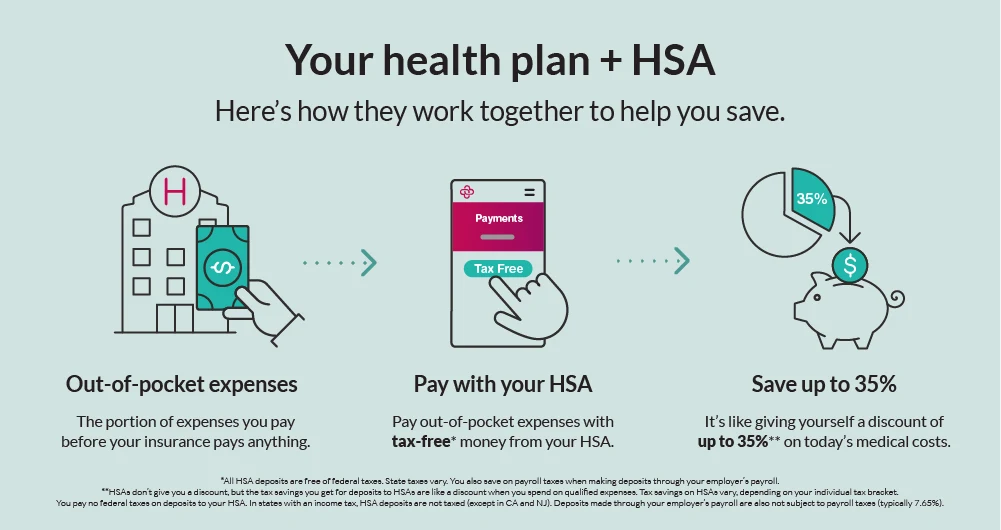

HDHPs charge participants lower monthly premiums. This is in exchange for requiring higher deductibles and out-of-pocket maximums. Choosing an HDHP could make sense if you don't need many health care items or services. Or if you only visit the doctor for preventative care. This is because you'll be spending less on your monthly health insurance plan premium. An HDHP could also make sense if you need more care. Here's why. Because HDHPs have a higher deductible, the IRS allows you to deposit pre-tax money into a savings account called an HSA or Health Savings Account. HSAs are tax-advantaged accounts because contributions are pre-tax.

The distributions and any gains those contributions make can also be tax-free. That's as long as the contributions are used to pay down your deductible or to pay for other qualified medical expenses. Depending on your tax bracket, this could help you save up to 30% on medical expenses. Where an HDHP could get you into trouble is if you suffer a catastrophic event that requires an expensive procedure or treatment. And you can’t afford the out-of-pocket maximum. Or if you have or develop a chronic condition that needs management.

Decide which plan is right for you with our Health Plan Comparison Calculator.

To choose an HDHP, you would make the election during the open enrollment period for either your place of employment or in the private market. The other time is after a Qualifying Life Event. If you’ve experienced a life event like the loss of health insurance, marriage, the birth of a child, or death of a dependent, you can sign up for an HDHP at any time during the year with a special enrollment period.

What are the benefits?

Whether you’re considering an HDHP or have been using one for years, there’s no question that higher deductibles are a tough pill to swallow. The good news is, this type of health plan does offer some unique flexibility and opportunities that other health insurance plans lack.

Flexibility – HMO health insurance plans require referrals from a primary care physician. This can be extremely frustrating for individuals who need to have some kind of care outside of a general practitioner. While HDHPs still have in and out of network designations, the list of in-network providers is extensive. And you can see a dermatologist, cardiologist, or other specialists even if you haven’t yet designated a primary care physician.

Lower cost – The problem with large, overarching health plans is they try to cover everyone. This might sound good on paper, but not in practice. This often leads to people with low health care needs paying more to cover people with high health care needs. HDHPs reward limited use of the medical system by charging participants low monthly premiums. While also covering preventative care before the deductible is met.

Health savings for the long term – HDHPs are the only health insurance plan that you can pair with an HSA. You own the contributions both you and your employer make to your HSA. And they never expire. The funds can be saved or invested in stocks and mutual funds, making these accounts function as a medical safety net. This is beneficial if you lose your employment or your employer changes your health insurance options. Or if your health insurance company decides to discontinue the plan you’re on, or you experience a catastrophic event. Any of which could leave you scrambling to cover unexpected medical expenses. And in the event you don’t spend your contributions before the age of 65, you can use that money, tax-free, for any expenses. Just like another retirement account.

Is a HDHP the right plan for me?

The right health insurance plan for you lies at the nexus of affordability and appropriate coverage.

You must be able to afford the monthly premium but also the annual out-of-pocket maximum in case you experience a catastrophic event.

The plan must also provide adequate coverage for your current medical needs. As well as those in the foreseeable future (e.g. having a baby, knee surgery, etc.). Inadequate coverage could cause your out-of-pocket expenses to get out of hand quickly. So take a look at the specifics for the HDHP you’re being offered.

Can you afford that monthly premium? If yes, then take a look at what procedures, treatments, and prescriptions are covered and at what levels. When taking coverage levels into account, can you afford the copays, co-insurance, and other out-of-pocket costs? Do you have the ability to contribute even a small amount to an HSA? Something to remember about HSAs is the money is contributed pre-tax. That means you could end up saving up to 30% on medical expenses depending on your income taxes bracket.

If, after answering these questions, an HDHP looks like it makes financial sense, then it could be the right plan for you. If you have questions about your specific situation, you should always reach out to your HR department.

HDHPs are often thought of as an affordable health insurance option, especially for the healthy or if you know you’ll exceed your out-of-pocket maximum. Combine an HDHP's monthly affordability with the option to pair the plan with an HSA, and you have an attractive setup. Not only for those who have limited medical care needs but those who can afford to contribute a little extra each month toward future costs and savings.

Benefits

2024 and 2025 HSA Maximum Contribution Limits

Lively · May 9, 2024 · 3 min read

On May 9, 2024 the Internal Revenue Service announced the HSA contribution limits for 2025. For 2025 HSA-eligible account holders are allowed to contribute: $4,300 for individual coverage and $8,500 for family coverage. If you are 55 years or older, you’re still eligible to contribute an extra $1,000 catch-up contribution.

Benefits

What is the Difference Between a Flexible Spending Account and a Health Savings Account?

Lauren Hargrave · February 9, 2024 · 12 min read

A Health Savings Account (HSA) and Healthcare Flexible Spending Account (FSA) provide up to 30% savings on out-of-pocket healthcare expenses. That’s good news. Except you can’t contribute to an HSA and Healthcare FSA at the same time. So what if your employer offers both benefits? How do you choose which account type is best for you? Let’s explore the advantages of each to help you decide which wins in HSA vs FSA.

Health Savings Accounts

Ways Health Savings Account Matching Benefits Employers

Lauren Hargrave · October 13, 2023 · 7 min read

Employers need employees to adopt and engage with their benefits and one way to encourage employees to adopt and contribute to (i.e. engage with) an HSA, is for employers to match employees’ contributions.

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox