The Lively Blog

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox

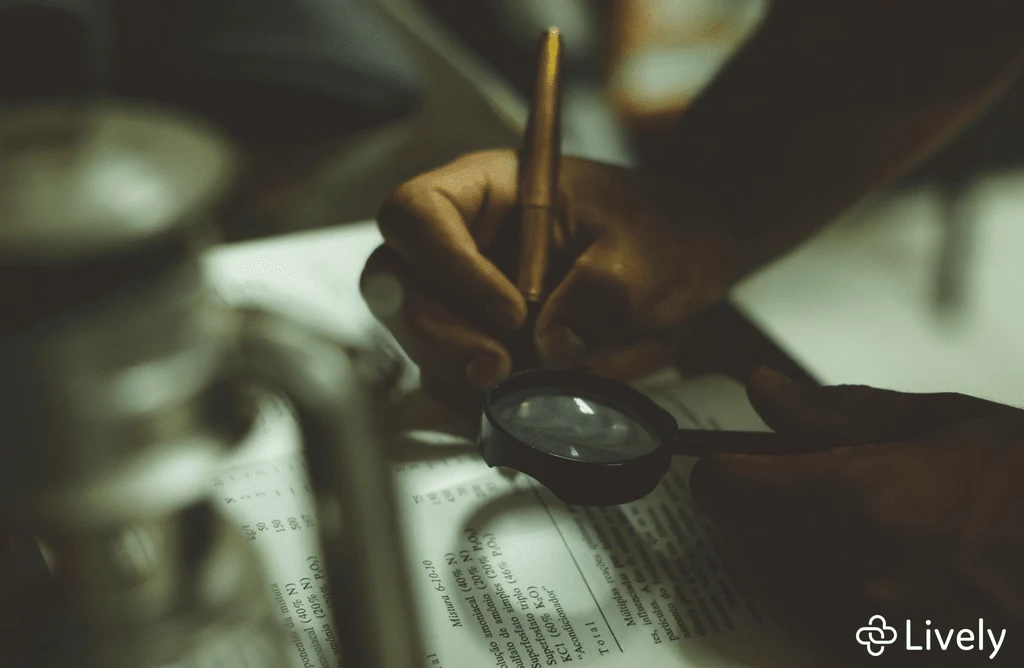

5 Reasons to Take a Closer Look at Flexible Spending Accounts

Vicky Warren · July 25, 2018 · 3 min read

Want to use pre-tax dollars for healthcare expenses?

If you don’t have a high deductible health insurance plan and want to set aside pre-tax dollars for healthcare expenses, a Flexible Spending Account (FSA) may be just what you’re looking for.

FSA Benefits

A Flexible Spending Account is an employer only option. If your employer offers an FSA, take time to see what is covered and crunch some numbers. Here are a few reasons to consider utilizing an FSA.

No high deductible health insurance plan? No problem…

Flexible Spending Accounts are offered by employers.

If you don’t have a high deductible health insurance plan, but your employer offers an FSA, take a hard look at your healthcare budget and see if the numbers make sense for you.

You can use your money from day one…

The entire amount you contribute to your FSA is available at the beginning of your benefit year (or shortly after the first contribution is made).

For example, let’s say you add $2,000 to your FSA for the year. You’ll likely contribute roughly $80 per paycheck. The entire $2,000 is available to use at any time even though you only make small contributions during the year.

It’s worth mentioning that if you leave a position before the year is over, the money in your FSA doesn’t have to be paid back.

Set and forget it healthcare savings

FSA accounts are typically established during open enrollment periods. Once the paperwork is taken care of, the contributions are taken out automatically making saving for healthcare easy.

Most FSA’s do not renew automatically, so you’ll need to re-enroll each year.

Tax breaks

FSA contributions are made with pre-tax dollars which means you get to keep more of your hard earned money!

You’ll want to use all your contributions for the year, as FSAs are a “use it or lose it” option. Some FSAs have a grace period (some as long as March 15th of the following year), and some allow you to carry over up to $500 a year, but not all. Be sure to find out what your plan does so you don’t lose your money.

Thousands of items are covered, why not buy them with pre-tax dollars?

Thousands of items are available for purchase with your FSA account. Here are a few items you can use those pre-tax dollars on:

First Aid

First Aid Kits

Liquid Bandages

And more

Baby/Mom Care

Thermometers

Breast Pumps

Nursing Pads

Boogie Wipes

Gas Relief

And more

Eye Care

Contact lens care

Reading glasses

Glasses

And more

Procedures

LASIK eye surgery

Chiropractic treatment

Acupuncture

And more

Using your account is easy

Using your FSA account is easy. Many plans offer debit cards, and others require you to fill out reimbursement forms.

Either way, using pre-tax dollars to help pay for healthcare each year makes a little paperwork worth it.

If you have the option to open an FSA through your employer, take a look, crunch some numbers and see if one makes sense for you. Using pre-tax dollars for items you need anyway makes lots of sense.

If you need more help with health account decisions, check out our blog. We will make you a healthcare benefits expert in no time, without any extra work or effort on your end.

Benefits

2025 and 2026 HSA Maximum Contribution Limits

Lively · May 9, 2024 · 3 min read

On May 9, 2024 the Internal Revenue Service announced the HSA contribution limits for 2025. For 2025 HSA-eligible account holders are allowed to contribute: $4,300 for individual coverage and $8,500 for family coverage. If you are 55 years or older, you’re still eligible to contribute an extra $1,000 catch-up contribution.

Benefits

What is the Difference Between a Flexible Spending Account and a Health Savings Account?

Lauren Hargrave · February 9, 2024 · 12 min read

A Health Savings Account (HSA) and Healthcare Flexible Spending Account (FSA) provide up to 30% savings on out-of-pocket healthcare expenses. That’s good news. Except you can’t contribute to an HSA and Healthcare FSA at the same time. So what if your employer offers both benefits? How do you choose which account type is best for you? Let’s explore the advantages of each to help you decide which wins in HSA vs FSA.

Health Savings Accounts

Ways Health Savings Account Matching Benefits Employers

Lauren Hargrave · October 13, 2023 · 7 min read

Employers need employees to adopt and engage with their benefits and one way to encourage employees to adopt and contribute to (i.e. engage with) an HSA, is for employers to match employees’ contributions.

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox