The Lively Blog

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox

Establishing Your HSA Account

Leslie Harding · November 24, 2020 · 5 min read

So you’ve made the choice, you’re ready for an HSA. Now you have to figure out how to open and establish an HSA so you get the most benefits possible. You already know you have to enroll in a qualified high deductible health plan to open an HSA. But there’s one step you may not be aware of—funding your HSA the same day you open it.

That may sound expensive, but in reality all it takes is one cent to establish your HSA. This ensures you can use it on qualified medical expenses moving forward. It's important to establish your HSA if you expect to have any large medical expenses close to your account opening date.

HSA overview

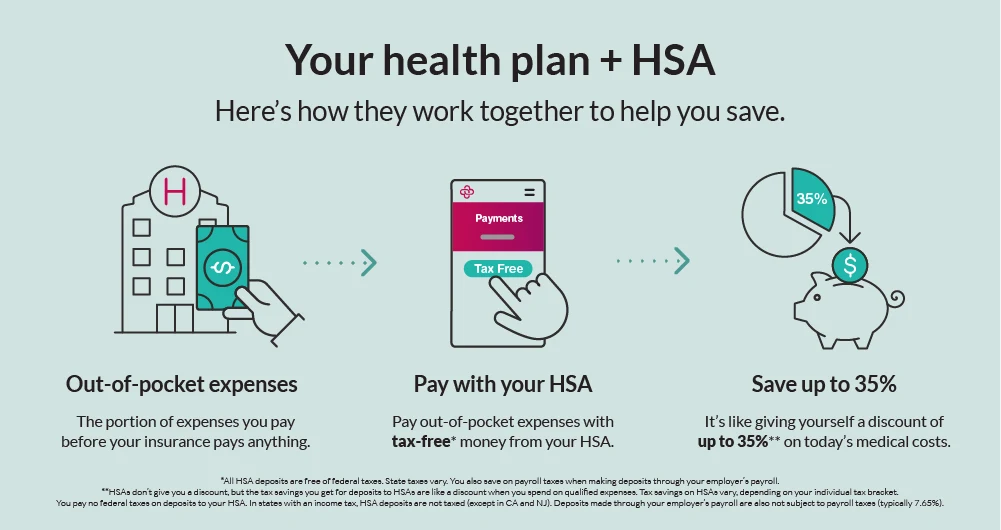

A Health Savings Account (HSA) is a tax-advantaged savings account. That means you can contribute funds tax free, grow funds tax free, and use funds for qualified medical expenses tax free. Those are some pretty big tax advantages for healthcare.

You are eligible to open an HSA if you are also enrolled in a HSA-qualified high deductible health plan (HDHP). You have to be enrolled in an HSA-eligible high deductible health plan to open and contribute to an HSA. But once you have opened and established an HSA, it’s yours to keep, for life.

If you switch to a non-qualified health insurance plan, you will not be able to contribute. However, you can still use the funds in your HSA to pay for qualified medical expenses.

HSA contribution limits

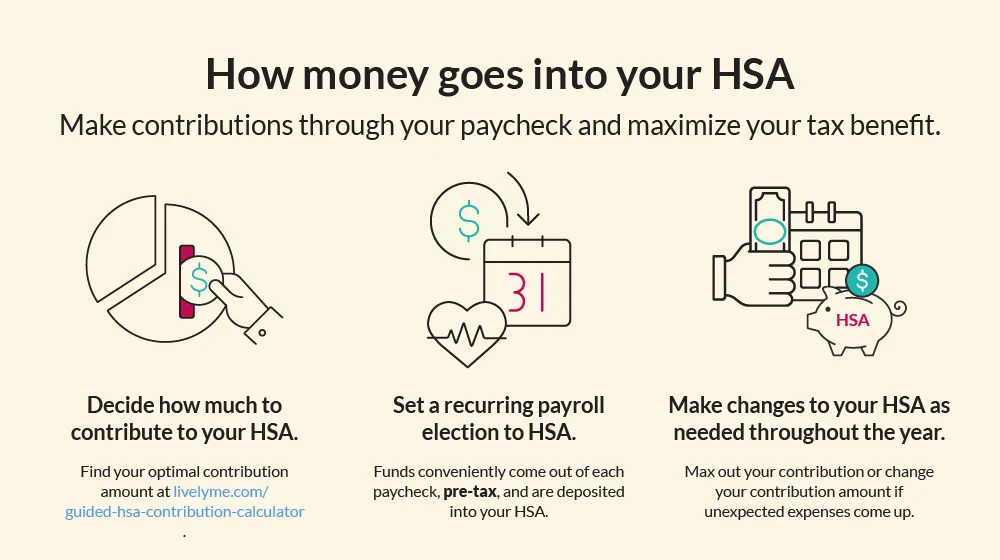

The IRS determines HSA contribution limits. Those limits often are updated yearly.

A Catch-Up Contribution of an additional $1,000 if you (or another member of your family on the plan) is 55 or older

Check out our article What is an HSA? if you need more of a refresher on the ins and outs of HSA accounts.

What it means to establish an HSA

Before we dive into the idea of establishing an HSA, it’s important to know that HSAs are a type of trust. Because they are a trust, this means that the state laws govern the regulations of an HSA. Each state has a different definition of what it means to establish an HSA. In most states, you must do two things to establish an HSA:

Sign up to open an account

Deposit at least $0.01 into the account

This may sound obvious, but you also have to be eligible to have an HSA and withdraw funds from it. In summary, you must be enrolled in a qualified HDHP, open an HSA, fund the HSA, and be eligible to withdraw funds for your HSA to be considered established.

Key dates to remember

There are some key dates you should pay attention to as you go through the process of establishing an HSA. They are:

Health Plan Start Date: You are eligible to contribute to an HSA on the first day of the first month that you meet all eligibility requirements. Let’s say you enrolled in an HSA-eligible health plan like an HDHP on January 15. You are not eligible to contribute to your HSA until February 1st. You must then ‘establish’ your HSA to start reimbursing eligible expenses.

HSA Establishment Date: The most important thing you can do (once you qualify to open an HSA) is to establish an HSA. “Establishing” means different things and unfortunately varies state by state. In some states, it’s as simple as opening up an account. In other states, it means you have to open the account and fund it with as little as $0.01. This is called “penny funding” and meets all federal government requirements for establishing an HSA. If you have any questions regarding this in your state, we recommend finding local tax advisors to help you.

Reimbursement Date: This date is important so you know exactly when you can use HSA funds for expenses. Any costs (based on purchase date), post-HSA established date are considered eligible expenses. Establishing an HSA adds more flexibility to your healthcare payment options. Find out using our "What's Eligible?" tool.

Not sure what requirements you have to meet? Check out our eligibility guide.

In an ideal world, all three of these dates may be the same. If they're different, it's important to keep track of things so you know what expenses are eligible and what isn't.

The importance of establishing an HSA

The reason why it's so important to establish your HSA is that you can use HSA funds for expenses incurred before your account had money in it. You can back-date your expense and reimburse yourself later when you do have funds in your account.

The most common way people contribute to an HSA is with pre-tax payroll deductions through an employer-sponsored plan. If you cannot contribute through payroll deductions, you’ll contribute after tax. These contributions are eligible for a tax deduction through your annual income tax.

After that, funds grow in your HSA tax free. You can also create an investment account for those funds. You can distribute funds tax free to spend on qualified medical expenses at any time. If you’re over age 65, you can use the funds on anything, but you will have to pay regular income tax, just like a 401(k). Establishing an HSA adds a lot more flexibility for retirement and specifically for healthcare costs.

Open now so you can save tomorrow

There is a lot to take into consideration when you open an HSA. Knowing the difference between opening and establishing your HSA is one of them. Your HSA can be a great way to save money for healthcare expenses now and save money for retirement long term. As long as you pay attention to the details and establish your HSA correctly, you’ll have a valuable savings tool for years to come.

Benefits

2025 and 2026 Maximum HSA Contribution Limits

Lively · June 20, 2025 · 3 min read

On May 1, 2025, the IRS announced the HSA contribution limits for 2026: $4,400 for individual coverage and $8,750 for family coverage. That’s a $100–$200 increase from the 2025 limits, which are $4,300 and $8,550 respectively. If you’re 55 or older, you can still contribute an extra $1,000.

Benefits

What is the Difference Between a Flexible Spending Account and a Health Savings Account?

Lauren Hargrave · February 9, 2024 · 12 min read

A Health Savings Account (HSA) and Healthcare Flexible Spending Account (FSA) provide up to 30% savings on out-of-pocket healthcare expenses. That’s good news. Except you can’t contribute to an HSA and Healthcare FSA at the same time. So what if your employer offers both benefits? How do you choose which account type is best for you? Let’s explore the advantages of each to help you decide which wins in HSA vs FSA.

Health Savings Accounts

Ways Health Savings Account Matching Benefits Employers

Lauren Hargrave · October 13, 2023 · 7 min read

Employers need employees to adopt and engage with their benefits and one way to encourage employees to adopt and contribute to (i.e. engage with) an HSA, is for employers to match employees’ contributions.

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox