The Lively Blog

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox

Adapting Your 2022 Benefits to Current Trends in the Healthcare Industry

Renee Sazci · April 1, 2021 · 18 min read

__Jump to:__ - [HSA Spending Trends Amidst the Pandemic](#pandemic-spending-trends) - [Legislative Updates](#legislative) - [How a CDHP Enhances Benefits Packages](#cdhp-benefits) - [How to Adapt to the Trends](#adapting) On March 30, 2021, Lively co-hosted a webinar produced in partnership with BenefitsPro. The speakers included Lively’s Director, Business Development, [Michael LaVance](https://www.linkedin.com/in/michaellavance/). And [Dana McCallum](https://www.linkedin.com/in/danabozza/), Principal, Client Services Executive at Lovitt & Touché, a Marsh & McLennan Agency. __The panel of speakers discussed:__ - How HSA spending trends shifted amidst the pandemic, - Legislative updates affecting HSAs and FSAs over the past year, - How an [HSA and qualifying health plan can lower healthcare costs](https://livelyme.com/guides/hsa-guide/), increase benefits satisfaction, and address benefits instability, and - How to prepare and adapt your 2022 benefits to recent healthcare trends. We’ve divided up the webinar by section so you can watch the portions that are of most interest to you—along with a summary of the discussion. Enjoy!

HSA Spending Trends Amidst the Pandemic

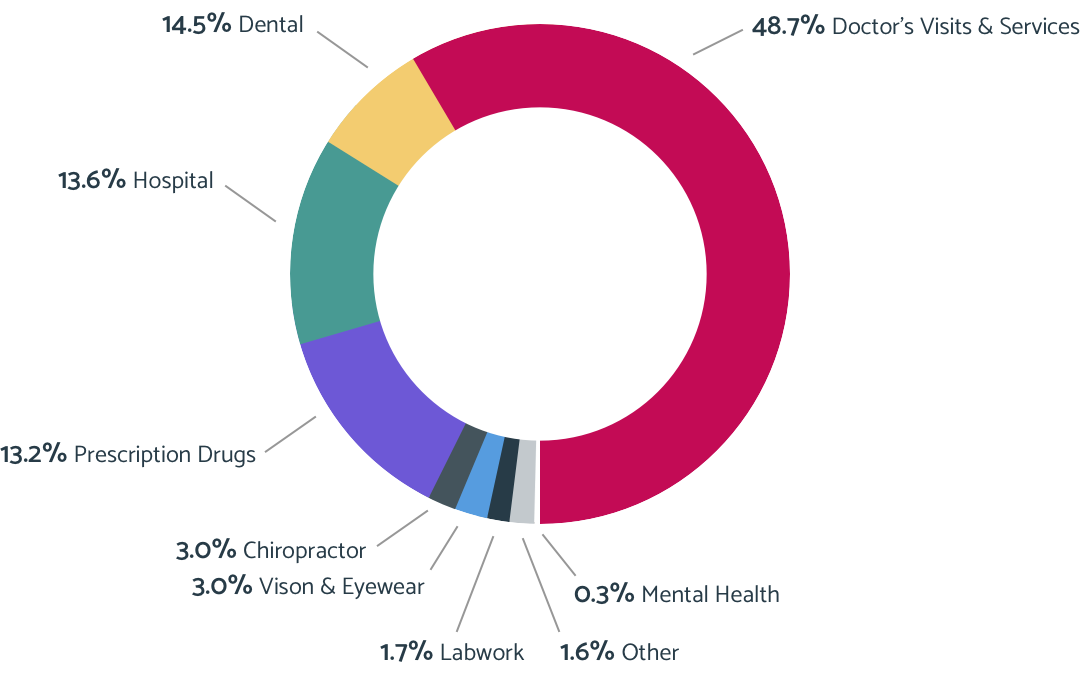

In 2020, 1 in 3 Americans went [without medical care](https://www.usnews.com/news/health-news/articles/2021-02-17/1-in-3-americans-delayed-skipped-medical-care-during-pandemic) because they feared COVID-19 exposure or because health care services were harder to come by; and 15.5% delayed or went without preventative care. Although HSA spending was down in 2020 and will be much of 2021, we can expect HSA spending for delayed preventative and elective procedures to rebound post-pandemic. It’s estimated that some semblance of regular life will resume for Americans in the fall of 2021 or by early 2022, but this is dependent on vaccine availability. The rebound from pent-up medical services demand could be seen beginning in summer 2022. *Why is this important?* __When employees postpone care it can result in higher overall healthcare costs as the delay makes treatable conditions more costly to treat.__ Encouraging employees to access preventative care or services can reduce long-term healthcare cost-sharing for employees and employers. And these services are available to employees pre-deductible. What do companies need to know to prepare for 2022? Comprehensive, ongoing, personalized employee education is vital. __Employees need to know which preventative care to access when they feel confident to do so—ultimately reducing healthcare costs for employees and company cost-sharing.__ Today, many companies could be realizing savings from delayed care, especially those that are self-funded, but that will likely change in plan year 2022. PwC estimates that a rebound effect from deferred care could increase [health insurance premiums](https://www.pwc.com/us/en/industries/health-industries/library/assets/hri-behind-the-numbers-2021.pdf) by as much as 10%. ### How Did Spending Change in 2020? COVID-19 wreaked havoc on Individual Retirement Accounts (IRA) and 401(k)s in 2020. Kiplinger revealed that 60% of Americans withdrew funds from these accounts in 2020, 27% borrowed against their [401(k)](https://hrdailyadvisor.blr.com/2021/03/01/401k-funds-are-being-diverted-for-medical-expenses/), and __a staggering 41% withdrew funds to pay for out-of-pocket medical expenses.__ With record unemployment rates and out-of-pocket expenses traditionally accounting for 38% of all household spending, households dipped into the funds they had accessible. __Those with savings built up in their HSA were more prepared and less likely to withdraw from their retirement accounts.__ Despite COVID-19, HSAs were used as intended—__86% of spending was for expected and routine medical expenses.__ However, there were spending categories that were impacted more than others.  ### Where Spending Was Down In March and April 2020, healthcare spending for preventative care and elective procedures halted. This was to prevent the pandemic spread and to safeguard low supplies of personal protective equipment for frontline workers. While healthcare spending picked up throughout summer 2020, it was slower than normal. __The HSA spending categories most impacted were doctor visits and services (-3%), hospital (-9%), dental spending (-9%), and lab work (-15%).__ Doctor visits and services, and hospital spending decreased due to government restrictions on travel and nonessential services, delayed care, the cancelation or postponement of elective procedures, and other impacts related to COVID-19. The lab work reduction correlated to a reduction in doctor and hospital spending. Dental spending is aligned with the 38% national decrease in dental care spending in 2020 caused by dental office closures in March and April 2020. The reduction of elective dental visits throughout the year and the loss of dental insurance may have also impacted dental spending. ### Where Spending Was Up An increase in HSA spending for prescription drugs resulted from reactive stockpiling due to the pandemic and price hikes. At the beginning of the pandemic, the CDC recommended that consumers fill or refill prescriptions. Then, there was the fear of COVID-19 related shortages, and speculative COVID-19 treatments. __The response resulted in a 32% increase in prescription drug spending between 2019 and 2020.__ We anticipate a reduction of HSA spending in this category because shortage fears and speculative treatments are on the decline. However, __employers should anticipate a continuing rise in drug prices. At the beginning of 2021, [pharmaceutical](https://www.cbsnews.com/news/prescription-drug-prices-rise-2021/) companies raised their prices by a median of 4.65% on over 500 drugs.__ Plus, mental health is a rising concern during the pandemic, so we could see anxiety and depression drug spend increase due to use and their [rising costs](https://www.goodrx.com/blog/how-covid-19-has-affected-anxiety-depression/). One area of prescription drug use that all employers should be on the watch for—specialty drugs. According to PwC, some of those drugs, like curative gene therapies, could come with multimillion-dollar price tags. Existing [specialty drugs](https://www.pwc.com/us/en/industries/health-industries/library/behind-the-numbers.html) are also driving spending as the conditions for which they are approved expand. ### How Can a Lively Account Help? __HSA account holders can use the money they’ve saved for expected costs and routine visits, but also for the unpredictable__—like stockpiling prescription drugs during a pandemic or care required due to the emergence of long-term work-from-home conditions. As healthcare consumers, HSA account holders make more cost-conscious decisions related to prescription drug spending, often choosing a generic prescription drug over name-brand, lowering the healthcare cost-sharing for the employee and employer.

Legislative Updates

There are several legislative changes that occurred over the past year that have impacted HSAs and FSAs. A few of those include the CARES Act, the Consolidated Appropriations Act of 2021, the American Rescue Plan Act of 2021, and relief for residents of Texas, Oklahoma, and Louisiana for the severe winter storm victims. Here is a summary of those changes. ### The CARES Act The CARES Act, effective March 27, 2020, __expanded HSA-eligible items to include over-the-counter (OTC) medical products without a prescription, or letter of medical necessity from a physician.__ This applies to all qualified purchases made after January 1, 2020, and is a permanent change that enables the purchase of OTC drugs or medicines, with HSA funds, for the account owner, their spouse, or tax dependents. Examples include pain relievers such as [Tylenol](https://hsastore.com/search?q=tylenol&utm\_source=Lively&utm\_medium=TPA+Public+Proprietary+EL&utm\_campaign=TPA+Partner), [Advil](https://hsastore.com/search?q=advil&utm\_source=Lively&utm\_medium=TPA+Public+Proprietary+EL&utm\_campaign=TPA+Partner), [Motrin](https://hsastore.com/search?q=motrin&utm\_source=Lively&utm\_medium=TPA+Public+Proprietary+EL&utm\_campaign=TPA+Partner), [cough medication](https://hsastore.com/search?q=cough&utm\_source=Lively&utm\_medium=TPA+Public+Proprietary+EL&utm\_campaign=TPA+Partner) and [decongestants](https://hsastore.com/search?q=decongestant&utm\_source=Lively&utm\_medium=TPA+Public+Proprietary+EL&utm\_campaign=TPA+Partner), [allergy medication](https://hsastore.com/search?q=allergy&utm\_source=Lively&utm\_medium=TPA+Public+Proprietary+EL&utm\_campaign=TPA+Partner), and others. Menstrual care products such as [tampons](https://hsastore.com/search?q=tampons&utm\_source=Lively&utm\_medium=TPA+Public+Proprietary+EL&utm\_campaign=TPA+Partner), [menstrual cups](https://hsastore.com/search?q=menstrual+cup&utm\_source=Lively&utm\_medium=TPA+Public+Proprietary+EL&utm\_campaign=TPA+Partner) (“diva cup”), [panty liners](https://hsastore.com/search?q=panty+liner&utm\_source=Lively&utm\_medium=TPA+Public+Proprietary+EL&utm\_campaign=TPA+Partner) (pantiliner or panty shield), [period panties](https://hsastore.com/search?q=period+panty&utm\_source=Lively&utm\_medium=TPA+Public+Proprietary+EL&utm\_campaign=TPA+Partner), sponges, and feminine wipes have been slated as “medical care” by the IRS, making them HSA-eligible. Under the same act, __“telemedicine,” or “telehealth” became temporarily HSA-eligible.__ This is effective for any appointments or services covered under HSA-eligible health plans that began between March 27, 2020, and December 31, 2021. During this time, an HSA-qualified plan that covers any portion of telehealth and/or remote care services before the deductible will not lose their HSA eligibility because of the telehealth coverage. __[Download our report](https://livelyme.com/2020-hsa-spend-report) to discover how HSA spending and healthcare costs were affected by COVID-19. Learn where consumers spent their funds regardless of the pandemic.__ [](https://livelyme.com/2020-hsa-spend-report/?utm\_medium=blog&utm\_source=lively&utm\_campaign=hsa-spend-webinar-recap) ### Consolidated Appropriations Act of 2021 The House and Senate passed the [Consolidated Appropriations Act of 2021](https://rules.house.gov/sites/democrats.rules.house.gov/files/BILLS-116HR133SA-RCP-116-68.pdf) in late December 2020. On December 27, 2020, it was signed into law. __This act enables Plan participants to change elections in the Plan Year ending in 2021 without experiencing a qualifying life event.__ Additional changes include: - All FSAs ([Healthcare FSA](https://livelyme.com/blog/what-is-a-healthcare-fsa), [Limited Purpose FSA](https://livelyme.com/blog/what-is-a-limited-purpose-fsa/), and [Dependent Care FSA](https://livelyme.com/blog/what-is-a-dependent-care-fsa/)) plan years ending in 2020 and 2021 may permit full carryover of unused amounts with no penalty. - All FSAs may permit a 12-month grace period with no penalty. - A Health FSA participant terminating participation during a plan year may spend down unused funds for the remainder of the plan year, if the Plan permits, for any plan year ending in 2020 or 2021. - If a Dependent Care Plan’s Plan Year enrollment was prior to January 31, 2020, and a participant’s qualifying dependent turned 13 during such Plan Year, the participant is eligible to enroll in and use Dependent Care FSA for the subsequent Plan Year to cover such dependent. - A Plan may make retroactive amendments to accommodate any of these changes to the rules. ### American Rescue Plan Act of 2021 On March 15, 2021, [The American Rescue Plan of 2021](https://www.congress.gov/bill/117th-congress/house-bill/1319/text) became law and __temporarily increases the tax-free dependent care flexible spending account (DCFSA) reimbursable limit.__ - This temporary increase applies to tax year 2021, not the Plan year. - [DCFSA](https://livelyme.com/blog/what-is-a-dependent-care-fsa/) reimbursable limit has been raised to $10,500 ($5,250 for married couples filing separate tax returns). - This relief is an option and employers are not obligated to adopt the increase in contribution. ### Tax Relief for Severe Winter Storm Victims Victims of Winter Storms that occurred February 8-19, 2021 now have __until June 15, 2021, to file various federal individual and business tax returns and make tax payments.__ This relief only applies to federal taxes and state tax deadlines should be confirmed. - [Texas](https://www.irs.gov/newsroom/irs-announces-tax-relief-for-texas-severe-winter-storm-victims), [Oklahoma](https://www.irs.gov/newsroom/irs-announces-tax-relief-for-oklahoma-severe-winter-storm-victims), and [Louisiana](https://www.irs.gov/newsroom/irs-announces-tax-relief-for-louisiana-severe-winter-storm-victims) residents can contribute to their HSA—for the tax year 2020—until June 15, 2021. - All individuals in Texas, Oklahoma, and Louisiana are eligible. - The IRS will automatically provide filing and penalty relief for those located in the disaster area.

How a CDHP Enhances Benefits Packages

### What is a Consumer-Driven Health Plan? A [Consumer-Driven Health Plan](https://livelyme.com/blog/broker/how-explain-cdhp-clients-infographic/) (CDHP) is an HSA-eligible [High-Deductible Health Plan](https://livelyme.com/blog/what-is-a-high-deductible-health-plan-hdhp/) paired with a tax-advantaged spending account for out-of-pocket costs such as an HSA or FSA. This strategy requires employees (consumers) to make proactive decisions about their health care. The health plans have a high deductible which employees are responsible to pay before the health plan helps pay. But employees are more incentivized—and motivated—to find a balance between cost, quality, and the need for services when they have financial skin in the game. Ultimately, an HSA and qualifying health plan can lower healthcare costs, increase benefits satisfaction, and address benefits instability. __Learn more about HSAs in the [Employer’s HSA Guide](https://livelyme.com/resources/employer-hsa-guide/).__ #### 6 Benefits of a Consumer-Driven Health Plan for Employees 1. __Lower premiums.__ What employees will immediately notice is the reduction in their premium cost. In 2020, the average health insurance premium for an HDHP was $323 compared to $511 per month for traditional plans. An HDHP can easily save employees more than $1,000 on premium costs per year. 2. __Tax-free savings options.__ Savings are tax-free. With an HSA, there are also triple tax advantages that help grow an employee’s financial health safety net. 3. __Financial health safety net.__ Funds deposited into the HSA are pre-tax, grow tax-free, and when withdrawn for qualified medical expenses are tax-free. 4. __Dental and vision covered pre-tax.__ Use to cover dental and vision expenses with pre-tax dollars — the coverage that typically gets used the most by employees. 5. __Funds never expire and can be invested.__ The deductible, plus other qualified medical expenses are paid using money set aside in the tax-free HSA and the balance rolls over year-to-year - so the funds never “expire” and can be used to invest in their health. 6. __Increased flexibility with expanded CARES Act coverage.__ Expanded coverage of CDHPs provides more flexibility. Telehealth, telepsychiatry, OTC medications, including menstrual care products, can all be paid with pre-tax dollars, helping employees save on these expenses. #### 5 Benefits of a Consumer-Driven Health Plan for Employers  1. __Lower premiums.__ Offering employees a qualifying HDHP with lower premiums and higher deductibles, represents an average of $720 less per employee (individual plan), per year, compared to PPO or HMO plans. 2. __Protect your company against future price increases.__ The CAGR on premiums for a traditional PPO vs an HDHP is higher so not only are you saving this year, but you are likely to save more in future years. The difference of paying an average 4.65% annual increase on a PPO versus an HDHP - and compounding that interest year-over-year is significant. 3. __Pre-tax payroll deductions can save employers 7.65% on FICA tax.__ According to Devenir’s 2020 Year-End HSA Market Statistics & Trends report, the average employee HSA contribution was $171 per month or $2,054 annually. If a $171 per month HSA contribution is made for 75 employees, that could [save your company](https://livelyme.com/payroll-tax-savings/) $11,733 in taxes per year. 4. __Expand employee benefits offerings for cost-conscious employees.__ Employees that have low healthcare utilization don’t want to overpay on premiums. They want choices. 5. __Attract and retain top talent.__ Because of the economic slowdown, some employers are reducing or canceling 401(k) contributions. One area they are not skimping on is HSA contributions. In 2019, 39% of employers offered an employer contribution to an HSA. HSA benefit growth could mean that more employees are looking for employer HSA contributions as part of their process in evaluating job opportunities, similar to the value placed on 401(k) contributions. #### How A CDHP Helps in Times of Benefits Instability The [Centers for Medicare and Medicaid Services](https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsProjected) estimated that health insurance premiums could grow an average of 4.65% per year between 2019 and 2028—and that was pre-pandemic. That’s an estimated 41.85% increase over nine years. But then the pandemic hit. And this time last year, there were projections that 2021 individual and employer premiums could increase between 4%-40%. There was a lot of uncertainty—and there still is. We don’t know what post-pandemic insurance premiums will look like. __What we do know is that a CDHP can help companies weather times of benefits instability—today.__ Here are a few ways how. __HDHP premium costs are lower than a typical HMO or PPO.__ Let’s assume you have 75 employees. *What kind of savings could you anticipate?* __In the short-term, save $54,000 per year__ (individual plan) when compared to a typical PPO plan. In the long-term, the compounded 4.65% premium increase for an HDHP will save you money. Save $365 per employee over 5 years when they choose an HDHP over a PPO. If you have 75 employees, you can __save nearly $68,000 in premium increase costs over 5 years when compared to the costs of a PPO.__ __HSA contributions help employers save on payroll taxes.__ According to [Devenir’s 2020 Year-End HSA Market Statistics & Trends](https://www.devenir.com/wp-content/uploads/2020-Year-End-Devenir-HSA-Research-Report-Executive-Summary.pdf) report, the average employee HSA contribution was $171 per month or $2,054 annually. If a $171 per month HSA contribution is made for 75 employees, that could __save your company $11,733 in taxes per year.__ Sock away all those short and long-term savings. When there’s an abnormal event your company can weather the storm.

How to Adapt to the Trends

Healthcare spending has changed. The delay in preventative care increases employer and employee healthcare costs in the future. These increases could happen in a variety of ways, but the 2020 HSA Spend Report illuminated the fact that postponed care could increase [insurance premiums](https://www.pwc.com/us/en/industries/health-industries/library/assets/hri-behind-the-numbers-2021.pdf)—by as much as 10%. Plus, increased prescription drug spending will raise healthcare cost-sharing for traditional HMO and PPO plans. Any savings seen from delayed care during the pandemic will be lost in the post-pandemic surge. *Why does this matter to you?* __Insurance premiums will go up, plus employers will experience a rise in healthcare cost-sharing for employees enrolled in traditional HMO and PPO plans.__ The response: HSA-eligible health plans. If the economy bounces back from the pandemic as it did after the 2008-2009 recession, we can expect more employers to turn to HDHPs. According to the Kaiser Family Foundation, the percentage of companies offering benefits that had an HSA-eligible HDHP among their benefits increased 56% between 2009 and 2011. __If the 2009 recession is a reflection of past HDHP expansion, you will experience more HDHP and HSA demand from your employees.__ It’s vital that you get ahead of demand and offer an HSA-eligible plan as part of a balanced health plan mix. ### Expect an HSA Surge in 2022  After the 2009 recession, HSA assets increased from $7.2 billion in 2009 to $12.2 billion in 2011, according to Devenir. Today, the benefits of HSAs are more widely understood than they were a decade ago when they were still in their infancy. That could lead to an __even greater surge of employers turning to HSA-eligible HDHPs as a way to increase savings and offer more diversified health care options that cater to individuals looking for a benefits plan that offers short-term and long-term upside.__ __The pandemic has illuminated the employee’s desire and need for robust health and financial wellness benefits. And the HSA is one of the only benefits that checks both of those boxes.__ ### Offer A Balanced Health Plan Mix Offering a balanced health plan mix is ideal during the roll-out of a [Consumer-Driven Health Plan](https://livelyme.com/blog/broker/how-explain-cdhp-clients-infographic/). This means offering employees the plans that they’re used to - a PPO and/or HMO, plus an FSA, in addition to an HSA-eligible HDHP and HSA. If an employer isn’t offering an FSA with their other plans, we believe it’s best practice to begin offering the FSA and HSA concurrently. __While *we know* that an HSA-eligible health plan is right for everyone, some employees may need additional education to agree.__ For some employees, the only interaction they have with their benefits is during open enrollment. If they don’t see the offering—how will they know about it? Offering an HSA-eligible health plan is the first step to lowering healthcare costs, increasing benefits satisfaction, and addressing benefits instability. Here are some high-level considerations when designing your program to maximize enrollment and the impact and ROI of your employee benefits. - __Limit choices:__ Too many choices make it difficult to assess each option. - __Provide savings:__ Offer the HSA plan at significant premium savings from other plans. And use the money you save on premiums to make an employer HSA contribution. By making employer contributions, employers incentivize employees to adopt and engage with CDHP, help employees bridge the premium gap between PPO/HMO and HDHP plans, and showcase commitment to employee health and wellness. - __Choose thoughtfully:__ Consider the HSA-eligible health plan’s deductible carefully. If set too high, the deductible can deter employees from choosing the plan. Just because a plan has a "high" deductible, doesn't mean the out-of-pocket maximum should be $15,000. ### How to Drive Employee Adoption __Avoid jargon__ - Use simple language -- break-down terms and explain in a way that employees can easily understand. - Don’t call the plan high-deductible. Instead, refer to it as an HSA-eligible plan. - When you talk about HSAs, avoid complicated tax-related terms and keep the message very simple. __Visualize the cost savings__ - Make sure information is presented in an easy-to-understand way. - Many employees would rather look at an infographic or chart than read a few paragraphs of text, regardless of how engaging it is. Create an easy-to-understand visual that compares the total CDHP costs (annual prices for all premiums, deductibles, out-of-pocket expenses, with the savings subtracted from HSA) compared with the total costs of other traditional plan options. __Leverage communication channels & mediums__ - Ensures that employees will see the information since employees consume information differently. __Focus on the benefits for the employee__ - Focus exclusively on what CDHPs can do for employees. All they really want to know is: “What do I get? And how much is going to cost me?” So that should be the focus across all of your communications. - For HSAs, highlight that HSAs complement retirement planning. Help employees think of an HSA as a 401(k) for healthcare, with the added benefit they can spend the money anytime throughout retirement. - Show employees how they can save money on premiums. Emphasize your company's investment in their health and financial well-being. - Don't give too much information too quickly. Introduce HSAs at a high level, and then follow up with details. __Start communicating early__ - Communications should start 4-6 months or more before open enrollment. These early communications should cover what and why the change is being made. - Ideally, large employers should start communications nine months in advance; mid-size companies should begin at least six months before enrollment season, and smaller groups should start at least three months prior. __Communication plan contents__ - Glossary of healthcare, health plan, and HSA terms. - [Most frequently asked HSA questions](15-most-frequently-asked-hsa-questions-employer) (address common questions and misconceptions before they’re asked). - Offer [plan comparison cost](https://livelyme.com/compare-health-insurance-plans/) tables, charts, and projections for different scenarios (show the impact on the bottom line visually). - Leverage [partner calculators](https://livelyme.com/resources/#calculators) so employees can customize projections for their anticipated needs. Employees are more likely to transition to a CDHP if they know more about them. This is why a comprehensive communication plan is an essential part of the planned rollout and ongoing (not just limited to open enrollment). ## Summary - Begin preparing now for an increase in healthcare costs - An HSA + HDHP can lower healthcare costs, increase benefits satisfaction, and address benefits instability - Similar to 2009, HSA demand will surge post-pandemic - Be prepared to offer an HSA in 2022 __[Download our report](https://livelyme.com/2020-hsa-spend-report/) to discover how 2020 HSA spending compared to national healthcare spending. And gain valuable insights to help you adapt your 2022 benefits to healthcare trends.__ [](https://livelyme.com/2020-hsa-spend-report/?utm\_medium=blog&utm\_source=lively&utm\_campaign=hsa-spend-webinar-recap)

Benefits

2026 Maximum HSA Contribution Limits

Lively · February 1, 2025 · 3 min read

For 2026, the HSA contribution limits are $4,400 for individual coverage and $8,750 for family coverage. These limits increased from 2025, when the caps were $4,300 and $8,550. If you’re age 55 or older, you can still contribute an additional $1,000 as a catch-up contribution.

Benefits

What is the Difference Between a Flexible Spending Account and a Health Savings Account?

Lauren Hargrave · February 9, 2024 · 12 min read

A Health Savings Account (HSA) and Healthcare Flexible Spending Account (FSA) provide up to 30% savings on out-of-pocket healthcare expenses. That’s good news. Except you can’t contribute to an HSA and Healthcare FSA at the same time. So what if your employer offers both benefits? How do you choose which account type is best for you? Let’s explore the advantages of each to help you decide which wins in HSA vs FSA.

Health Savings Accounts

Ways Health Savings Account Matching Benefits Employers

Lauren Hargrave · October 13, 2023 · 7 min read

Employers need employees to adopt and engage with their benefits and one way to encourage employees to adopt and contribute to (i.e. engage with) an HSA, is for employers to match employees’ contributions.

SIGN UP FOR OUR

Newsletter

Stay up to date on the latest news delivered straight to your inbox